Medicare Advantage plans, which enrolled nearly 33 million Medicare beneficiaries or 54% of the eligible Medicare population in 2024, because they typically offer extra benefits, such as dental, vision and hearing, often for no additional premium, as well as lower cost sharing compared to traditional Medicare without supplemental insurance, with the trade-off of more restrictive provider networks and greater use of cost management tools, such as prior authorization.

This brief provides an overview of premiums and benefits in Medicare Advantage plans that are available for 2025 and key trends over time. This brief uses data from the CMS Landscape and Benefit files. See methods for more details. In general, this brief refers to Medicare plans available for general enrollment, excludes Special Needs Plans (SNPs), except where noted, and excludes employer plans. A companion analysis describes trends in plan offerings.

Medicare Advantage Highlights for 2025

- Two-thirds of all Medicare Advantage plans with Part D prescription drug coverage (MA-PDs) (67%) will charge no premium (other than the Part B premium) in 2025, similar to 2024 (66%).

- Nearly one-third (32%) of Medicare Advantage plans will offer some reduction in the Medicare Part B premium in 2025, an increase compared to 2024 (19%).

- Nearly all Medicare Advantage plans (97% or more) are offering vision, dental and hearing, as they have in previous years. However, the share of plans offering certain benefits has declined, such as over-the-counter benefits (85% in 2024 vs. 72% in 2025), remote access technologies (74% in 2024 vs. 53% in 2025), meal benefits (72% in 2024 vs. 65% in 2025) and transportation (36% in 2024 vs. 29% in 2025).

- The share of Special Needs Plans (SNPs) offering transportation, remote access technologies and in-home support services declined slightly in 2025, while the share offering bathroom safety devices and the Part B rebate increased.

- A larger share of SNPs than other Medicare Advantage plans are offering Special Supplemental Benefits for the Chronically Ill, which are extra benefits available to a subset of a plan’s enrollees, particularly food and produce (84% in SNPs; 15% in individual plans) and general supports for living, such as housing and utilities (67% in SNPs; 11% in individual plans).

Premiums

The vast majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage (MA-PDs), the same as in 2024, and the share of MA-PDs that charge no premium (other than the Part B premium of $185 per month) is 67% in 2025, similar to 2024 (66%). Nearly all beneficiaries (99%) have access to a MA-PD with no additional monthly premium in 2025, the same as in 2024 (99%).

In 2024, 75% of enrollees in MA-PD plans pay no premium other than the Medicare Part B premium. Based on enrollment in March 2024, 10% of enrollees pay at least $50 a month, including 3% who pay $100 or more. CMS estimates that the average monthly plan premium among all Medicare Advantage enrollees in 2025, including those who pay no premium for their Medicare Advantage plan, will be $17.00 a month. In 2024, 12 percent of Medicare Advantage enrollees are in a plan that offered some reduction in Medicare Part B premiums.

In 2025, 32% of Medicare Advantage plans will offer some reduction in the Part B premium, higher than the share in 2024 (19%) (Figure 1).

