Buying compact discs (CDs) used to be a thing. That’s how we bought music back in the 1980s and 1990s. Most of you remember.

I spent a few thousand dollars on CDs throughout high school, college, and my early working years. One summer, I worked in a record store to earn money because my internship at a financial services company was unpaid.

For how long I listened to them, CDs were a good entertainment value for my dollar, similar to a book or video game.

I listened to thousands of hours of music, critiquing different bands, memorizing lyrics, playing guitar chords, and searching for music with more complex sounds.

During all that time I spent listening to so many bands and genres, it never dawned on me to start creating music myself. I was a music consumer and connoisseur, but nothing more.

What if I had spent some of those hours writing songs and practicing guitar?

By creating my own music, maybe I could have produced something of value that others might have enjoyed. Maybe my music creations could have earned a royalty income stream.

Probably not. But I’ll never know because I didn’t try. It was easier to listen to what others created.

Consumption vs. Creation

We are all consumers. We consume food, energy, information, toys, automobiles, homes, entertainment, and so much more. How much we consume is based on where we live, our prosperity, needs, values, and thoughtfulness.

When we spend money to consume, sometimes there’s an economic value in return, and sometimes there isn’t.

For example, buying gasoline for your car enables you to drive to work and earn money to support your family.

But when you buy a CD or a piece of furniture, neither item provides any economic value. The CD plays music, and that entertains. The furniture is a place to park your butt after a long day.

Neither purchase makes us wealthier. They both make us less wealthy.

What we consume must be created.

Exxon and Chevron create a product by extracting oil from the ground and refining it into fuel for our cars. They do this quite profitably.

Musicians write and record songs for us to listen to. Good music earns royalties.

Farmers grow food, which eventually ends up in our grocery stores and on our dinner plates.

When something is created that is of value to others, the resulting economic transaction creates wealth for the creator.

Reducing consumption (to save money) and increasing what you create (to earn money) are ways to enhance your ability to build income streams and grow wealth.

The Creation Mindset

Now, I’m not saying you should write a power ballad (←great list) to put on Spotify. We can apply the creation mindset broadly to many aspects of our lives.

You can invest your money into assets that grow in value or produce an income stream to create more wealth for yourself.

Another example is your career. Are you creating value for your employer or just drawing a paycheck?

By value, I don’t mean you’re nice to have in the office or you work hard to complete tasks reliably and on time.

Does the work you do provide a quantifiable value to the customer? Does it drive revenue and profit for your employer?

Or are you in more of a support role?

Another form of creation is thought leadership. Are you somebody who thinks critically to solve problems, or do you carry out the ideas of others?

A more extreme example is energy consumption at home. Most of us pay the electric company for the power we use.

What if you install solar panels on your roof or a geothermal system in your backyard instead of simply drawing power from the grid?

Any excess energy you create could be sold back to the power company. You become an energy creator instead of only a consumer.

Entrepreneurs have a creation mindset. They look at how to add value to a potential customer. They find what problems exist that can be solved with a better product, service, or technology.

It’s not about selling any old material object. It’s about creating products and services that make our lives better.

The taxi systems sucked. Uber created a better way to purchase a ride using existing technologies.

Blockbuster charged too many late fees on movie rentals. Netflix created a new way to deliver the same product without charging late fees.

People have short attention spans but still want to know what’s happening in the world. Entrepreneurs created social media to fill that need.

That kind of ambition isn’t practical for most of us, but small opportunities to create are everywhere. Look in the most obvious places.

My Personal Transformation

I used to watch a lot of sports. When I met the future Mrs. RBD, we watched cable TV almost every night.

During my free time before we had kids, I read a lot of personal finance and investing articles on the internet. Many were written by ordinary people, not journalists.

At the same point, I was looking for a way to earn extra money. What if I started writing investing-related articles and publishing them on the internet?

RBD and my side business were born. Now, I read fewer online articles and produce them instead.

My weekly writing schedule requires more time in front of the computer and less in front of the TV.

Watching less TV in the early RBD days freed me more time to write personal finance articles and grow my presence on the internet. As my writing improved and the popularity of my blog grew, it started earning more money.

It eventually became my full-time gig.

This transformation from consumer to creator enabled me to earn money outside of my day job, helping to grow our family’s wealth before it became my sole career pursuit and a more purposeful craft than my previous career.

Accelerate Your Wealth Trajectory

This concept isn’t meant to shame leisure. But just think — a subtle shift in your thinking could lead to more time creating and less time consuming. This was life-changing for me.

As with any change in mindset, results won’t come immediately. My transformation took a solid year to gain traction and longer to realize that my mindset had shifted.

It begins by changing the way you think about everyday life.

Start with your money. Are you spending too much money consuming? Can you funnel more of your money toward assets that create more wealth?

In your career, focus not only on earning a salary for yourself. Think about how you can create more value for your customers and drive revenue for your employer. They’ll both notice and reward you for it.

If not, someone else will.

Then, think about what you’re doing with your time.

Is consuming more sports and TV helping you to accomplish your savings goals? Can you slice off a fraction of your TV time and focus on creation instead?

Are your talents being utilized to their potential?

The masses consume and are happy to give their money to the creators.

Somebody will deliver what consumers crave, be it music, YouTube videos, useful devices, a needed service, sports entertainment, handy crafts, funny tweets, sexy Instagram posts, online courses, interesting blog posts, or a helpful invention.

Will it be you?

Disclosure: The author is long CVX stock. This article was originally published in August 2nd, 2018. It was slightly modified to reflect my recent shift to self-employment.

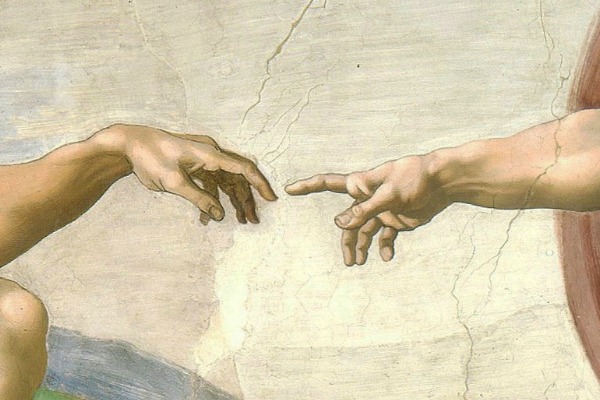

Photo via Wikipedia Commons CC Public Domain published in the U.S. before 1923 and public domain in the U.S.

Craig Stephens

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Boldin — Spreadsheets are insufficient. Build financial confidence. (review)

Sure Dividend — Research dividend stocks with free downloads (review):

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Publisher: Source link