Right Capital is financial planning software designed for financial advisors that is sometimes made available direct to consumers through advisories. Recently, Right Capital decided that they needed to limit access through some advisors. If you’ve been using the tool, it may be time to explore Right Capital alternatives. Below we’ll dig into a comparison of Right Capital vs. Boldin as well as some other tools. We’ll look at how they stack up across use case, features, cost, and ease of use — and help you decide which is the right fit.

Right Capital vs. Boldin: Who They’re Built For

Both the Right Capital and Boldin planning tools offer powerful modeling capabilities. However, they were originally designed for different audiences.

- Boldin: Boldin was always designed and intended for individuals and families who want to take control of their own long-term financial future. Whether you’re planning for retirement, optimizing taxes, or modeling your financial “what-ifs,” Boldin gives you the tools to build a credible plan — no advisor required.

- RightCapital: Built for financial advisors, RightCapital is a powerful back-end platform for creating and presenting client financial plans. While consumers don’t sign up directly, you can access RightCapital through an advisor, and in many cases that access is included at no additional cost.

Bottom line: Boldin is direct-to-consumer. It was designed from the start with real people in mind. RightCapital is advisor-delivered, but available to end users through those relationships.

How a users of both tools compares their capabilities

Scott, says, “Right Capital was the gold standard. Boldin is getting closer all the time.”