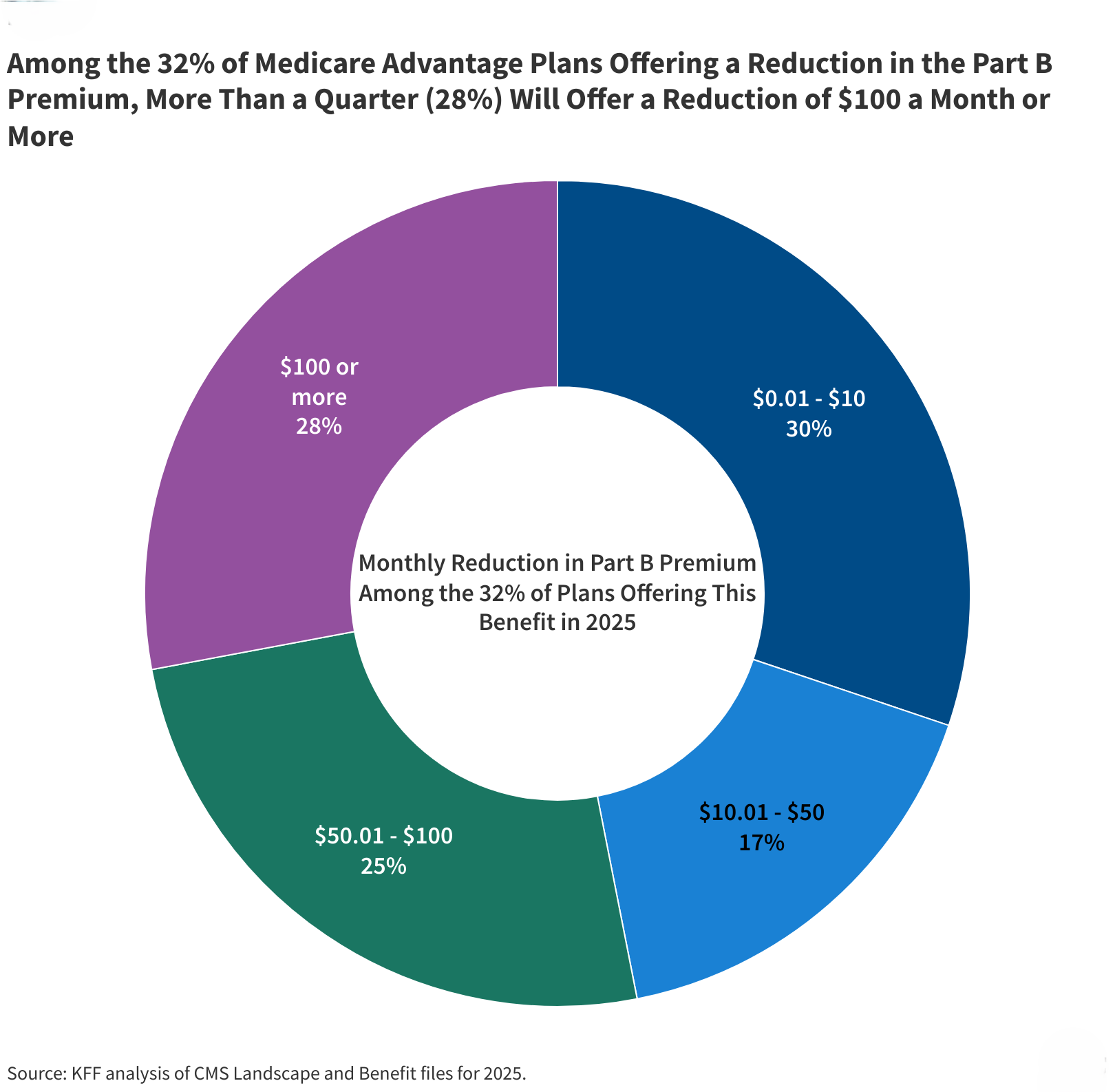

Among plans that are offering a monthly reduction in the Part B premium ($185 per month in 2025), 28% are offering a monthly reduction of $100 or more, 25% are offering a reduction of $50.01 to $100, 17% are offering a reduction of $10.01 to $50, and 30% are offering a monthly reduction of $10 or less.

In previous years, a smaller share of Medicare Advantage enrollees has typically ended up in plans that reduced the Part B premium. For example, for the 2024 plan year, 19% of plans offered a reduction in the Part B premium, but ultimately only 12% of Medicare Advantage enrollees were enrolled in plans with this benefit.

While many employers and unions also offer Medicare Advantage plans to their retirees, no information about these 2025 plan offerings is made available by CMS to the public during the Medicare open enrollment period. Employer and union plans are administered separately and may have enrollment periods that do not align with the Medicare open enrollment period.

Extra Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare, are considered “primarily health related,” and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits. Beginning in 2019, CMS expanded the definition of “primarily health related” to allow Medicare Advantage plans to offer additional supplemental benefits. Medicare Advantage plans may also restrict the availability of these extra benefits to certain subgroups of beneficiaries, such as those with diabetes or congestive heart failure, making different benefits available to different enrollees.

Availability of Extra Benefits in Individual Plans for General Enrollment. In 2025, 97% or more individual plans offer some vision, dental or hearing benefits, similar to 2024 (Figure 2). Though these benefits are widely available, the scope of coverage for these services varies. For example, a dental benefit may include cleanings and preventive care or more comprehensive coverage, and often is subject to an annual dollar cap on the amount covered by the plan. From year to year, plans may change the parameters of this coverage, such as increasing or decreasing annual maximums the plan will pay toward the benefit or adjusting cost sharing for services. There is not yet data available about utilization of these benefits or associated costs, so it is not clear the extent to which supplemental benefits are used by enrollees.

As of 2020, Medicare Advantage plans have been allowed to include telehealth benefits as part of the basic benefit package – beyond what was allowed under traditional Medicare prior to the COVID-19 public health emergency, which was extended to December 2024. Therefore, these benefits are not included in the figure above because their cost is not covered by either rebates or supplemental premiums. Medicare Advantage plans may also offer supplemental telehealth benefits via remote access technologies and/or telemonitoring services, which can be used for those services that do not meet the requirements for coverage under traditional Medicare or the requirements for the telehealth benefits as part of the basic benefit package (such as the requirement of being covered by Medicare Part B when provided in-person). In 2025, 53% of plans are offering remote access technologies, a decline from 74% in 2024. A similar share of plans are offering telemonitoring services (2% in 2025 vs 3% in 2024).

Some benefits are being offered by a smaller share of plans in 2025 than in 2024. For example, 72% of plans are offering an allowance for over-the-counter items (vs. 85% in 2024), while 65% are offering meal benefits (vs. 72% in 2024), and 29% are offering transportation benefits for medical needs (vs. 36% in 2024). A similar share of plans is offering acupuncture (32% in 2025 vs. 34% in 2024), bathroom safety devices (24% in 2025 vs 22% in 2024), and support for caregivers of enrollees (5% in 2025 and 2024). A smaller share of plans are offering in-home support services (6% in 2025 vs 9% in 2024). This is not an exhaustive list of extra benefits that plans offer, and plans may provide other services such as home-based palliative care, therapeutic massage, and adult day health services, among others.

