“For too many, coverage is either unavailable or insufficient.” This is the harsh reality the American Hospital Association highlighted in a recent statement to the US Senate, urging action to address growing medical debt. Despite efforts to expand insurance coverage, hospitals continue to lose billions of dollars through unpaid bills. The statement notes that hospitals provided over $42 billion in uncompensated care in 2020 alone.

Guiding low-income patients to appropriate charity care programs can mitigate a significant portion of this uncompensated care. Unfortunately, many eligible patients are either unaware of these options or choose not to apply, causing hospitals to waste time and money chasing bills from people who cannot afford to pay. Helping those patients find and apply for financial support is critical to reducing bad debt.

But that’s a challenging prospect without automation. Presumptive screening with Patient Financial Clearance offers a faster route to reliable charity care classifications and a reduction in uncompensated care.

What is charity care?

Charity care programs provide free or discounted healthcare to patients who can’t afford to pay their bills, covering medically necessary inpatient and emergency room services. Typically, programs offer full or partial discounts to uninsured patients, but those with insurance may be entitled to assistance if their plan doesn’t cover their care. Eligibility depends on the hospital’s financial assistance policies and relevant state regulations.

Hospitals do not expect to be reimbursed for charity care, though tax exemptions and government funding may offset some of the cost. In this way, charity care is distinct from “bad debt,” which refers to unpaid patient bills that hospitals expect to collect.

Frustratingly, too many accounts that could have been eligible for charity care are written off to bad debt—perhaps because patients don’t realize they’re eligible, don’t know how to fill out the application, or feel embarrassed to seek help. The problem is further exacerbated by the growth in high-deductible and “skinny” health plans, as patients without sufficient coverage assume support is only for the uninsured.

Several states are tackling medical debt by bolstering charity care programs. For example, North Carolina plans to boost federal payouts to hospitals that agree to waive medical debt for low-and middle-income patients. In Milwaukee, County Supervisors are taking a preventive approach, using income data to automatically enroll at-risk patients into charity care programs to stave off bad debt before it takes root, in a process known as presumptive charity.

What is presumptive charity?

Checking eligibility and helping patients apply for charity care is predictably form-heavy. Patients must provide tax returns, pay stubs, and bank statements to confirm their household income and financial status. Manual reviews are time-consuming for providers, while the overall experience can feel intrusive or confusing to patients.

Presumptive charity screening expedites charity care checks by automatically screening patients for financial assistance eligibility. It uses automation and data analytics to quickly evaluate the patient’s credit information, financial data and demographic details to make a ‘presumptive’ determination of eligibility for charity care, regardless of coverage status.

Better charity care classifications reduce bad debt

Automated charity care checks mean more patients will be classified correctly so hospitals can confidently seek reimbursement from the appropriate source. This offers several advantages, such as:

- Reducing bad debt: Presumptive charity screening results in fewer eligible patients missing out on financial support, so they’re less likely to be sent bills they can’t pay.

- Increasing efficiency: More accurate screening allows staff to cut time spent on administrative tasks and stop chasing collections from patients who are unlikely to be able to pay.

- Expediting classification decisions: Automation means eligible patients don’t have to wait for long periods to find out if they’ll get financial support, which is especially important in urgent and high-volume services, such as emergency departments and large hospital systems.

- Improving the patient experience: Speedy systems with fewer forms reduce the patient’s involvement to a minimum, contributing to a more convenient and compassionate financial journey.

- Maintaining compliance: Hospitals comply and maintain their non-profit status by providing charity care to their community.

- Supporting patients: Providing accessible healthcare to those who are low-income and are most vulnerable.

How can Patient Financial Clearance help providers improve charity care classifications?

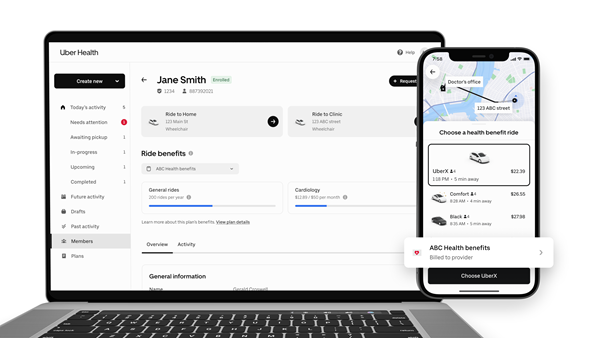

Patient Financial Clearance (PFC) is a presumptive screening tool designed to help providers quickly determine which patients may be eligible for financial assistance. It then connects those patients with relevant charity care programs and automatically enrolls them, or establishes tailored payment plans for the amount they owe based on their financial situation.

First, Patient Financial Clearance triggers automatic checks before or at the point of service to rapidly assess whether the patient qualifies for Medicaid, charity care or other financial assistance programs. It uses Experian Health’s superior data and analytics to accurately estimate the patient’s income, household size and Federal Poverty Line (FPL) percentage, and it calculates a Healthcare Payment Risk Score to predict their propensity to pay. Unlike alternative models which are built to estimate incomes for consumers with higher incomes, PFC’s income estimates are optimized to predict incomes below 400% of the FPL.

Then, if patients are likely to be eligible for charity care, the tool pre-populates application forms and initiates auto-enrollment to reduce staff manual input and the risk of errors.

There needs to be a prompt process to help patients who do not qualify for charity care manage their bills. For patients who do not qualify for charity care, there also needs to be a prompt process to help. Patient Financial Clearance recommends optimal payment plan amounts per the organization’s terms and policies. Staff can pull up summarized and detailed views of the patient’s credit history and custom scripts to guide financial counseling discussions.

Alex Liao, Product Manager for Patient Financial Clearance at Experian Health, explains how better charity classifications help reduce bad debt and increase collections:

“The obvious benefit is that clients can accelerate the charity care application process and ensure eligible patients get assistance quickly. However, having a more accurate picture of patients’ financial needs offers wider benefits across the revenue cycle: it ensures each patient account is handled appropriately to increase upfront collections and reduce bad debt. Those with a low ability to pay receive a payment plan they can afford, while those with a greater capacity to pay are not just paying the minimums.”

Patient Financial Clearance in practice

See how UCHealth used PFC to create a more streamlined approach to charity care classifications, resulting in:

- $26 million in disbursed charity care.

- More than 1,700 patients covered.

- 600 charity cases closed in one month alone (August 2023).

To hear more about how automating charity care classifications with Patient Financial Clearance could help your organization reduce bad debt, contact us today for a demo.

Publisher: Source link