There are about half as many stocks trading in the U.S. today as there were in 1996 — 4,010 vs. 8,090.

Fewer public companies means less of the economy is available to everyday investors.

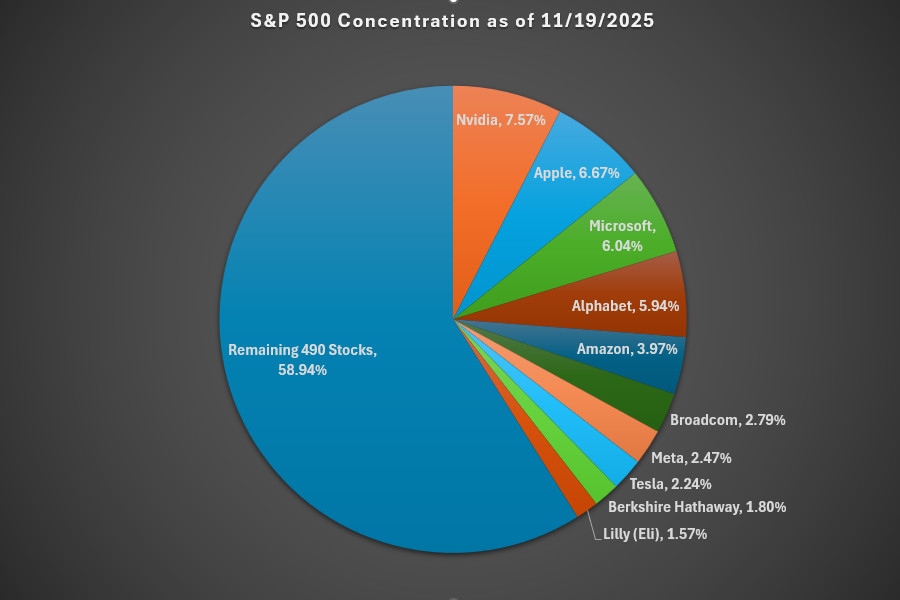

Passive index investing has become less diversified AND more concentrated, as the largest 10 companies (Nvidia, Microsoft, Apple, Alphabet, etc.) now make up the highest percentage of the S&P 500 in history, about 41% (or about 34% for total market funds like VTI).

That’s because the underlying indexes are weighted. So when Nvidia’s stock goes up (deservedly, it’s printing money), it makes up a larger percentage of the S&P 500 and the total market funds.

And that’s been a great deal for public-market investors. Incredible gains from stocks like Nvidia and TSLA offset the hundreds of companies that contribute little to gains.

But all-time highs for index concentration suggest an inevitable reversal.

Concentration isn’t the only shift happening in the markets.

At the same time, many of the fastest-growing companies of our time are staying private.

Consider these recent private valuations:

- Open AI — $500 billion

- SpaceX — $400 billion

- Anthropic — $350 billion

- xAI — $230 billion

- Databricks — $130 billion

- Stripe — $100 billion

- Figure AI (robotics) — $39 billion

These are all U.S. companies, but none are publicly traded.

Ten years ago, each of these was either non-existent or worth less than a few billion.

That’s more than a trillion dollars in gains that didn’t go to retail investors, but to founders, employees (disproportionately in the San Francisco area), and venture capital firms and their already-wealthy clients.

These “startups” are leading the trend of private companies staying private longer.

Ask, and they say it’s due to regulatory and compliance issues or to Wall Street scrutiny, preferring to focus on growth rather than meeting quarterly estimates.

In reality, these companies are staying private because they can efficiently raise the capital they need and provide liquidity to employees and early investors in the private markets.

Private markets also tend to support higher valuations because pricing is opaque and driven by negotiated funding rounds, not daily public trading.

The number of public stocks has fallen for other reasons. Private equity has been buying and delisting companies, big corporations have been absorbing smaller rivals, and post-Enron regulations have made going public more expensive.

Add in a flood of VC money and higher private valuations, and there’s been little incentive for young companies to list at all.

A shrinking number of public companies means less economic exposure for retail investors, even if our stock funds are “diversified.”

With all this growth in the venture-backed world, which largely excludes retail investors and retirement accounts, the elite VC firms earn more and reinvest proceeds into the next generation of the fastest-growing and most disruptive startups like Cursor, Mercor, Anduril, Ripple, Polymarket, Kalshi, Harvey, etc.

