With the healthcare affordability and insurance premiums in particular in the headlines, a new report finds that while the employer-sponsored space is largely stable, declines continue among smaller firms.

The Employee Benefit Research Institute released a report diving into the “shifting landscape” around employer-sponsored health insurance and found that just under half (49%) of employers offered health benefits.

The portion of individuals eligible for coverage through their employer was 80.2%, which reflects large employers’ commitment to offering benefits even as smaller players pull back. About two-thirds of workers are employed by large firms, per the report.

Paul Fronstin, Ph.D., director of health benefits research at EBRI, said in a press release that, even though larger firms are generally willing to continue offering health coverage, they are finding ways to mitigate the expense by shifting more of the cost to workers.

This could come in the form of higher deductibles or coinsurance, or through more restrictive networks, Fronstin said.

If premium costs continue to escalate, it will also likely drive further small businesses away from coverage, he added. Respondents to a November Mercer survey, for example, said they anticipate health benefits costs will rise by 6.7% this year.

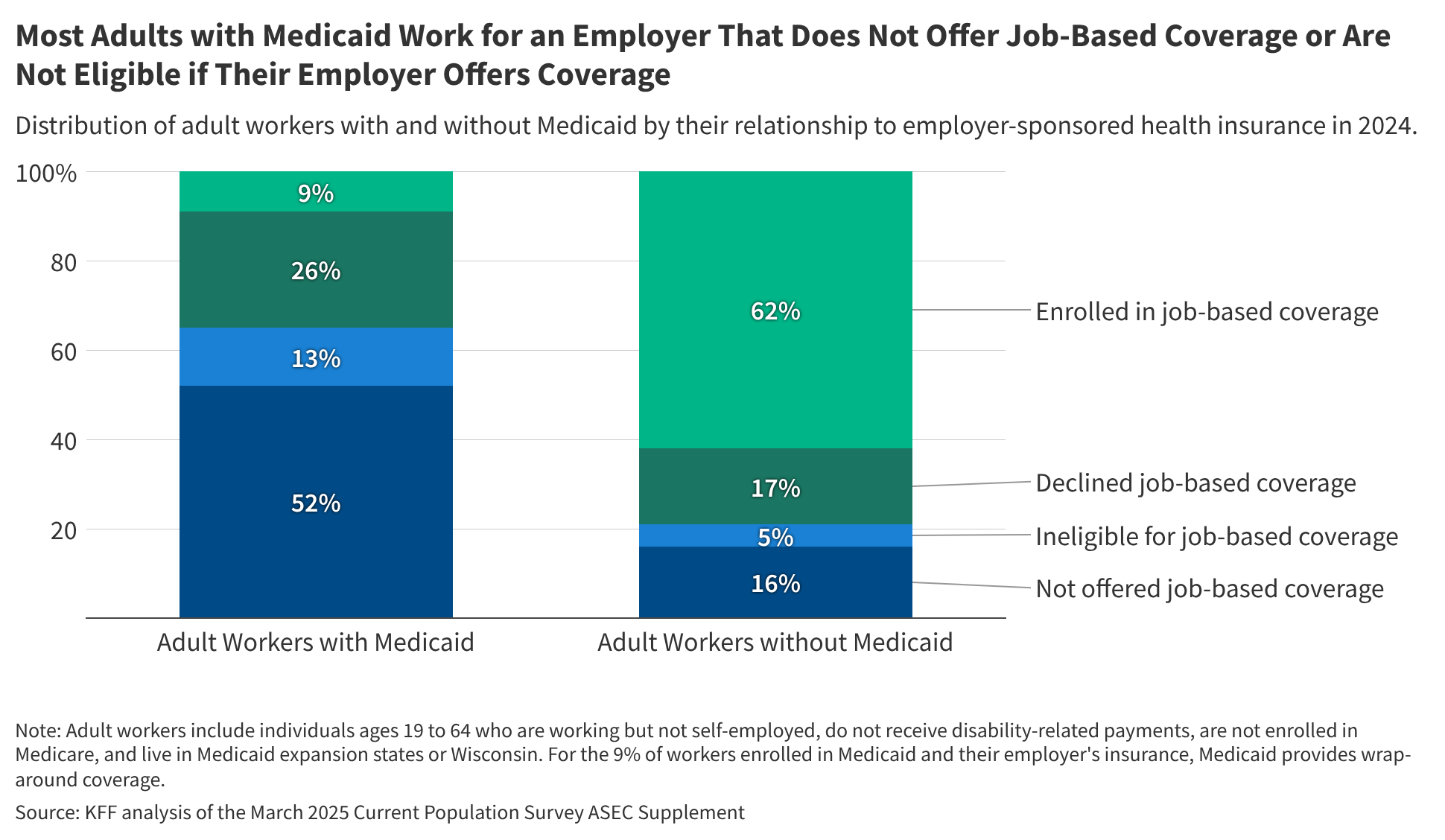

“For workers, the impact could be significant, meaning higher out-of-pocket costs, greater reliance on public programs and increased financial insecurity tied to health care expenses,” said Fronstin.

The study found that 70% of the non-elderly population was covered through employer plans between 1970 and 1989, however by 2024, the percentage had fallen to 61%. That said, employer-sponsored plans remain the most common form of coverage for non-elderly people.

The current, center-stage debate over insurance premiums has centered on the Affordable Care Act’s individual market and the expiry of enhanced premium tax credits put in place during the COVID-19 recovery. Prominent Republicans, including President Donald Trump, have argued to instead send the value of those funds directly to individuals and allow them to purchase their own coverage.

In this conversation, however, little attention has been paid to mounting costs in the employer-sponsored coverage market, and it remains to be seen if reforms designed to address expenses in this segment will be explored down the line.

Publisher: Source link