Editor’s note: This story has been updated with healthcare industry reactions and additional information released by the administration on the new reciprocal tariffs.

President Donald Trump made good on his threat of announcing new and steeper tariffs during a Wednesday afternoon White House event, setting the stage for higher prices and supply chain uncertainty for numerous industries, including healthcare.

The tariffs, set to go into effect at midnight, are the largest trade policy shift for the U.S. in decades and an end to the so-called free-trade era. They include a minimum 10% tariff that affects “all countries,” according to the White House.

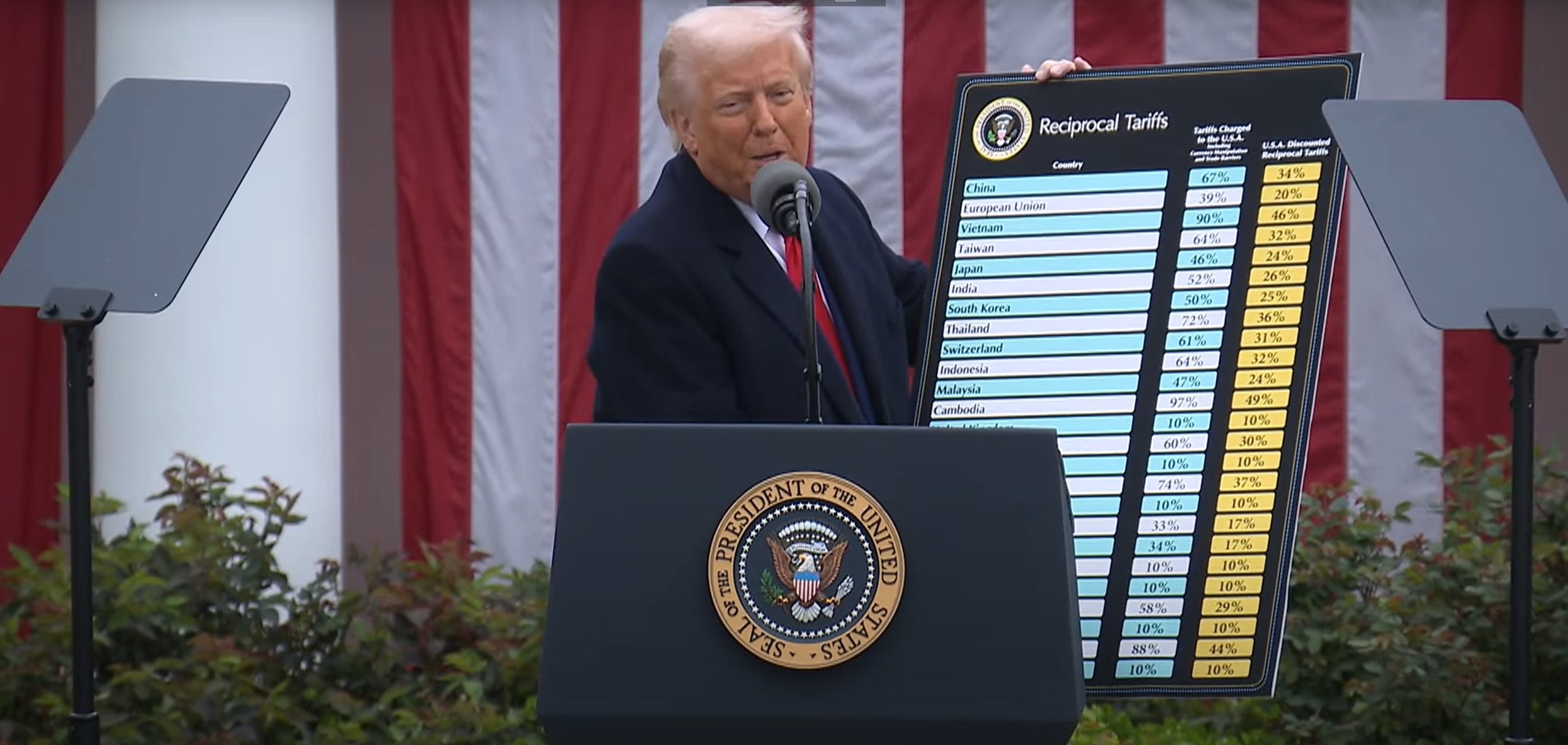

Additionally, a slew of higher, individualized reciprocal tariffs will go into effect for dozens of countries with which the U.S. has a large trade deficit, including longtime allies, the White House said. These are broadly designed to be around half of the collective tariffs and non-tariff trade barriers imposed by most trade partners—though the calculation methodology later released by the Office of the U.S. Trade Representative shows that the value assigned to other countries is derived by dividing the U.S. trade deficit with that country by the value its exports to the U.S.

