Over the last decade, Medicare Advantage, the private plan alternative to traditional Medicare, has taken on a prominent role in the Medicare program. In 2024, nearly 33 million Medicare beneficiaries are enrolled in a Medicare Advantage plan, more than half, or 54%, of the eligible Medicare population.

Despite concerns that modifications to the payment formula and higher utilization would impact the number of Medicare Advantage plans offered in 2025, the Medicare Advantage market appears to be relatively stable. While Medicare Advantage insurers have made some adjustments in their offerings, the average Medicare beneficiary has a choice of more than 30 Medicare Advantage prescription drug (MA-PD) plans, and virtually all plans provide multiple extra benefits like vision, hearing and dental benefits, similar to last year.

This brief provides an overview of the Medicare Advantage plans that are available for 2025 and key trends over time. This analysis uses data from the CMS Landscape files. In general, this brief refers to individual Medicare plans available for general enrollment, excludes Special Needs Plans (SNPs), except where noted, and excludes employer plans. (See methods for more details.) A second, companion analysis, describes premiums and benefits that are available for 2025 Medicare Advantage plans and over time.

Medicare Advantage Highlights for 2025

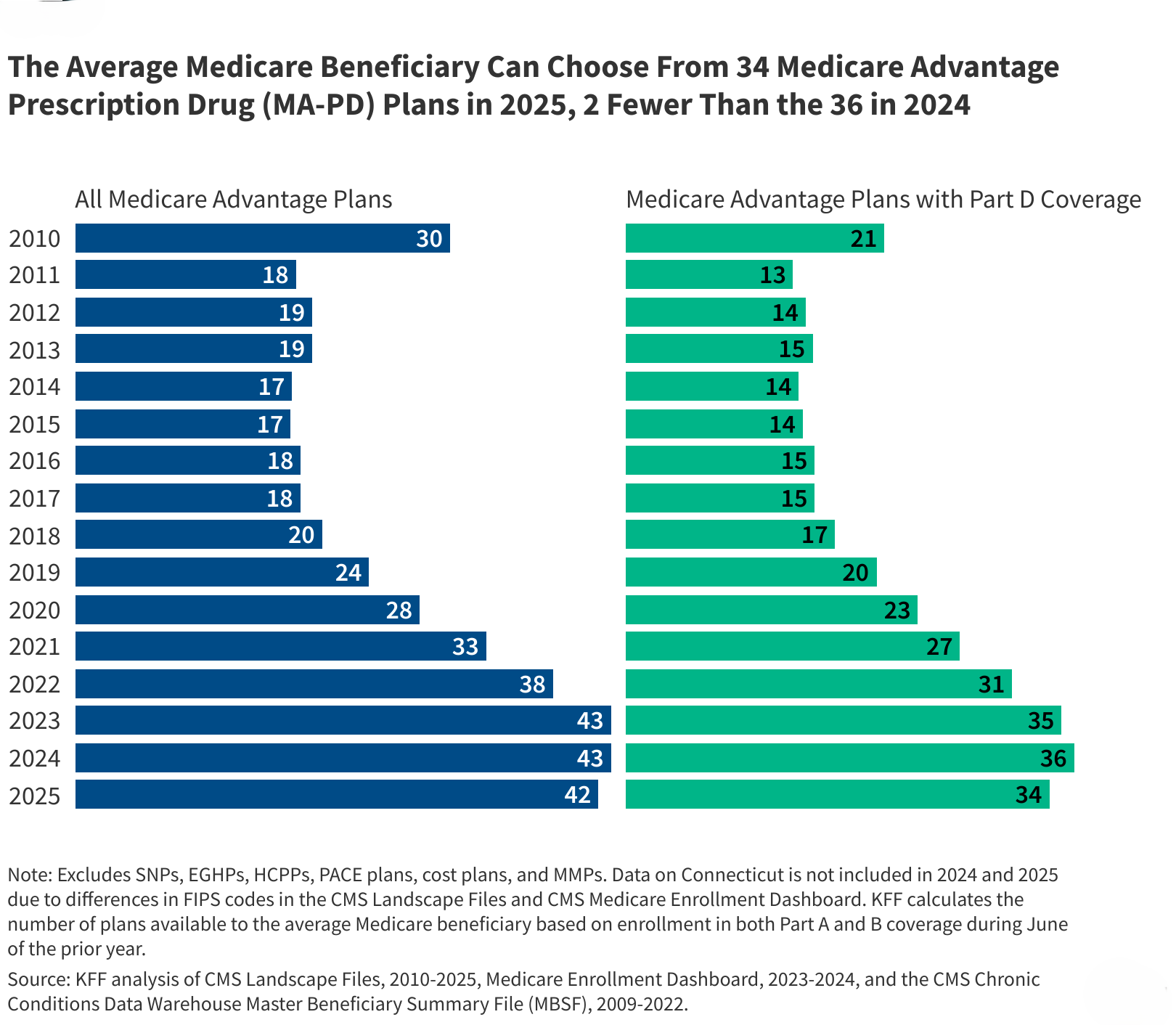

- The average Medicare beneficiary will have the option of 34 Medicare Advantage prescription drug (MA-PD) plans in 2025, 2 fewer than the 36 options available in 2024. Across all plans for individual enrollment, including those with and without prescription drug coverage, the average beneficiary has 42 options in 2025, compared to 43 options in both 2023 and 2024.

