Section 1115 Medicaid demonstration waivers offer states an avenue to test new approaches in Medicaid that differ from what is required by federal statute, so long as the approach is likely to “promote the objectives of the Medicaid program.” Waivers generally reflect priorities identified by states as well as changing priorities from one presidential administration to another. Each administration has some discretion over which waivers to approve and encourage, but that discretion is not unlimited. The Trump administration’s Section 1115 waiver policy emphasized work requirements – which were challenged in court – and other eligibility restrictions and capped financing. In contrast, the Biden-Harris administration has encouraged states to propose waivers that expand coverage, reduce health disparities, and advance whole-person care. Both administrations prioritized improving access to behavioral health services.

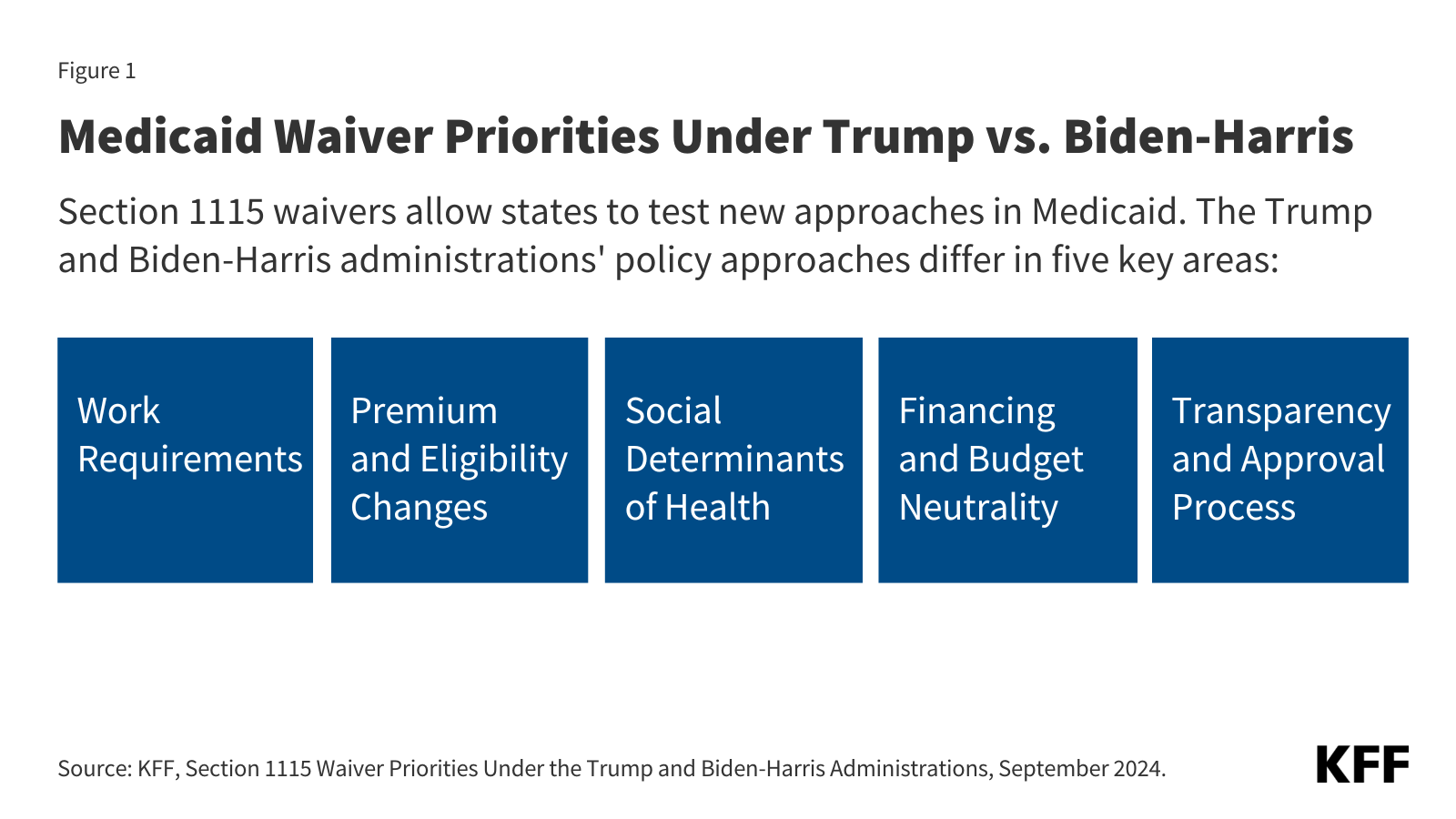

As with broader Medicaid policy, the future landscape of Section 1115 waivers depends on the outcome of the November 2024 presidential election as a new administration could focus on different priorities, rescind existing guidance, or withdraw already-approved waivers. This waiver watch summarizes five key areas of difference in 1115 waiver policy and waiver approvals under the Trump and Biden-Harris administrations (Figure 1, also see Appendix Table 1).