The result is that a calculated 39% European Union “tariff” rate, for instance, will be matched by a 20% import tariff rate from the U.S., the president explained. A 67% rate assigned to China will see a reciprocal 34% tariff from the U.S.

Pharmaceuticals are among a select list of goods that will not be subject to the higher reciprocal tariffs, according to a fact sheet released shortly after the signing ceremony and affirmed in the signed executive order. An annex to the order since provided by the White House outlines specific drugs and compounds that are exempt from the reciprocal tariffs.

The president also signed an order to close the “de minimis loophole,” a trade policy signed into law by Congress that allows shipments valued at less than $800 to be duty-free, for Chinese imports. The president had aimed to do so earlier during the term but paused the effort due to what the administration described as logistical challenges.

A separate 25% automobile tariff previously announced by the president is also set to go into effect. The administration has previously introduced or increased tariffs against China, Mexico and Canada, which a White House fact sheet said would not be affected by the new orders until they are rescinded.

“Jobs and factories will come roaring back into our country, and you see it happening already,” Trump said during an executive order signing event held Wednesday afternoon at the White House Rose Garden. “We will supercharge our domestic industrial base, we will pry open foreign markets and rip down foreign trade barriers, and ultimately more production at home will mean stronger competition and lower prices for consumers. This will be, indeed, the Golden Age of Americans coming back.”

Trump’s commentary during the event on healthcare and pharmaceutical products was largely limited to touting new domestic manufacturing commitments and bemoaning reduced drugmaking capacity—likely a relief for the sector following recent comments floating a “25% or higher” tax on foreign-made pharmaceuticals.

“The United States can no longer produce enough antibiotics to treat our sick,” he said. “We have a tremendous problem, we have to go to foreign countries to treat our sick. If anything ever happened from a war standpoint, we wouldn’t be able to do it.”

The U.S. is the world’s largest market for pharmaceuticals, importing over $200 billion of medicinal products in 2024. An analysis published just this week specific to Canadian-made drugs outlined the $3 billion of Canadian-made drugs imported during a single year and a corresponding $750 million spending increase that would come with a 25% tariff.

Healthcare group purchasing organization Premier Inc., in a statement, didn’t explicitly applaud or condemn the policy shift but reaffirmed its position that “targeted and thoughtful” healthcare product tariffs can help support supply chain resilience.

“But they cannot live in a vacuum, lest they become just another cost without real impact,” Soumi Saha, the group’s senior vice president of government affairs, said. “Premier believes that tariffs need to be put to work, funding innovation that ensures long-term stability and a stronger, more resilient U.S. supply chain.

The American Medical Manufacturers Association (AMMA), meanwhile, celebrated the “targeted” tariffs it said would support domestic manufacturing of personal protective equipment.

“For decades, foreign producers have exploited unfair trade practices to flood U.S. markets with low-cost imports,” the group said in a release. “They have also exploited trade loopholes, built factories in neighboring countries, and ignored global labor standards to undercut domestic manufacturers and hollow out communities reliant on industrial jobs. Ending these practices is a bipartisan priority as leaders in both houses of Congress have introduced legislation to hold these nations accountable.”

Ash Shehata, healthcare sector leader at professional services, consulting and accounting firm KPMG, painted the tariffs as a “pressure test” for healthcare’s supply chain.

“Medical device costs have been rising for years, and tariffs add to that,” Shehata said. “Healthcare businesses now face a tough choice: absorb the costs, pass them on or overhaul how they source and manufacture. The immediate impact is clear, but the real question is whether the industry can continue absorbing this volatility, or if we’re at a tipping point that drives reshoring and builds more resilient, long-term supply chains.”

Months of trade policy uncertainty

The duties on international imports were a campaign trail talking point and have been in a near-constant state of flux since Trump began his second term in the Oval Office.

Though outlined as early as his inaugural address, the administration on Feb. 1 formally unveiled an additional 25% tariff on Canada and Mexico plus a 10% increase on China—the latter went into effect on Feb. 4 while the former two negotiated a one-month delay. The Chinese tariff was raised from 10% to 20% in early March. Mexico and Canada’s went into effect but were shortly followed by a delay for all goods covered under the U.S.-Mexico-Canada trade agreement of 2018.

These escalations were each shortly followed by retaliatory tariffs from the three countries. However, in the weeks leading up to April 2—referred to by Trump as “Liberation Day”—the president promised a much wider swath of reciprocal and industry-specific tariffs to be imposed on these and other trade partners, including the European Union and India.

Trump has said the tariffs will allow for “fair trade” between the U.S. and other nations that impose their own tariffs, and that the measures would help reduce trade deficits. He’s also leveraged tariffs as a threat in pursuit of international policy goals, such as tighter border security, and to encourage domestic job growth.

Of particular note, he has often said that the duties will be paid for by other countries—a false claim, as the taxes are paid by importing companies and, according to economists and financial institutions, most often passed along to the consumer through higher prices. The president has somewhat shifted that rhetoric in recent months, when he acknowledged that the policy could cause short-term economic pain for Americans while affirming their long-term benefits.