- The number of plans available to the average beneficiary varies across states. In 28 states and Puerto Rico, the average beneficiary has a choice of fewer plans in 2025 than in 2024, while in 16 states and DC, the average beneficiary has a choice of more plans, and in five states the number of plans available, on average, stayed the same.

- Nearly one-third of Medicare beneficiaries (32%) live in a county with more than 50 Medicare Advantage plans available in 2025, up from 7 percent in 2020, and similar to 2024 (33%). Less than 0.5 percent live in a county with no plans available.

- The average Medicare beneficiary can choose among plans offered by 8 firms in 2025, the same as in 2024. Three new insurers entered the Medicare Advantage market in 2025, while eight firms exited the market in 2025.

- Major insurers are both expanding into new counties and exiting others. For example, Humana is entering 12 new counties and exiting 70 counties, while UnitedHealthcare is entering 42 new counties and exiting 38 counties. Both insurers are offering plans in nearly 90% of all U.S. counties.

- About 5% of current Medicare Advantage enrollees in individual MA-PDs (or about 1.4 million people) are in a plan that has been terminated for 2025, while up to 7% of enrollees in MA-PDs (or as many as 1.8 million people) may be affected by a consolidation, meaning they are in a plan where some portion of the 2024 enrollment will be automatically assigned to a different plan in 2025.

- More than half (58%) of Medicare beneficiaries live in a county (1,188) where at least one firm is offering 10 or more plans for individual enrollment.

Plan Offerings in 2025

Number of Plans

Number of Plans Available to Beneficiaries. For 2025, the average Medicare beneficiary will have access to 34 Medicare Advantage prescription drug (MA-PD) plans, just 2 fewer than the 36 in 2024 (Figure 1). Across all plans for individual enrollment, including those with and without prescription drug coverage, the average beneficiary has 42 options in 2025, compared to 43 options in both 2023 and 2024. Since 2018, the number of plans available to the average beneficiary has doubled. These numbers exclude employer- or union-sponsored group plans, Special Needs Plans (SNPs), PACE plans, cost plans, and Medicare-Medicaid plans (MMPs) that are only available to select populations.

Total Number of Plans. In total, 3,699 Medicare Advantage plans are available nationwide for individual enrollment in 2025 – a 7% decrease from the number of plans (260 fewer plans) offered in 2024 (Appendix Figure 1).

HMOs account for more than half (55%) of all Medicare Advantage plans offered in 2025 but have declined as a share of all Medicare Advantage plans since 2017 (71% of plans), while during this period local PPOs rose as a share of all plans (Appendix Figure 1). During this period, the share of plans that are local PPOs increased from 24% to 43%. The share of plans that are regional PPOs has slowly declined from around 3% of plans offered in 2017 to 1% in 2025.

While many employers and unions also offer Medicare Advantage plans to their retirees, no information about these 2025 plan offerings is made available by CMS to the public during the Medicare open enrollment period. Employer and union plans are administered separately and may have enrollment periods that do not align with the Medicare open enrollment period.

Special Needs Plans (SNPs). In 2025, 1,442 SNPs will be offered nationwide, an 8 percent increase between 2024 and 2025 (Figure 2).

D-SNPs. Nearly two-thirds of SNPs (63%) are designed for people dually eligible for Medicare and Medicaid (D-SNPs). The number of D-SNPs has increased substantially since 2018, increasing from 401 D-SNPs in 2018 to 906 D-SNPs in 2025 (up from 851 D-SNPs in 2024), suggesting insurers continue to be drawn to this high-need population. In 2024, 5.9 million Medicare beneficiaries are enrolled in D-SNPs.

I-SNPs. The number of SNPs for people who require an institutional-level of care (I-SNPs) nearly doubled from 97 plans in 2018 to 189 plans in 2023, before dropping modestly to 173 plans for 2024 and 160 in 2025. In 2024, about 115,000 Medicare beneficiaries are enrolled in I-SNPs.

