CMS has just released information about Medicare Part D plans for 2025, including plan availability and premiums for the coming year. While CMS’s headline emphasized stability in terms of average Part D premiums, a quick review of the data shows that many insurers are increasing premiums for their stand-alone drug plan offerings, but not across the board. Some major plan sponsors, including Aetna and UnitedHealthcare, are also reducing their stand-alone prescription drug plan offerings, and overall, there will be fewer PDPs in 2025 than in 2024 – 524 plans nationwide, down from 709 in 2024.

Normally the release of the Medicare plan “landscape file” is a somewhat sleepy late September occurrence, but there was greater anticipation of this year’s release due to uncertainty around the impact on premiums of changes to the Part D benefit under the Inflation Reduction Act that are taking effect in 2025. These changes include a new $2,000 cap on out-of-pocket drug spending for Part D enrollees and an increase in the share of high drug costs paid for by insurers. While Part D enrollees stand to benefit from enhanced financial protection for their drug costs, concerns were raised that the changes in the benefit design would lead insurers to significantly increase premiums for Part D coverage, especially for Medicare’s stand-alone prescription drug plans.

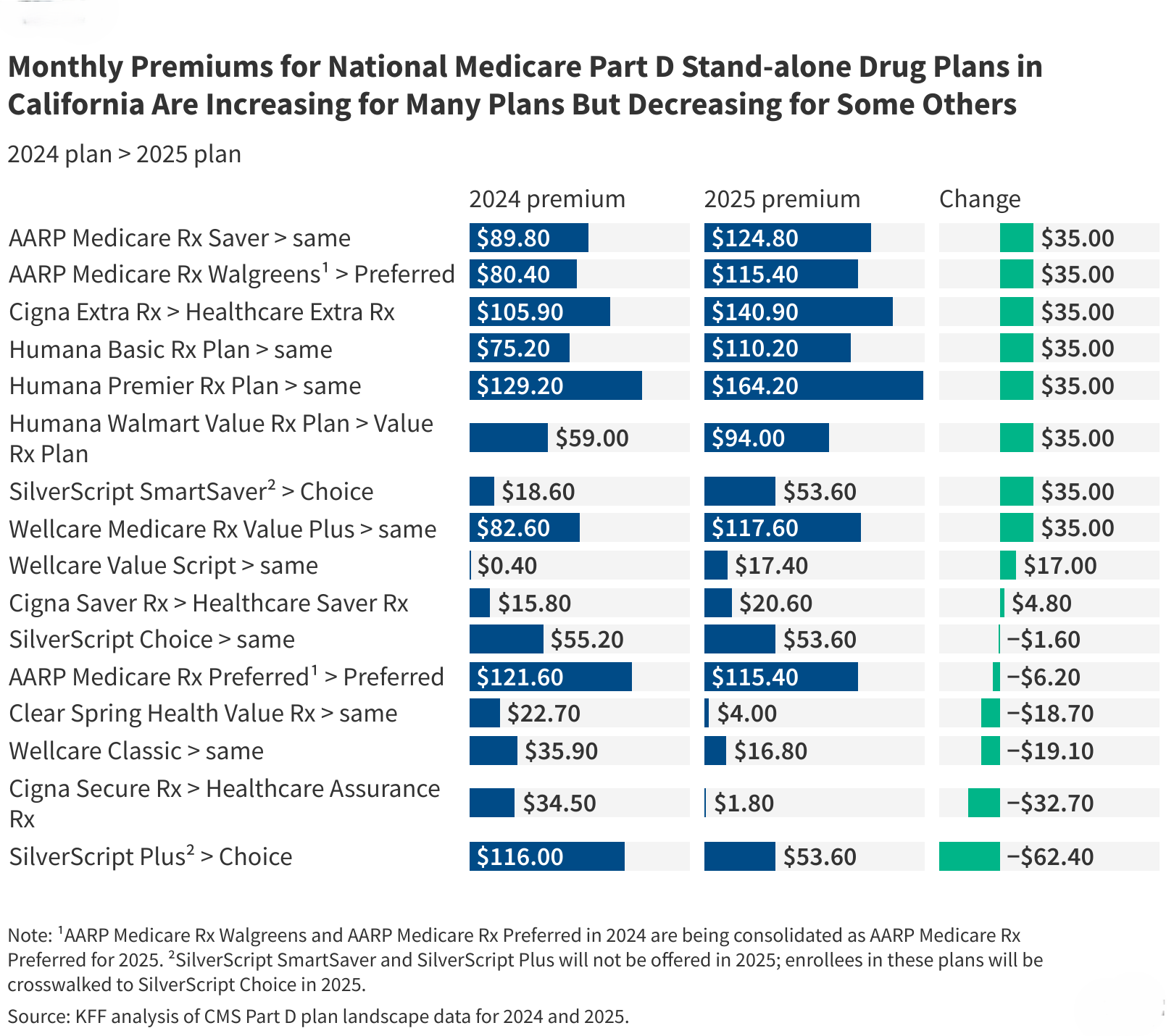

A comprehensive KFF analysis will follow in the future, but it appears that premium increases for 2025 were moderated due to a new Biden-Harris administration Part D premium stabilization demonstration for PDPs, which capped premium increases at $35 per month along with other measures. However, looking at premium changes for a few of the more popular plans shows a mixed picture across plans, with premium decreases in some cases (based on premiums in California; monthly premiums and premium changes vary by state) (Figure 1):

- The monthly premium for the most popular PDP nationally, Wellcare Value Script, is increasing by $17 in California, from $0.40 to $17.40.

- The second most popular PDP, Aetna’s SilverScript SmartSaver, will no longer be offered nationwide in 2025. Enrollees in that plan will be switched into Aetna’s sole PDP offering for 2025, SilverScript Choice, unless they choose a different plan, and their monthly premium will increase from $18.60 to $53.60, a $35 increase. But enrollees currently in SilverScript Choice will see their premium decrease by $1.60 between 2024 and 2025.

- Enrollees in another popular PDP, Humana’s Value Rx Plan, will see their premiums increase by $35, from $59 to $94.

At most, stand-alone drug plan premiums are increasing by $35 per month over 2024 levels, due to the premium stabilization demonstration. According to CMS, virtually all PDP enrollees are in plans sponsored by insurers that opted to participate in the voluntary demonstration. In the absence of this demonstration, premium increases would certainly have been larger. In California, enrollees in 8 of the 16 national PDPs offered in 2024 will see their premiums increase by $35 if they do not switch to a different plan in 2025, while enrollees in 6 other national PDPs in 2024 will see a premium reduction.With 57% of all Part D enrollees in Medicare Advantage drug plans in 2024 and 43% in stand-alone PDPs, most Part D enrollees are not likely to face increases of this magnitude. This is because Medicare Advantage plans can use rebate dollars from the federal government to reduce premiums for prescription drug coverage. According to CMS, Medicare Advantage drug plan premiums for 2025 are holding steady at considerably lower levels than stand-alone drug plans, on average, with many plans charging zero premium as in previous years.

Changes in plan availability and premium increases for some of the more popular stand-alone drug plans are likely to bring about substantial enrollment shifts in the PDP market during this year’s open enrollment period, more so than in previous years when plan availability and premium changes overall were more modest. It’s also possible that premium increases for PDPs will lead to more enrollees switching from traditional Medicare to Medicare Advantage drug plans, accelerating the steady growth in the Medicare Advantage market.

Publisher: Source link