Businesses, investors and consumers alike have been operating under economic uncertainty all the while, partly due to the expectations of increased U.S. spending, and partly due to day-by-day changes on the impending policy by Trump himself. These factors and others, such as inflationary pressures and reduced GDP tied to the president’s trade war, recently led Goldman Sachs to raise projections on the probability of a U.S. recession from 20% to 35%.

Some countries have also threatened their own reciprocal tariff increases as a response to the changes in U.S. policy.

Healthcare, pharma cautiously lobby for exemptions, incremental implementation

The healthcare, pharmaceutical and medical device industries have been keenly awaiting—and advocating against—the promised trade policy changes. Academic research and leadership surveys suggest that new or stiffer tariffs could increase care delivery expenses and disrupt supply chains, particularly for pharmaceuticals either produced abroad or manufactured in the U.S. using imported resources.

Recent reports, confirmed in part by the White House, are that debates over the final tariffs announced Wednesday were down to the wire.

Sector-specific trade groups and lobbyists have also been working to ease the measures—pharmaceutical makers, in response to March comments from Trump singling out pharmaceutical products, have been advocating an incremental ramp-up toward the “25% or higher” drug tariffs floated by the president. Per a recent report, the White House was receptive to the drugmakers’ message that propping up domestic manufacturing could take multiple years—though the administration has been quick to celebrate multi-billion-dollar announcements of new U.S. production facilities from Eli Lilly, Johnson & Johnson and others.

Mark Cuban, the billionaire backer of direct-to-consumer drug supplier Cost Plus Drugs, recently said that the company “wouldn’t have a choice” but to raise prices for generics should new tariffs be placed on Indian manufacturing.

Healthcare providers are keeping a close eye on these impacts. In response to an earlier round of tariffs, the American Hospital Association petitioned Trump in February to grant carve-outs for medical devices, pharmaceutical products and other supplies such as face masks used by hospitals, and that failing to do so could curtail product availability and threaten lives.

The hospital lobby declined a request for comment shortly before Wednesday’s White House event, with a representative saying the association would need to see the final announced changes before issuing a statement.

Tariff talk has also been a mainstay during for-profit health systems’ recent earnings calls and conference appearances, with investors probing for insight into potential expense increases. Health system executives such as HCA Healthcare’s Sam Hazen have generally outlined the efforts of their group purchasing organizations to cut fixed-price contracts through much of the coming year, but declined from commenting further without visibility into potential healthcare exemptions.

Premier Inc., a group purchasing partner for numerous U.S. hospitals, had said in February it was eying resiliency strategies for its new supply contracts, pursuing expanded domestic manufacturing partners and tasking its advocacy team to advocate that the government’s tariff proceeds be reinvested into supply chain resiliency.

The American Medical Manufacturers Association last week said it has submitted recommendations that the administration avoid “broad-based tariffs that lack strategic focus. … Such actions could disrupt supply chains, increase costs, weaken innovation and inadvertently benefit lower-quality competitors like China.” The manufacturing lobby, in contrast to hospitals, called for a steeper, 100%-minimum tariff on personal protective equipment imports and the elimination of the de minimis loophole to push back on ”low-quality Chinese products,” the latter of which Trump addressed with one of Wednesday’s executive orders.

Hundreds of millions in spending increases on Canadian drugs alone

Among the most recent analyses of trade tariff’s impact on the industry is a research letter published Monday in JAMA. It outlined 411 drug products being sold in the U.S. during a one-year span (Q4 2022-Q3 2023) that are manufactured in Canada, 323 of which are generics, 88 of which are brand-name and 20 of which are under patent protection. The 411 products represent about $3 billion in sales, meaning that a 25% tariff would add $750 million in cost—though these tallies more than double when considering Canadian drug products with final production outside of the country, researchers wrote.

Further, across all unique drugs on the U.S. market, there are 52 where over half of the supply comes from Canada. Twenty-three of these are rated as clinically important, and 27 have a history of shortages.

Though brand-name manufacturers can likely absorb some short-term costs, others may adjust production in response to the policy change, potentially introducing drug shortages and other disruptions to the drug supply chain, the researchers warned. Extending the tariffs to other countries that produce greater quantities of pharmaceuticals could further fuel supply disruption.

“We’re closely monitoring the potential impact of new tariff and counter-tariff measures on the already fragile global drug supply chain,” Mina Tadrous, lead author of the research letter and faculty at the University of Toronto, told Fierce Healthcare. “These policies add uncertainty for manufacturers and could worsen supply challenges—particularly for drugs already at risk of shortage, which tend to have few producers and smaller market size. While we don’t expect immediate disruptions, we should be increasing surveillance and will be tracking developments closely in the coming months.”

Publisher: Source link