C-SNPs. The number of SNPs offered for people with chronic conditions (C-SNPs) has nearly tripled since 2018, from 132 plans that year to 376 plans in 2025 (an increase of 67 plans since 2024). Most C-SNPs focus on people with diabetes, heart disease, or lung conditions, as has been the case since the inception of C-SNPs. For 2025, one firm is offering a C-SNP for people with dementia (different than the one firm offering one in 2024). Two firms are offering C-SNPs for people with mental health conditions (compared to no firms in 2024), and one firm is offering a C-SNP for people with HIV/AIDS, the same one as in 2024. Ten firms are offering C-SNPs for people with end-stage renal disease (up two from 2024). In 2024, 675,000 Medicare beneficiaries are enrolled in C-SNPs.

Variation in Medicare Advantage Plans, by State and County. The number of plans available to the average beneficiary varies across states (Figure 3; Appendix Table 1). In 28 states and Puerto Rico, the average beneficiary has a choice of fewer plans in 2025 than in 2024. In 16 states and DC, the average beneficiary has access to more plans in 2025 than in 2024. In the remaining 5 states, the number of plans available to the average beneficiary stayed the same. This includes Alaska, which had no plans available in 2025, as in 2024. Connecticut is not included in this calculation – see methods for more details.

Nearly 2.2 million beneficiaries in 26 counties can choose from 75 or more Medicare Advantage plans in 2025 (down slightly from 29 counties in 2024). In the same 26 counties, beneficiaries can choose from 63 to 73 Medicare Advantage plans with Part D coverage. Similar to the last three years, the counties with the most plan options are predominantly in Pennsylvania and Ohio. In Pennsylvania, for example, beneficiaries can choose from 80 or more Medicare Advantage plans in 10 counties, including Dauphin County (Harrisburg). Beneficiaries in Cumberland, Pennsylvania can choose from 87 Medicare Advantage plans – the most offerings of any county in the U.S. In Ohio, beneficiaries can choose from 80 or more Medicare Advantage plans in 4 counties, including Summit County (Akron) and Cuyahoga County (Cleveland). In Michigan, beneficiaries in Oakland County (Detroit metro area) can choose from 75 plans (Figure 4).

In 2025, nearly one-third (32%) of Medicare beneficiaries (in 9 percent of counties) can choose from more than 50 Medicare Advantage plans (Figure 5).

Nearly one-third of Medicare beneficiaries (32%) have a choice of at least 50 Medicare Advantage plans in 2025, roughly the same as 2024 (33%). In 2025, less than 0.5 percent of beneficiaries live in a county with one to four Medicare Advantage plans available, while less than 0.5 percent of beneficiaries live in a county without any plans available. Similar to 2024, there are no Medicare Advantage plans for individual enrollment being offered in any county in Alaska in 2025, which includes about 99,000 beneficiaries. In 81 counties, about 250,000 Medicare beneficiaries (including those in Alaska) will not have access to a Medicare Advantage plan (an increase from 58 counties and about 196,000 Medicare beneficiaries in 2024). Additionally, no Medicare Advantage plans are available in territories other than Puerto Rico.

Variation in Medicare Advantage Plans by Geographic Status. Medicare beneficiaries living in metropolitan areas – counties with at least 50,000 people – can choose from 45 Medicare Advantage plans in 2025 on average (down from 47 in 2024), including 37 with Part D coverage, substantially more than beneficiaries living in rural or micropolitan areas. Beneficiaries in micropolitan areas (10,000 to 50,000 people) can choose from an average of 31 plans (1 fewer plan than in 2024), including 24 with Part D coverage.

Beneficiaries in rural areas – counties with less than 10,000 people – can choose from an average of 27 plans (the same as in 2024), including 20 with Part D coverage. Since 2020, when 14 plans were available on average to beneficiaries living in rural areas, the availability of plans in rural areas has nearly doubled.

As in recent years, virtually all Medicare beneficiaries (99.6%) have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.9%), micropolitan (99.0%) and rural (97.8%) areas.

Medicare Advantage Plan Availability by Firm

The average Medicare beneficiary is able to choose from plans offered by 8 firms in 2025, the same as in 2024 (Figure 6). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentrated in plans operated by UnitedHealthcare and Humana, and together UnitedHealthcare and Humana account for nearly half (47%) of Medicare Advantage enrollment in 2024.

In 2025, nearly one-third of beneficiaries (31%), in 169 counties, are able to choose from plans offered by 10 or more firms or other sponsors (a decline from 33% in 2024). In contrast, nearly 5 percent of beneficiaries live in a county where one to three firms offer Medicare Advantage plans (501 counties).

Further, in 126 counties, only one firm will offer Medicare Advantage plans in 2025. These are mostly rural counties with relatively few Medicare beneficiaries (less than 1 percent of total). In some of these counties, there were no firms offering Medicare Advantage in 2024, e.g., 5 counties in Idaho (Benewah, Clearwater, Custer, Lemhi, and Lewis). In contrast, Medicare beneficiaries in some counties had access to plans offered by two or three firms in 2024 but only one firm in 2025, such as people living in Coos County, Oregon.

