I recently had lunch with a former coworker.

He was on the interview team that hired me years ago, and my direct manager on the very last day of my corporate consulting career.

Our conversation provided an opportunity for me to explain in more detail why I left.

Ultimately, it was a data-driven decision. I had enough money saved and generating income to support a career and lifestyle change.

The consulting world uses data to tell stories and help organizations make decisions. Advice without data has little authority.

DIY retirement planners should also use data to make informed decisions.

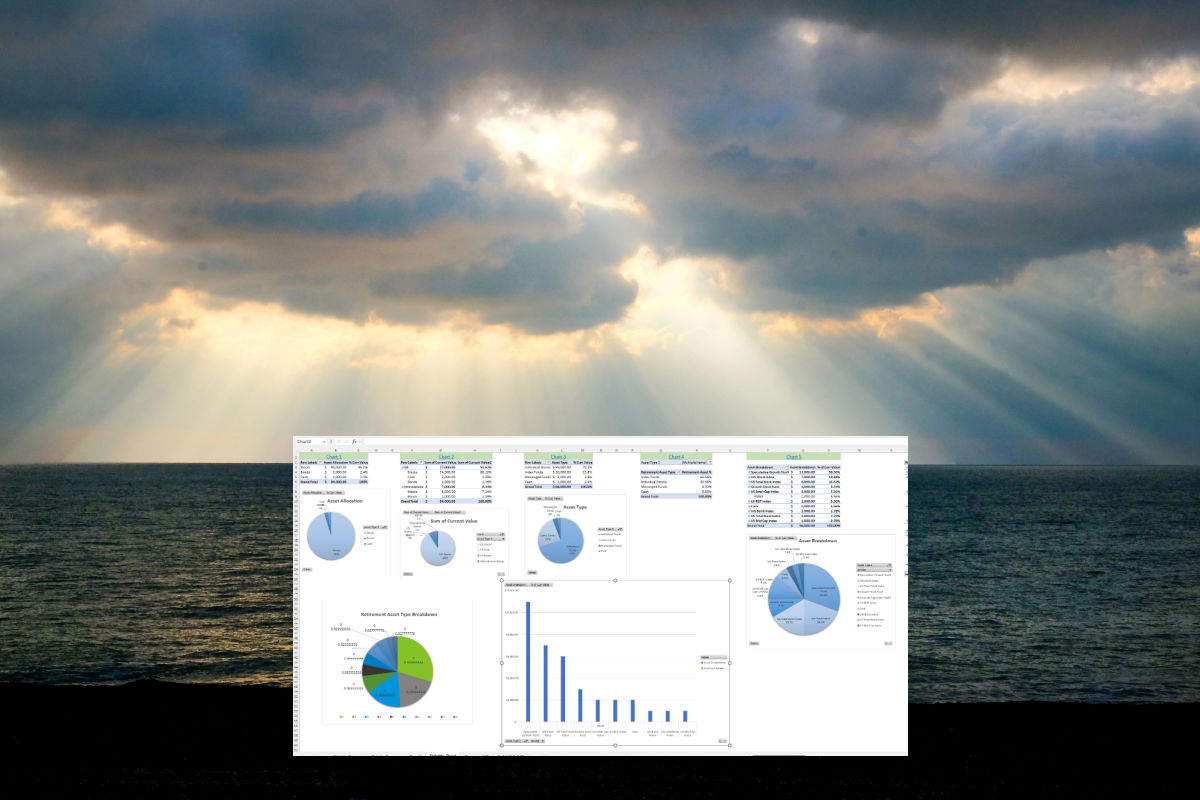

And there’s no more ubiquitous financial data tool than a custom spreadsheet.

My former coworker shared that he outlined his entire retirement plan in an elaborate spreadsheet that he’d been molding for the last 20 years.

When I mentioned that software tools can model financial plans far better than any spreadsheet, he became defensive and said, “What can they do that my spreadsheet can’t?”

I froze, not knowing how to respond without offending him.

On a walk one day, I discovered my neighbor is a dividend growth investor.

But his proudest accomplishment in investing wasn’t any single stock pick — it was his investment spreadsheet.

This thing sounded incredible, with data connections, tables, charts, projections, income, and fancy scripts.

Impressive? Maybe.

But probably nothing most of us couldn’t build with enough dedicated time, effort, and ChatGPT guidance.

When I suggested that several plug-n-play portfolio tracking tools are likely more comprehensive and easier to use, he scoffed, saying he’d NEVER stop using his spreadsheet.

It was his baby.

Recently, I learned that another friend is planning an early retirement from a career that has long been unfulfilling.

As an engineer, he, too, has an elaborate all-knowing spreadsheet that tracks and projects his investments and career exit goal.

It does “everything”, he said.

Except he lacked confidence in his spreadsheet once it included the planned construction of his retirement home.

He already owns the land, but building the home adds several layers of uncertainty and complexity to his long-term finances.

Considering his early retirement ambitions and college costs, he realized his spreadsheet was finally defeated.

I introduced him to the tools I used to plan my career exit, which I knew could help model a home purchase.

He was willing to give them a try, supplementing his bible.

With a more professional tool, he discovered his retirement goal was closer than he thought.

He also learned he had more options to finance his dream retirement home, and better clarity to reduce his second-guessing himself.

The retirement home will cost several hundred thousand dollars to design and build.

His early retirement exit is a multi-million dollar calculation, with impact over three or four decades.

Decisions of this magnitude require more than a bootstrapped spreadsheet, no matter how good you are at spreadsheets.

As DIY finance types, most of us shun the help of a professional.

It’s no surprise we gravitate toward a flexible and cheap tool, right there on our computers, disguised as work.

But DIY financial planners who rely on spreadsheets overlook the obvious:

- They are not the first to encounter these same planning challenges.

- Well-established best practices already exist.

- Available tools implement best practices by default.

- The tools offer the same capabilities as a professional advisor, but at a fraction of the cost.

- User communities check math, provide feedback, and share experiences.

- Spreadsheets are susceptible to formula errors, suboptimal methodologies, and changes to assumptions (e.g., annual tax rates, inflation).

Retirement planning is complicated.

DIY investors should start by simplifying their finances and investment portfolios. Fewer variables give you and your loved ones financial clarity.

Simplified finances will make your retirement and estate planning jobs easier, whether I can convince you that your spreadsheet is insufficient or not.

Planning tools — paired with the discipline to use them well — can give you the reliable data and perspective needed to make confident choices amid life’s uncertainties.

Spreadsheet Replacement Tools*

I recommend and use all of these tools now that I’ve abandoned most of my elaborate spreadsheets.

I feel more confident and secure than ever about my decision to leave my career early for more fulfilling work, enabled by the insights I’ve extracted from the following tools:

Featured image via Deposit Photos used under license.

Favorite tools and investment services (Sponsored):

Boldin — Spreadsheets are insufficient. Build financial confidence. (review)

ProjectionLab — Build financial plans you love. (review)

Empower — Free net worth and portfolio tracking + retirement planning. User since 2015.

Sure Dividend — Research dividend stocks with free downloads (review):

Publisher: Source link