Access to Medicare Advantage Plans with Extra Benefits. Virtually all Medicare beneficiaries live in a county where at least one Medicare Advantage plan available for general enrollment (excluding SNPs) has some extra benefits not covered by traditional Medicare, with over 99% having access to at least one or more plans with dental, fitness, vision, and hearing benefits for 2025, the same as in 2024. The vast majority of beneficiaries also have access to one or more plans that offer an allowance for over-the-counter items (over 99%), a meal benefit (over 99%), remote access technologies (99%), acupuncture (98%), bathroom safety devices (96%), transportation assistance (94%) but fewer have access to one or more plans that offer in-home support services (60%), caregiver support (41%), or telemonitoring services (16%). (Connecticut is not included in these estimates – see methods for more details.)

Availability of Extra Benefits in Special Needs Plans. SNPs are designed to serve a disproportionately high-need population, and a somewhat larger percentage of SNPs than plans for other Medicare beneficiaries provide their enrollees over-the-counter benefits (92%; similar to 2024 – 94%), transportation benefits for medical needs (81%; a decline from 88% in 2024), meals (73%, similar to 2024 – 75%), bathroom safety devices (54%; up from 34% in 2024), and in-home support services (17%; down from 25% in 2024) (Figure 3). Compared to individual plans, a smaller share of SNPs offer fitness benefits (83%, similar to 2024 – 84%), remote access technologies (49%; a decline from 66% in 2024), and the Part B rebate (29%; up from 7% in 2024). Similar to plans available for individual enrollment, a relatively small share of SNPs offer support for caregivers (5%) or telemonitoring services (2%).

Availability of Special Supplemental Benefits for the Chronically Ill (SSBCI). Beginning in 2020, Medicare Advantage plans have also been able to offer extra benefits to a subset of a plan’s enrollees, that are not primarily health related and are specifically for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill (SSBCI). In addition, Medicare Advantage plans participating in the Value-Based Insurance Design Model may also offer these non-primarily health related supplemental benefits to their enrollees, but can use different eligibility criteria than required for SSBCI, including offering them based on an enrollee’s socioeconomic status (e.g., LIS eligibility) or whether the enrollee lives in an underserved area.

Most individual and SNP Medicare Advantage plans still do not offer these benefits, though more SNP plans generally offer these benefits, particularly food and produce. SSBCI benefits offered in 2025 include food and produce (15%% for individual plans and 84% for SNPs), general supports for living (e.g., housing, utilities) (11% in individual plans and 67% for SNPs), transportation for non-medical needs (8% for individual plans and 46% for SNPs), and pest control (3% for individual plans and 23% for SNPs) (Figure 4).

Like for other types of supplemental benefits, the scope of services for SSBCI benefits varies. For example, many plans offer a specified dollar amount that enrollees can use toward a variety of benefits, such as food and produce, utility bills, rent assistance, and transportation for non-medical needs, among others. This dollar amount is often loaded onto a flex card or spending card that can be used at participating stores and retailers, which can vary depending on the vendor administering the benefit. Depending on the plan, this may be a monthly allowance that expires at the end of each month or rolls over month to month until the end of the year, when any unused amount expires.

Meredith Freed, Jeannie Fuglesten Biniek, and Tricia Neuman are with KFF. Anthony Damico is an independent consultant.

Methods |

|

This analysis focuses on the Medicare Advantage marketplace in 2025 and trends over time. Data on Medicare Advantage plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS):

Connecticut is excluded from the Access to Medicare Advantage Plans with Extra Benefits section of this analysis due to a change in FIPS codes that are in the Medicare Enrollment Dashboard data but are not yet reflected in the Medicare Advantage enrollment data. Some Alaskan counties are also excluded due to differences in FIPS codes. In previous years, KFF had calculated the share of Medicare beneficiaries enrolled in Medicare Advantage by including Medicare beneficiaries with either Part A and/or B coverage. We modified our approach in 2022 to estimate the share enrolled among beneficiaries eligible for Medicare Advantage who have both Medicare Part A and Medicare B. These changes are reflected in all data displayed trending back to 2010. Additionally, in previous years, KFF had used the term Medicare Advantage to refer to Medicare Advantage plans as well as other types of private plans, including cost plans, PACE plans, and HCPPs. However, cost plans, PACE plans, HCPPs are excluded from this analysis in addition to MMPs. These exclusions are reflected in all data displayed trending back to 2010. KFF’s plan counts may be lower than those reported by CMS and others because KFF uses overall plan counts and not plan segments. Segments generally permit a Medicare Advantage organization to offer the “same” local plan, but may vary supplemental benefits, premium and cost sharing in different service areas (generally non-overlapping counties). |

Publisher: Source link