Comparing the Features of Boldin vs. RightCapital

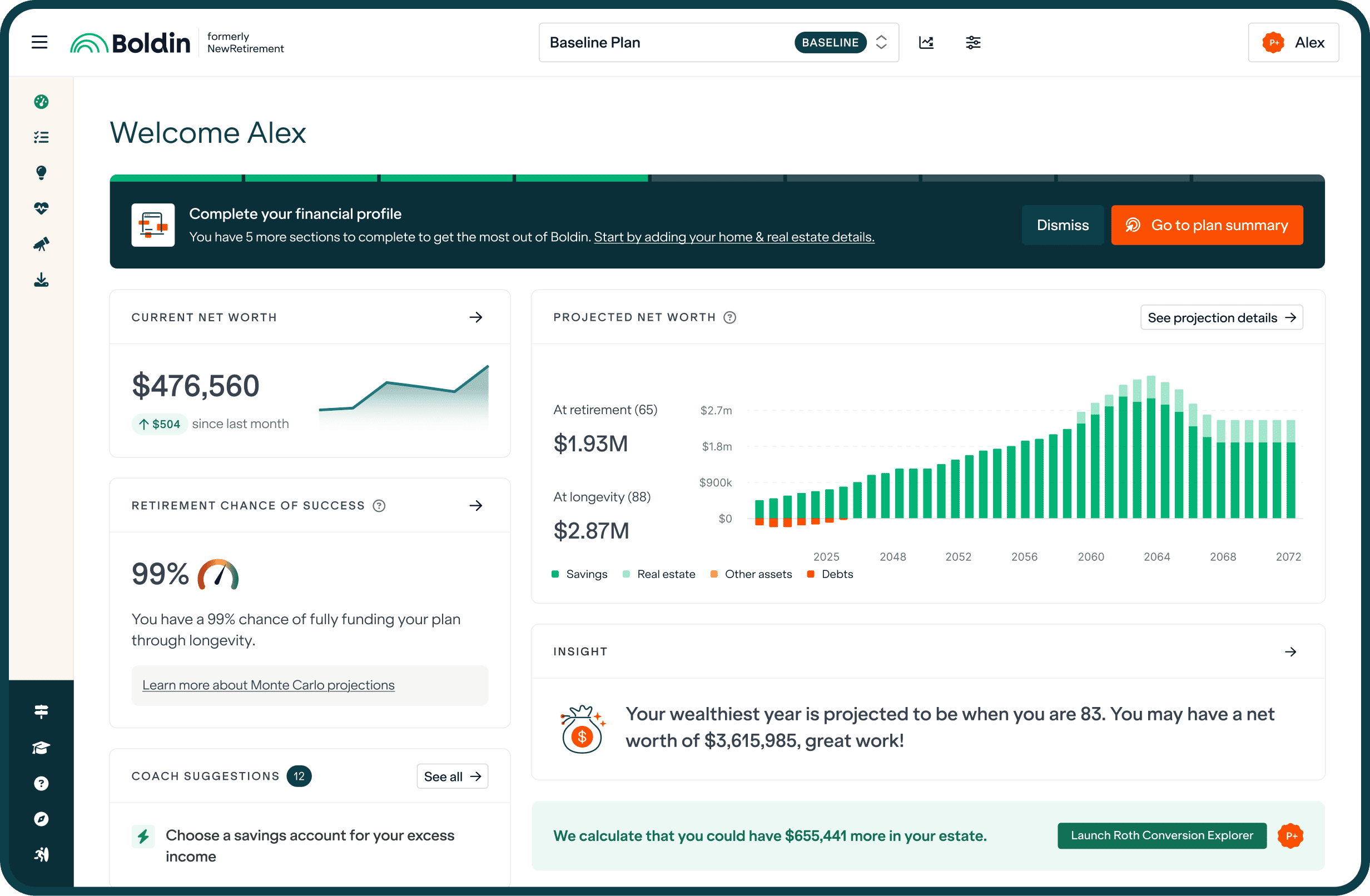

These are two powerful tools that deliver truly comprehensive planning capabilities. They both cover retirement projections, Social Security modeling, Roth conversion analysis, tax planning, “what if” scenario modeling, Monte Carlo simulations, health care and long term care analysis, home and real estate decision making, and so much more.

Boldin is a great alternative to RightCapital. The Boldin Retirement Planner focuses on giving everyday users deep visibility into critical decisions — including tax optimization, withdrawals, home equity, and income strategy.

RightCapital offers expansive tools for advisors, including CRM integration, billing, compliance features, and advanced estate and business planning.

- However, what an advisor can do in the software is usually much more expansive than what an end user can do. Consumers primarily access a client portal to view their financial information, collaborate with their advisor, and may be able to access certain modules or tools, depending on the advisor’s preferences. Advisors, on the other hand, utilize the platform’s more comprehensive features for planning, risk assessment, tax planning, and client engagement.

Costs and How to Access Boldin and RightCapital

Accessing Boldin is simple: Anyone can sign up directly at Boldin.com. You can create an account in minutes, start modeling your full financial plan, and choose from a range of support options — from fully DIY to working with a fee-only CFP®.

- There’s no advisor relationship required, no hidden fees, and pricing starts as low as $10/month and you can try it out for a 14 day free trial.

- A limited feature set is always available for free.

- Live and recorded classes are available to everyone.

- 1:1 coaching and full service fee-only advice from a CFP® can be added on if desired

Accessing RightCapital requires going through a financial advisor: RightCapital is not available for direct consumer signup. Instead, you gain access when working with a financial advisor who uses the platform.

Support and Planning Help

- Boldin:

Offers flexible support options — including onboarding help, group education, affordable coaching, and full-service advice (only if you want it). - RightCapital:

Support comes entirely from your advisor, who sets up your plan and interprets results for you.

Other RightCapital Alternatives

- Some advisors include the software as part of a larger service package (sometimes at no visible cost to you), while others may charge separately depending on their pricing structure. You might look at the following advisories to access RightCapital:

If you’re evaluating alternatives, here are a few other tools worth mentioning:

- Empower (formerly Personal Capital): Good for investment tracking, but lighter on deep planning and scenario modeling.

- MoneyGuidePro: Advisor-focused like RightCapital, also not available directly to consumers.

- eMoney: Another professional platform for advisors; extremely powerful, but not accessible unless you work with a professional.

Checkout a full comparison of the best Right Capital alternatives

Compare Right Capital and Boldin to the best:

Conclusion: Choosing the Right Tool for You

RightCapital is a top-tier solution — but it’s built for advisors, not directly for you. If you’re looking for a RightCapital alternative that puts the power in your hands, Boldin may be the better fit.

You don’t need an advisor to build a real plan. You just need the right tools

Choose Boldin if:

- You want to take control of your own financial future

- You value affordability, independence, and transparency

- You’re planning for retirement, taxes, and life decisions and want tools that make it easy to model scenarios and feel confident

Choose RightCapital if:

- You work with a financial advisor who offers it

- You want a guided experience from a professional

- Your planning needs are complex and you prefer a fully-managed approach

Publisher: Source link