Contrary to what many financial planners suggest, you can live on a lot less than 100% or even 80% of your pre-retirement income. In fact, a survey by T. Rowe Price of new retirees who have 401(k) account balances or rollover IRAs found that you can live comfortably on a lot less.

The report suggests that nearly three years into retirement, the majority of retirees are living on just 66% of their pre-retirement income (on average).

Is 66% of Your Work Income Really Enough Retirement Income? Too Much?

Only you can really know what you need. But, it is useful to understand what is actually happening in households across the country.

Eighty-five percent of the survey’s 1,507 respondents say they don’t need to spend as much as they did before retirement to be satisfied. And, 57% report they live as well or better than when they were working.

“It [the data] doesn’t surprise me,” says Cynthia Petzold, a certified financial planner with CommonWealth Financial Planning LLC in Roanoke, Va. “Each person’s situation is different, but I think that 66% is reasonable [to cover] basic living expenses.”

But the figure likely doesn’t include special or one-time expenses, such as traveling, house repairs, or car replacements, she adds.

Interested in Living on Less in Retirement? Here Are a Few Tips:

Don’t Rely on Rules of Thumb: Project What You Will Actually Need

The consensus among financial planners is that there isn’t one magic income number that everyone should strive to achieve. The only real way to determine the amount you and your household will need is to make detailed budget projections. Maybe you’ll need 50%, 66%, 100%, or even 200% of your work income.

Get serious about budgeting your next 20–30 years. That may sound crazy or unrealistic, but you can break your projections down into five year increments or think about big milestones like kids graduating college or your spouse’s retirement.

You can also think about retirement in phases – an active phase when you first quit working and may be spending even more than when you were working, a slowing down phase when you start to spend less and an end of life phase where healthcare costs might be expensive.

The NewRetirement Planner lets you do this kind of lifetime budgeting. Set as many different spending levels for as many different phases of retirement as you like as a whole or in 75 different categories. Budgeting your future helps you to envision and build a plan for the life you want.

Need more guidance? Here are 9 tips for predicting retirement expenses.

Create a Buffer in Your Retirement Savings

Make sure to include those occasional expenses, which can take significant chunks out of your savings if not budgeted for properly.

Home and car repairs, entertainment expenses, and rising health care costs are often forgotten about during the planning stages, but these should be budgeted.

“You don’t want to be in a position post-retirement where something comes up [that can] destroy your retirement plan,” says Jim Cantrell, a certified financial planner with Brookfield, Wisconsin-based Financial Strategies Inc. “You want some buffers in your retirement plan, and one way to do that is to estimate costs on the high side – add in those occasional expenses. If they’re not in the plan, those can be $10,000 to $50,000 that you weren’t expecting and can really damage your retirement plan.”

For example, most retirees tend to replace their car within five to 10 years of retirement, he says. So to plan for that cost down the road, retirees should look at how much it might cost to buy a new or used car and add that into their budget.

Don’t Forget Travel or Other Goals

And, don’t forget travel. Travel is the most desired retirement pursuit by the highest numbers of retirees.

Whether it is travel, or something else, make sure you budget for what you want to do in retirement.

Monitor Your Budget and Be Flexible

Being flexible is key to setting and reaching your target retirement income level.

“Once you’re in retirement, then every year take a look at your planned expenditures, your sources of income, and adjust your spending depending on what your income is going to be,” Petzold suggests. “Be flexible as you’re thinking about your retirement spending. Sometimes I don’t think people understand that you don’t have to take out the same amount every month.”

The NewRetirement retirement planning system saves your data so it is easy to make adjustments and keep things up to date.

Ultimately, finding the right balance between your cash flow and spending patterns, while adjusting for any occasional expenses, is key to living comfortably in your retirement.

“People say financial planning is like a puzzle, but I don’t think that’s true,” Cantrell says. “It’s more like a Rubik’s Cube: All the pieces are interrelated with the other pieces. Anytime you say ‘I’m going to change what I spend on one thing,’ it changes what you spend on everything else.”

Consider Average Retirement Income

Not sure if 66% of your work income will really cover what you need and want in retirement? Maybe consider the average household retirement income: $71,446 for 2022. (However, remember that averages, especially national averages can be tremendously misleading. Where you live, your age, and the specifics of your lifestyle are more important than averages.)

Prioritize

Budgeting for 66% of your pre retirement income might not mean that you can buy everything you want, but you may make it work if you prioritize spending on what is really important to you.

Try Living on a Reduced Budget Before You Retire

It may not be totally realistic, but it can be a great idea to try living on a reduced budget before you retire to just get a feel for it.