Availability of Plans by Firm and County. UnitedHealthcare and Humana, the two firms with the most Medicare Advantage enrollees in 2024, have large footprints across the country, offering plans in most counties, similar to 2024 (Figure 7).

Some major insurers are expanding into new counties, while leaving others (Figure 8).

Humana is offering plans in more counties than any other large Medicare Advantage insurer – 2,848 counties in 2025 – though that represents a decrease of 58 counties from 2024. Humana is exiting 70 counties, while entering 12 new counties. UnitedHealthcare is offering plans in 2,808 counties in 2025, an increase of 4 counties from 2024. UnitedHealthcare entered more counties (42 new counties) than it exited (38 counties).

Blue Cross Blue Shield Affiliates are offering plans in 2,604 counties in 2025, an increase of 35 counties from 2024. Blue Cross Blue Shield Affiliates are exiting 44 counties, but are entering 79 new counties. CVS is offering plans in 2,227 counties, an increase of 22 counties. CVS exited 65 counties, but is entering 87 new counties.

Insurer decisions to exit some counties while entering new ones may suggest that local market factors impact insurer evaluations about their potential to attract enrollees and earn a profit.

Multiple Plan Offerings by Firms in the Same County. Many Medicare Advantage firms are also offering more than one plan option in each county.

More than half (58%) of Medicare beneficiaries live in a county (1,188) where at least one firm is offering 10 or more plans for individual enrollment. For example, in Cumberland County, Pennsylvania (the county with the most plan offerings – 87), four firms are offering 10 or more plans (Humana, Blue Cross Blue Shield Affiliates, UPMC Health Plan, and CVS Health). In 125 counties, two firms are offering 10 or more plans, and in 50 counties, three firms are offering 10 or more plans.

In 2025, Humana is increasing the number of plan options available in 631 counties, while decreasing the number of plan options in 1,192 counties. UnitedHealthcare is increasing the number of plans in 381 counties but decreasing plan offerings in 693 counties. Blue Cross Blue Shield Affiliates are increasing the number of plans options in 698 counties, while decreasing plan options in 630 counties. CVS Health is increasing the number of plan options in 667 counties, while decreasing them in 775 counties. This also suggests that insurers evaluate local markets when making decisions about the number of plans to offer and different county characteristics may make the market more or less attractive in a given year to a particular insurer.

Plan Renewals and Terminations

In 2025, 5% of Medicare Advantage enrollees in MA-PDs or about 1.4 million people, are in a plan that has been terminated for the coming year and will not be automatically assigned to another plan. (This number includes people enrolled in SNPs but excludes people in MA-only plans or people with employer coverage). People in this group will be able to enroll in another Medicare Advantage plan if one is available or choose traditional Medicare. If they choose traditional Medicare, they will qualify for a special enrollment period for Medigap with guaranteed issue rights, meaning they can switch to traditional Medicare and will not be denied a Medigap policy due to a pre-existing condition.

Another 7% of Medicare Advantage enrollees in MA-PDs or about 1.8 million people, are in plans that have been affected by a consolidation. In this situation, some portion of this 1.8 million people will be moved into another plan under the same insurer automatically if the contract includes another plan of the same type (i.e., HMO or PPO) in the same county. (Some enrollees in consolidated renewal plans will not see changes in their plan because they were already in the plan that other enrollees are now being assigned to.) They may still enroll in another Medicare Advantage plan if one is available or choose traditional Medicare. However, they do not qualify for a special enrollment period under federal law for Medigap.

New Market Entrants and Exits

In 2025, three firms (Healthy Mississippi, SECUR Health Plan and UCLA Health Medicare Advantage plan) entered the market for the first time, while eight firms exited the market (Appendix Table 2). Healthy Mississippi has one new HMO plan available for general enrollment in Mississippi, while UCLA Health is offering two HMO plans available for general enrollment in California. SECUR Health Plan is offering two I-SNPs in Florida.

In the last few years, some firms have introduced plans that are either co-branded or are in partnership with another company. For example, in 2025, Alignment Health is offering three plans co-branded with Instacart in 7 counties in California and Nevada. These plans will offer groceries to qualifying beneficiaries with chronic conditions. Alignment Health also partners with Walgreens and Rite Aid. Other companies with a partnership that are offering plans in 2025 include Select Health and Kroger and Humana and USAA though this is not an exhaustive list.

Eight firms that participated in the Medicare Advantage market in 2024 are not offering plans in 2025. Six of the firms had low enrollment in 2024 (around 10,000 or fewer enrollees per firm). Two of the firms had contracts taken over by other insurers.

Meredith Freed, Jeannie Fuglesten Biniek, and Tricia Neuman are with KFF. Anthony Damico is an independent consultant.

Appendix

Publisher: Source link