The minus your age rule of thumb is a simple math formula used in personal finance to help DIY investors and advisors determine a suitable stock-to-bond ratio for an investment portfolio.

I’ve always referred to this as the 130 minus your age rule of thumb on this website, but that only tells part of the story.

The 130 value is the formula constant. Then, we subtract our age to get a ballpark target stock allocation for our investment portfolios.

The remaining percentage goes to bonds.

As I dug into the origins of this rule of thumb for this article, I found a lot of wiggle room in how we can use it.

Companion Video

Read all about it below or check out the 5-minute YouTube video.

The 130 Minus Your Age Rule of Thumb

Here’s how I’ve always used the rule of thumb.

= 130 - [Your Age] = % of portfolio in stocks

I’m 49.

So my calculation looks like this:

= 130 - 49 = 81% Stocks/19% Bonds

The 130 value is an aggressive place to start. But I’ve consistently tweaked the outcome further to match my risk tolerance, which is a bit higher.

This simple method for targeting an ideal stock-to-bond asset allocation has been around for a while, but its use has gotten more aggressive in the last few decades.

The 100 Minus Your Age Rule of Thumb (Your Age in Bonds)

The idea that investors should have their age in bonds was a common adage back in the more conservative days of financial planning.

Age in bonds is the same as 100 minus your age. So, if I were to implement this asset allocation at my age, my numbers would look like this:

= 100 - 49 = 51% Stocks/49% Bonds

Having just 51% of my portfolio in stocks is far too conservative for my risk tolerance and anticipated investment horizon (decades).

However, back in the day, advisor clients were much more skeptical of the stock market because the 1929 crash and the Great Depression were a less distant memory.

Plus, war and widespread smoking led to shorter lifespans. So, being this conservative may have been the appropriate strategy for many.

Vanguard founder Jack Bogle recommended the age in bonds rule of thumb for young and old and said he used it himself later in life.

The 120 Minus Your Age Rule of Thumb

I likely first heard about the 120 minus your age rule of thumb in a CNBC interview sometime between 1994 and 2012 (when I was an avid watcher and listener). The “120 rule of thumb” is probably the most common reference to this asset allocation method.

Here’s how it would look for me:

= 120 - 49 = 71% Stocks/29% Bonds

By the 1980s and 1990s, advisors realized that investors could be more aggressive as lifespans increase and long-term stock market returns are more reliable as investment horizons expand.

120 builds on age in bonds by bumping up the stock allocation by 20 percentage points.

Jack Bogle also recommended 120 in interviews over his career. He was an influential voice for decades, and his thousands of enthusiastic fans still reference and follow his wisdom.

Here are a few rabbit holes if you care to dig further into this topic:

One point he certainly drove home throughout his lifetime was that age should influence stock-to-bond allocation, and we should increase bond holdings as we age.

Another legend of finance shared this view.

The 115 to 140 Minus Your Age Rule of Thumb

A more academic and data-driven version of the minus your age rule of thumb emerged in a 1996 article in the Journal of Financial Planning by a famed financial advisor named William Bengen.

Hat tip to a Rob Berger video on this topic where I learned about the Bengen article.

Bengen is best known for laying the mathematical groundwork for the 4% rule of thumb, a FIRE handy tool.

As Bengen’s client lifespans increased, he was receiving a lot of questions about the ideal stock-to-bond ratio in a retirement portfolio. So, he ran the math using historical market data and a 4.1% safe withdrawal rate.

The outcome was the article in which he advocated using a range, tailoring the minus your age constant based on risk tolerance and current age. The article is primarily focused on retirement accounts.

Bengen’s Target Asset Allocations

| Risk Tolerance | Retirement Accounts | Taxable Accounts |

|---|---|---|

| Conservative | 115 – age | 120 – age |

| Moderate | 128 – age | 133 – age |

| Aggressive | 140 – age | 145 – age |

The moderate number of 128 seems odd, but it’s about the halfway point between 115 and 140. Here’s an article summary.

To cover all risk tolerances, he combined the three numbers into one formula:

% of portfolio in stocks = (115 to 140) - [Your Age]

With my aggressive attitude toward investing and long-term investment horizon, I reran my number using 140 and got this:

= 140 - 49 = 91% Stocks/9% Bonds

And that’s just about where my portfolio is right now — 90% stocks, 10% bonds.

So, I actually like this framework better than just using 130 because differences in risk tolerance are built in, and there’s data behind the study to back it up.

In the future, I’ll likely continue to refer to this as the 130 rule of thumb (but link to this article) because it’s near the moderate point and easier to remember.