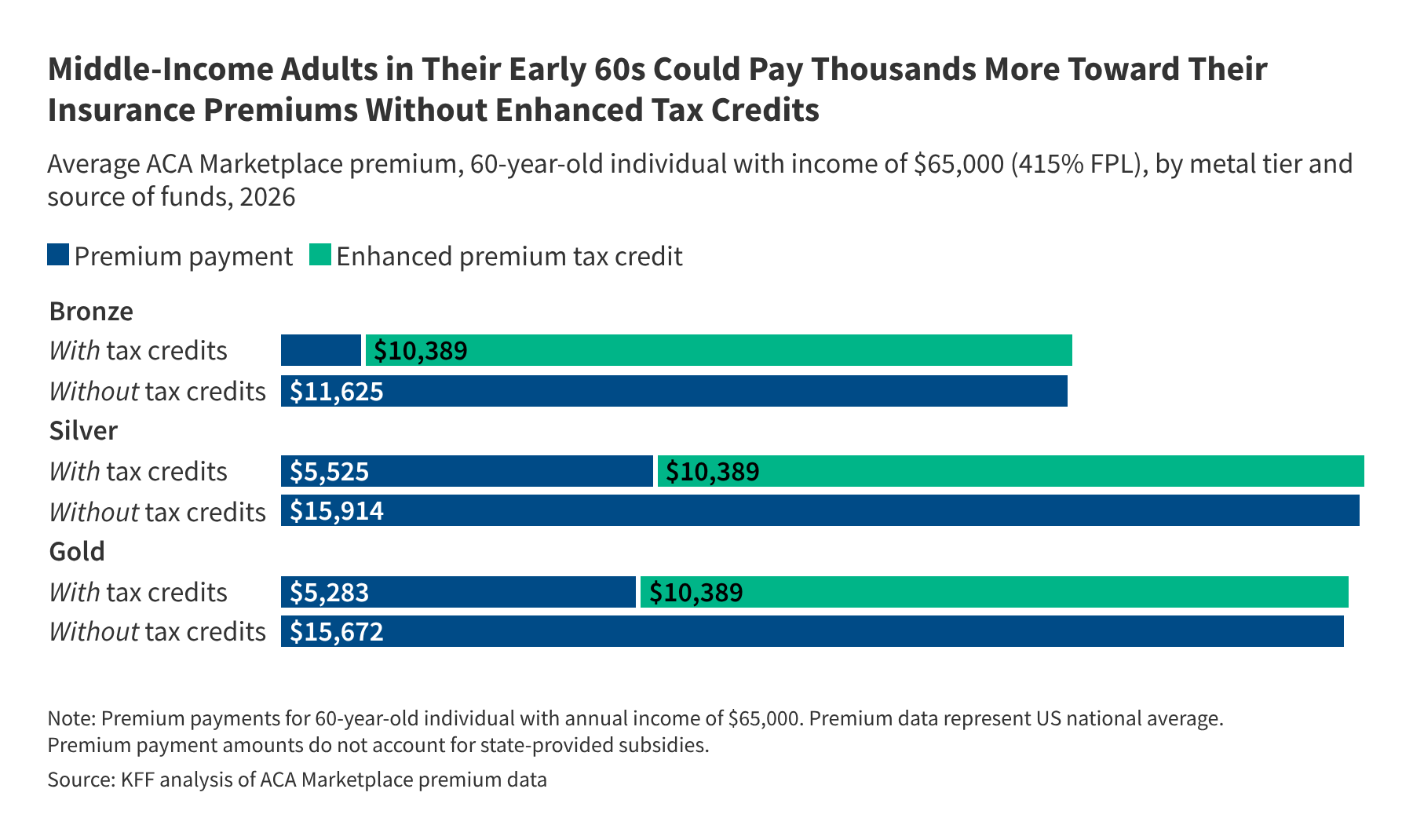

Budget Healthcare

If you think that Medicare is going to cover your healthcare. Think again.

Research from Fidelity Investments estimates that a 65-year old couple retiring in 2023 may need approximately $315,000 saved to cover health and medical expenses throughout their retirement. And, that doesn’t include the potential cost of long term care.

Get a personalized estimate for your healthcare costs in the NewRetirement Planner. You can also discover different ways to plan for and fund long term care.

At Whatever Spending Level, You’ll Likely Make it Work and Be Quite Happy

Research from Merril Lynch found that 92% of retirees say that retirement gives them “greater freedom and flexibility to do whatever they want — regardless of how much money they have.” The sweet spot of freedom is between the ages of 61 and 75. This is the time when the study says that most people enjoy the “greatest balance of health, free time, fun and emotional well being.”

Publisher: Source link