HCA Healthcare raised its guidance for 2025 amid the third quarter’s solid demand and greater per patient revenue metrics, though management was largely reluctant to prognosticate on hot button issues like exchange subsidy extensions and how they might affect utilization in the fourth quarter and beyond.

In quarterly performance numbers released Friday morning and a subsequent earnings call, the 191-hospital chain surpassed investors’ consensus estimates with a 9.6% year-over-year increase in revenues to $19.16 billion and a 29% improvement in net income attributable to HCA of $1.64 billion, or $6.96 per diluted share.

Compared to the third quarter of 2024 and all on a same-facility basis, admissions rose 2.1%, equivalent admissions grew 2.4% and emergency room visits grew by 1.3% despite what management described as a slow start to the respiratory season. Inpatient surgeries increased 1.4%, and outpatient surgeries rose 1.1%.

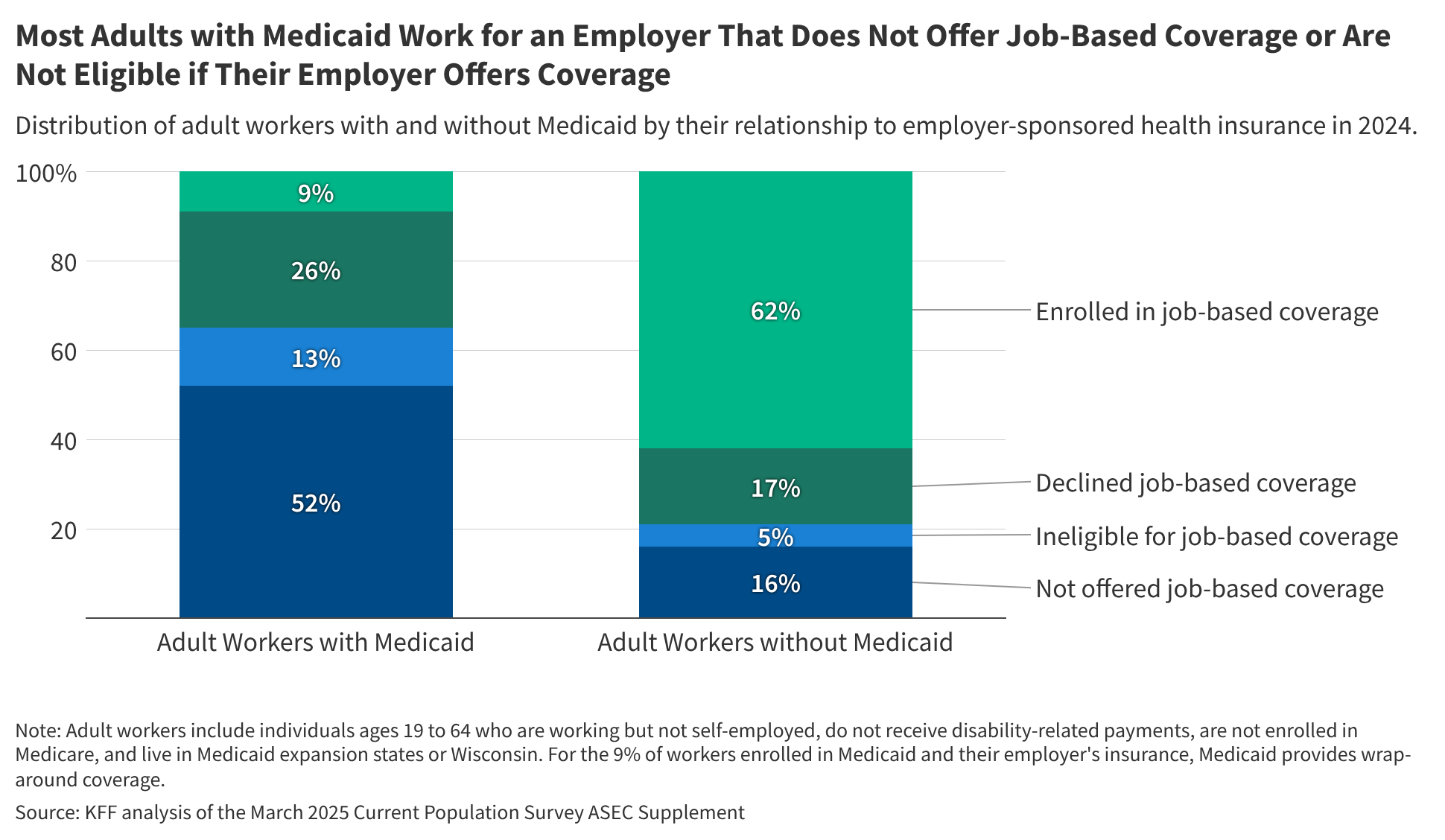

Chief Financial Officer Mike Marks, on Friday’s call, outlined positive movement in HCA’s payer mix, as commercial and Medicare visits in particular rose from last year. On a same-facility basis, commercial equivalent admissions rose 3.7%, split between 8% from exchanges and 2.4% from all other commercial. Medicare rose by 3.4%, Medicaid grew by 1.4% and self-pay declined by 6%.

That payer mix combined with greater success on dispute resolution with payers, a largely “consistent” case mix index with a slight uptick in complex service utilization, and increased Medicaid state supplemental payment revenues to help grow HCA’s inpatient revenue per equivalent admission by 6.1% from the prior year.

The supplemental payment programs alone were responsible for about half of that year-over-year jump, Marks said, with a roughly $240 million increase in net benefit to adjusted EBITDA largely driven by payments from Tennessee’s program and grandfathered applications in Kansas and Texas. Payer mix was the second most impactful.

Executives said they were also pleased with the company’s ability to manage its operating expenses. The quarter’s contract labor spending was “basically flat” compared to the prior year on a same-facility basis, Marks told investors, and represented 4.2% of HCA’s total labor costs.

Other notable expense increases were related to the Medicaid state supplemental payments and to a lesser extent professional fee growth, he said. Executives also outlined the company’s work managing supply utilization and monitoring tariff risk with its vendor contracts, as well as new technology adoption and the company’s multiyear resiliency initiative, as contributors to HCA’s limited expense creep.