And That’s Why They’re Rules of Thumbs and not Laws

Personal finance is littered with rules of thumb but devoid of concrete laws.

That’s because nearly everyone’s situation, life experiences, and risk tolerance are personal.

Navigating rules of thumb, like minus your age, requires taking in many data points to determine before executing a plan.

I recently went through this exercise with my parents when they left their financial advisor after 20 years. We took a broader view of their assets and income, which include an ironclad teacher’s pension that covers their expenses.

My Dad’s pension allows us to be more aggressive with their allocation percentages, falling at around 132 minus his age.

That was a foundation based on recent risk-free high-yield savings and interest rates. As we approach annual rebalancing, we’ll reevaluate the current situation and likely add another 1%-2% to bonds, just as Bogle and Bengen advised.

Remember that even if you reach your target asset allocation, the next day it will change when the market opens. Wait at least a year between substantial portfolio reshuffling. The simpler the portfolio, the easier it is to maintain an appropriate asset allocation.

Featured photo by Matthew Brodeur via Unsplash.

Craig Stephens

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — Research dividend stocks with free downloads (review):

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

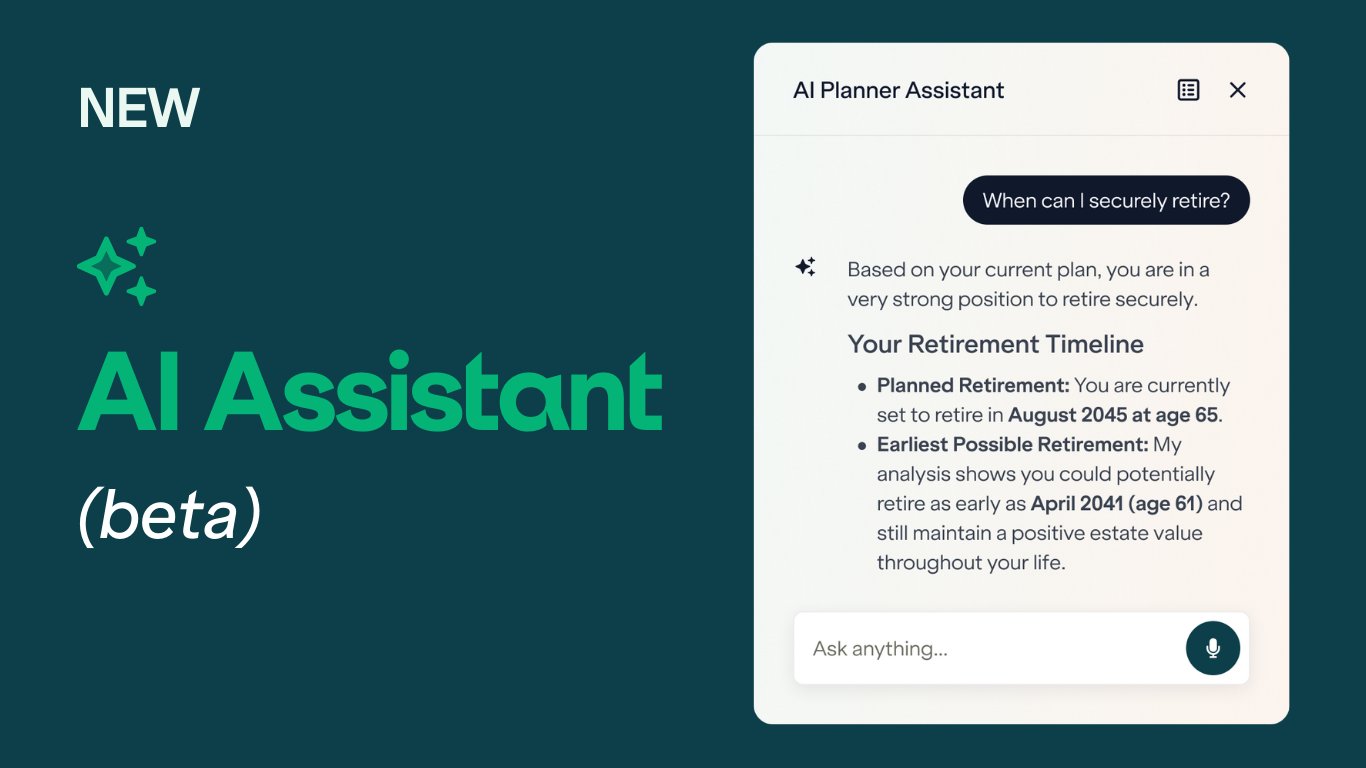

Boldin (NewRetirement) — Spreadsheets are insufficient. Get serious about building financial confidence. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Publisher: Source link