- Work Requirements. For the first time in the history of the Medicaid program, the Trump administration encouraged and approved Section 1115 waivers that conditioned Medicaid coverage on meeting work and reporting requirements, approving 13 state work requirement waivers. The Biden-Harris administration withdrew Medicaid work requirement waivers in all states that had approvals, concluding that these provisions do not promote the objectives of the Medicaid program.

- Premiums and Eligibility Changes. Under the Trump administration, CMS approved a range of demonstrations that included eligibility restrictions, including permitting states to apply restrictions (e.g., charging premiums, locking out enrollees disenrolled for unpaid premiums, and eliminating retroactive eligibility) to new populations (beyond ACA expansion adults) and approving several eligibility restrictions for the first time in program history. The Biden-Harris administration took steps to withdraw or phase out Medicaid premium requirements for several states and has encouraged states to propose waivers that expand Medicaid coverage and improve continuity of care.

- Social Determinants of Health. The Trump administration generally had a limited focus on enrollee social determinants of health. In contrast, addressing health disparities and promoting integrated (“whole person”) care has been a primary focus of the Biden-Harris administration. In 2022, CMS announced a new 1115 demonstration opportunity that expands flexibility for states to leverage Medicaid to help address enrollee health-related social needs (HRSN) (including housing instability, homelessness, and nutrition insecurity).

- Financing and Budget Neutrality. The Centers for Medicare and Medicaid Services (CMS) made changes to 1115 waiver budget neutrality policy in 2018, limiting the amount of federal funds that could be used for waiver spending. The Trump administration also introduced a demonstration opportunity that would have allowed states “extensive flexibility” to use Medicaid funds to cover certain adults without being bound by many federal standards (related to eligibility, benefits, delivery systems, and oversight) if states agreed to annual limits on federal financing (no state took up this option). The Biden-Harris administration made changes to Section 1115 budget neutrality policies that may provide greater flexibility for states to design and implement 1115 demonstration programs, including HRSN initiatives.

- Transparency and Approval Process. Under the Trump administration, in a departure from prior policy, CMS approved waiver extension requests for up to 10 years, signaled an interest in reducing the frequency of required state reporting on 1115 waivers, and did not enforce state-level public notice and comment procedures for certain new/renewal 1115 waiver requests. Under the Biden-Harris administration, CMS removed the option for 10-year extensions and for less frequent state reporting and has enforced transparency and public notice requirements.

Work Requirements

Current Law/Context. Data show most Medicaid adults are working or face barriers to work. Current law prohibits conditioning Medicaid eligibility on meeting a work or reporting requirement. Prior to the Trump administration, no states had received Section 1115 waiver approval to condition Medicaid coverage on work and reporting requirements, and legislative attempts to incorporate work requirements into Medicaid statute failed. Medicaid can support employment by providing health coverage and access to care and medications that enable people to work, and it can also provide voluntary employment referral and/or work support programs. A central question in the debate over work requirements in Medicaid is whether such policies promote health. A review of research on the relationship between work and health found that although there is strong evidence of an association between unemployment and poorer health outcomes, there is limited evidence on the effect of employment on health (studies have found job quality and stability are key factors in work-health relationship). While work requirements were the subject of litigation during the Trump and Biden-Harris administrations, the Supreme Court never ruled on the issue leaving it open for future administrations; however, any future waivers with work requirements would likely face legal challenges. Several states continue to pursue work requirement waivers, often tied to Medicaid expansion efforts.

Trump. The Trump administration encouraged and approved Section 1115 waivers that conditioned Medicaid coverage on meeting work and reporting requirements, approving 13 state work requirement waivers. Only Arkansas implemented work and reporting requirements with consequences for noncompliance, which resulted in over 18,000 people losing coverage before the court deemed the work requirement unlawful. While the vast majority of enrollees were working or qualified for exemptions, barriers with meeting reporting requirements led to people getting dropped from the program. Other states with approvals for work requirements paused implementation due to litigation and/or the COVID-19 pandemic. Plans from some Republican and conservative groups continue to support federal legislation to allow or require work requirements in Medicaid. A Congressional Budget Office analysis of a recent work requirement proposal shows that the policy would reduce federal spending due to reductions in enrollment but would not increase employment.

Biden-Harris. The Biden-Harris administration withdrew Medicaid work requirement waivers in all states that had approvals, concluding that these provisions do not promote the objectives of the Medicaid program. Although CMS withdrew work and premium requirements in Georgia’s “Pathways” waiver, these provisions remain in place after a federal judge vacated the CMS rescission. Georgia’s waiver expands eligibility to 100% of the federal poverty level (FPL) for parents and childless adults (not a full Medicaid expansion under the ACA that does not qualify for enhanced federal matching funds), with initial and continued enrollment conditioned on meeting work and premium requirements. The waiver was implemented in July 2023. A year into the demonstration, enrollment remains low—as of June 2024, the state had only enrolled about 4,300 adults.