The next wave of $100 billion companies will likely emerge in private instead of public.

Retail investors will be left out of many of these growth stories again, unless the SEC acts to:

- Reduce the reporting and compliance burdens of public companies.

- Place guardrails on shareholder proposals and litigation risk to encourage more IPOs.

- Modify the accreditation definition to allow more investors to participate in the pre-IPO economy.

- Open up secondary pre-IPO markets to more retail investors by enabling “tokenization” of private companies — using blockchain and crypto technologies to enable 24/7 trading of real-world assets.

All while maintaining oversight and investor protections.

SEC Chairman Paul Atkins says these changes are coming.

Until then, index investors have fewer stocks to own and more concentration risk.

Meanwhile, retail investors (and all the funds and institutions we invest through) are missing out on a big chunk of economic growth.

Is this really a problem?

Today, it doesn’t seem like it because anyone who’s invested in public markets is making money.

But we all know that won’t always be the case.

Moreover, venture capital investors are making more money. And since the asset class is mostly only available to accredited and well-connected investors, this trend is contributing to the wealth gap.

People who aren’t invested in stocks feel the pain of missing out. And anyone competing to buy a home in San Francisco is frustrated, too.

So what are retail investors to do?

For many of us with a long-term investment horizon, nothing.

Long-term performance data tells us that as we extend our investment horizons, stock market returns perform in that 9%-10% range.

Even if there are imbalances due to the AI and fintech crazes or unforeseen black swans, the market has a way of shaking things out and returning to the mean.

For a total U.S. stock market or S&P 500 retirement portfolio balanced with an age-appropriate allocation to bonds and global stocks, history shows that patient investors can weather most storms.

But of course, investors (both professional and DIY) like to position portfolios to protect and profit from market imbalances.

One approach to countering concentration risk is to own an equal-weighted S&P 500 index fund (like the Invesco S&P 500 Equal Weight ETF – symbol “RSP”) with a portion (not all) of your portfolio.

This RSP historically underperforms, logically, because it didn’t hold as much Nvidia or Tesla.

But as concentration sits at all-time highs (risky or not), some less passive investors may deem it appropriate to hedge while still investing in the top 500 public companies.

Another option is to increase exposure to international, small and mid-cap U.S. stocks. When markets stumble, these won’t be immune, but may be less so.

For more ambitious investors (for better or worse), and as I laid out in my four-day mini-course, I’m OK with measured speculation with no more than 5% of your invested assets — that is, making investments based on research you’ve done or industry knowledge you have that might lead to profits above market returns.

My preferred way to “speculate” is to find opportunities to invest in private companies that are growing but not yet public. As an accredited investor in the U.S., I have far more options than a non-accredited investor.

However, to this point, I’ve avoided investing directly into hot pre-IPO companies on secondary marketplaces like Hiive* and EquityZen because of the added risk, complexity, and higher minimum investments.

Instead, I invest in venture capital through the diversified funds available at Fundrise Venture* and the ARK Venture Fund (available at SoFi Invest).

These investments provide access to the fastest-growing venture-backed companies in AI, defense, and fintech with low minimum investments and broad exposure.

Though higher fees and only quarterly liquidity apply, the tradeoff is worth it for me. I’ve participated in the growth of some of the extraordinary private companies mentioned above.

Twenty years ago, these types of companies would already have been public. Today, we need to find other avenues to invest. Otherwise, the innovation and profits taking place will only benefit those with significant wealth and connections.

That is, until the SEC and legislators act. I’m not holding my breath.

The public markets are shrinking, private markets are exploding, and everyday investors are stuck with a smaller slice of America’s economic growth.

That doesn’t mean the index-fund playbook is broken — it still works. But if more of the fastest-growing companies remain private, stealing market share from public companies, and acquisitions continue, the reliability of the passive index strategy could erode.

*Please note: This is a testimonial in partnership with Fundrise and Hiive. We earn a commission from partner links on RetireBeforeDad.com. All opinions are my own.

Favorite tools and investment services (Sponsored):

Boldin — Spreadsheets are insufficient. Build financial confidence. (review)

ProjectionLab — Build financial plans you love. (review)

Empower — Free net worth and portfolio tracking + retirement planning. User since 2015.

Sure Dividend — Research dividend stocks with free downloads (review):

Publisher: Source link