The performance led HCA to update its 2025 estimated guidance ranges given over the summer. Revenues are now expected to fall between $75 billion and $76.5 billion, net income attributable to the company between $6.5 billion and $6.72 billion, adjusted EBITDA between $15.25 and $15.65, and earnings per diluted share between $27 and $28.

The updated guidance does not take into account any additional state supplemental payments that could stem from HCA’s pending applications, which management noted are unlikely to be approved by the Centers for Medicare & Medicaid Services amid a government shutdown. They also pointed to the upward trajectory of facilities that had been impacted by last year’s Hurricane Helene, where revenues have so far lagged compared to the prior year performance but should see a tangible bump in the fourth quarter.

Though management broadly signaled confidence for the remainder of 2025 and the upcoming year, executives kept much of their planning related to Washington extending or ending enhanced subsidies for Affordable Care Act exchange plans close to the vest.

Hazen said HCA continues to advocate for the subsidy extension, and that, weeks into the shutdown, “we believe there is greater recognition by legislators of the negative impact this issue will have on families, small businesses and individuals than earlier in the year. At this point, however, we still do not know how this policy will play out.”

The executives declined to comment on whether expiring subsidies could lead to utilization changes, such as a rush to book elective surgeries, in the fourth quarter. A potential deal could lead to a special enrollment period, in which case Marks noted that HCA has financial counseling teams and other resources to help patients navigate toward Medicaid or exchange coverage.

“It’s really difficult to size the potential impact of that until we get a little bit closer to the fourth quarter call, and that’s when we’ll intend to do that,” Marks said.

Executives were willing to share their belief that demand into 2026 will remain within the company’s 2% to 3% volume growth range. Operating costs are expected to follow “mostly stable trends consistent with the past couple of years,” Hazen said. “As usual, there are some pressures in certain areas, but we believe our resilience plan should provide some relief.”

HCA’s earnings included the declaration of a $0.72 per share cash dividend, which will be paid Dec. 29. The company also said it repurchased 6.51 million shares of its common stock at a cost of $2.5 billion, and had another $3.26 billion remaining under its repurchase authorization.

HCA’s shares were trading 2.5% higher than open as of Friday afternoon. The company has so far been joined by fellow for-profit Community Health Systems in reporting a third-quarter performance beyond Wall Street’s expectations.

Publisher: Source link