Premiums and Eligibility Changes

Current Law/Context. Given that people covered by Medicaid have low-incomes, federal rules limit states’ ability to charge premiums. States may not charge premiums to Medicaid enrollees with incomes below 150% of the FPL ($22,590 for an individual in 2024). Total family out-of-pocket costs (premiums and cost-sharing) are limited to no more than 5% of family income. Some states have received 1115 waiver approval to charge premiums or monthly contributions that are not otherwise allowed. States can also request 1115 authority to implement other eligibility and enrollment restrictions or to implement eligibility expansions, not otherwise allowed under current law (see Appendix Table 2).

Trump. Under the Trump administration, CMS approved a range of demonstrations that included eligibility restrictions. The administration approved some eligibility- and enrollment-related waiver provisions that had been approved under previous administrations (e.g., charging premiums, eliminating retroactive eligibility, making coverage effective on the date of the first premium payment (instead of the date of application), and locking out enrollees disenrolled for unpaid premiums); however, the Trump administration permitted states to apply these restrictions to new populations beyond ACA expansion adults (e.g., low-income parent/caretakers). The Trump administration also approved several eligibility restrictions for the first time, including:

- Coverage lock-outs for failure to timely renew coverage or report changes affecting eligibility

- Authority to charge premiums up to 5% of family income and to impose a premium surcharge for tobacco users

- Eligibility conditioned on the completion of a health risk assessment

Biden-Harris. The Biden-Harris administration has taken steps to withdraw or phase out Medicaid premium requirements for several states, indicating the research evidence shows imposing premiums reduces access to coverage and care and is not likely to promote the objectives of the Medicaid program. The Biden-Harris administration also withdrew or phased out the authority for states to condition Medicaid eligibility on the completion of a health risk assessment.

The Biden-Harris administration has encouraged states to propose waivers that expand Medicaid coverage and improve continuity of care. For example, the Biden-Harris administration has encouraged states to adopt strategies to promote continuity of coverage, including providing multi-year continuous eligibility for children (e.g., birth to age 6) through Section 1115. In April 2023, CMS released guidance encouraging states to apply for a new Section 1115 demonstration opportunity to test transition-related strategies to support community reentry for people who are incarcerated. This demonstration allows states a partial waiver of the inmate exclusion policy, which prohibits Medicaid from paying for services provided during incarceration (except for inpatient services). CMS has developed a standard demonstration application and special terms and conditions for reentry waivers to expedite approval.

Social Determinants of Health

Current Law/Context. Social determinants of health (SDOH) are the conditions in which people are born, grow, live, work and age. SDOH include but are not limited to housing, food, education, employment, healthy behaviors, transportation, and personal safety. While there are limits, states can use Medicaid – which, by design, serves a primarily low-income population with greater social needs – to address social determinants of health. States can use a range of state plan and waiver authorities to add certain non-clinical services to the Medicaid benefit package including case management, housing supports, employment supports, and peer support services.

Trump. The Trump administration generally had a limited focus on enrollee social determinants of health. One exception was the administration’s 2018 approval of North Carolina’s “Healthy Opportunities Pilots,” allowing the state to cover certain non-medical services that target social needs, including housing, nutrition, transportation, and interpersonal relationship supports. The Trump administration later released guidance in 2021 highlighting existing federal authorities and opportunities for states to use Medicaid to address enrollee social determinants of health, including under Section 1115 authority.

Biden-Harris. Addressing health disparities and promoting integrated, “whole person” care in Medicaid has been a primary focus of the Biden-Harris administration. In 2022, CMS announced a Section 1115 demonstration waiver opportunity to expand the tools available to states to address enrollee health-related social needs (or “HRSN”). In 2023, CMS released a detailed Medicaid and CHIP HRSN Framework accompanied by an Informational Bulletin. The new demonstration opportunity includes federal guardrails and requirements including expenditure limits, service delivery requirements, and monitoring and evaluation requirements. CMS has stressed new HRSN initiatives are not designed to replace other federal, state, and local social service programs but rather to complement and coordinate with these efforts. HRSN demonstration approvals to date include coverage of rent/temporary housing and utilities for up to six months and meal support up to three meals per day, departing from longstanding prohibitions on payment of “room and board” in Medicaid.

Financing and Budget Neutrality

Current Law/Context. Medicaid financing is shared by states and the federal government with a guarantee to states for federal matching payments with no pre-set limit. The federal Medicaid match rate is an area that may not be changed under Section 1115 waiver authority. Under long-standing policy and practice (although not required by statute), waivers must also be “budget neutral” to the federal government over the course of the waiver (usually five years). In other words, federal costs under an 1115 waiver may not exceed what they would have been for that state without the waiver. Typically, budget neutrality calculations are determined on a per enrollee basis—so, per enrollee spending over the course of the waiver cannot exceed the projected per enrollee spending calculated in the “without-waiver baseline.” Waiver budget neutrality—measured against the estimated without-waiver baseline over the entire demonstration period—is not the same as a federal per enrollee limit on spending set at rates lower than expected under current law to generate federal savings. These broader limits on federal spending have been and continue to be part of plans supported by Trump and other Republicans.

Trump. CMS released guidance in 2018 revising Section 1115 budget neutrality policy. The guidance established new rules for calculating the “without-waiver” baseline to require “rebasing” every five years and to limit the trend to historical state spending rates or the President’s Budget trend rate (whichever rate was lower). These changes were designed to limit the “without-waiver” baseline and thereby limit the amount of federal funds that could be used for waiver spending.

After major legislative attempts to restructure Medicaid financing (into a block grant or per capita cap) as part of the 2017 ACA repeal debate failed, in January 2020 the Trump administration introduced the option for states to pursue “Healthy Adult Opportunity” (HAO) Section 1115 demonstrations. This demonstration opportunity would have allowed states “extensive flexibility” to use Medicaid funds to cover certain adults (including ACA expansion adults) without being bound by many federal Medicaid standards related to eligibility, benefits, delivery systems, and program oversight. In exchange, states would agree to a limit on federal financing in the form of a per capita or aggregate cap (with methods that differed from those used to determine budget neutrality). Only one state (Oklahoma) submitted an HAO demonstration request, which included a work requirement and other eligibility and benefit restrictions that would have applied to a new ACA expansion adult population. However, the state withdrew its application following a successful ballot measure adopting a traditional Medicaid expansion (in June 2020).

In January 2021, CMS approved a waiver request from Tennessee (not part the HAO initiative) that set an aggregate cap on federal spending and provided an opportunity for the state to keep a portion of any unspent federal dollars up to the cap without putting up the state match, as is required under current law. Unlike legislative block grant proposals designed to reduce federal spending, aggregate caps proposed In the Tennessee waiver were designed to be adjusted to reflect expected growth in federal Medicaid spending in the President’s budget and adjusted for changes in enrollment, posing less fiscal risk to the state.

Biden-Harris. The Biden-Harris administration renegotiated Tennessee’s waiver approval, replacing the aggregate cap with a traditional (i.e., 1115 waiver / budget neutral) per member per month cap. The Biden-Harris administration has also made changes to Section 1115 budget neutrality policies that may provide greater flexibility for states to design and implement 1115 demonstration programs (including “HRSN” initiatives). Republican members of the US House and Energy Commerce Committee have raised concerns about changes to Section 1115 budget neutrality requirements made by the Biden-Harris administration.

Transparency and Approval Process

Current Law/Context. Waivers are generally approved for a five-year period and can be extended, typically for three-to-five-year periods. The ACA made Section 1115 waivers subject to new rules about transparency, public input, and evaluation. In February 2012, HHS issued regulations that require public notice and comment periods to occur at the state and federal levels before CMS approves new Section 1115 waivers and extensions of existing waivers. Although the final regulations on public notice do not require a state-level public comment period for amendments to existing/ongoing demonstrations, CMS historically applied these regulations to amendments as well. The ACA also implemented new evaluation requirements for Section 1115 waivers, including that states must have a publicly available, CMS-approved evaluation strategy. States have traditionally been required to submit quarterly reports as well as an annual report to HHS that describes the changes occurring under the waiver and the impact on access, quality, and outcomes.

Trump. CMS released an Informational Bulletin in November 2017 signaling an interest in reducing the frequency of required state reporting from quarterly to semi-annual or annual for certain demonstrations. In the November 2017 bulletin, CMS also indicated that it would consider approving “routine, successful, non-complex” 1115 waiver extension requests for up to 10 years. The administration approved several 10-year waiver extension requests (e.g., most notably Florida, Indiana, Tennessee, and Texas as well as several family planning waivers). CMS, under the Trump administration, did not enforce state-level public notice and comment procedures for certain new 1115 waivers or extension requests (e.g., Indiana and Kentucky), including waivers that proposed significant changes (e.g., work requirements).

Biden-Harris. In 2022, CMS reinstated guidance from 2015, removing the option for 10-year extensions and for less frequent state reporting; however, the Biden-Harris administration has not rescinded any of the 10-year approvals. Additionally, under the Biden-Harris administration, CMS has enforced transparency and public notice requirements, returning incomplete 1115 applications submitted for federal review back to states to remedy (e.g., when an application failed to provide sufficient detail summarizing state-level public comments, including how the state considered the comments in developing the application).

Publisher: Source link