After a three-year pause in Medicaid disenrollments, the continuous enrollment provision ended on March 31, 2023, kicking off a long process in which states were required to complete renewals verifying the eligibility of all enrollees in the program. States were permitted to resume disenrollments in April 2023, but some states delayed the start of their unwinding periods until June or July 2023. By August 2024, all but three states have completed their unwinding periods (one additional state, New York, has not set an end date for unwinding). States also had considerable flexibility in how they implemented their unwinding plans, and these decisions likely affected renewal outcomes. For example, 17 states opted to prioritize “likely ineligible” enrollees early in their unwinding period, while some states chose to de-prioritize certain vulnerable populations for later in the unwinding period. States also implemented a substantial number of policy and procedural changes leading up to and during the unwinding, such as adopting federal flexibilities, updating eligibility systems and processes, and experimenting with new outreach strategies and partnerships.

During the unwinding period, states were required to report monthly data on renewal outcomes, providing for the first time, a mechanism for monitoring the renewal process across states. To date, roughly 24 million have been disenrolled and 54 million have had their coverage renewed during the unwinding. As a result, national Medicaid/CHIP enrollment has declined by more than 13 million (13.9%) from its peak at the start of unwinding and stands at 82 million people enrolled as of April 2024. Because enrollment data include new people entering the program as well as people reenrolling after losing Medicaid, the net change in enrollment is smaller than the total disenrolled during the unwinding. April 2024 enrollment is still roughly 10.4 million (14.6%) higher than pre-pandemic enrollment levels of about 71 million, though most states had not yet finished their unwinding periods as of April 2024.

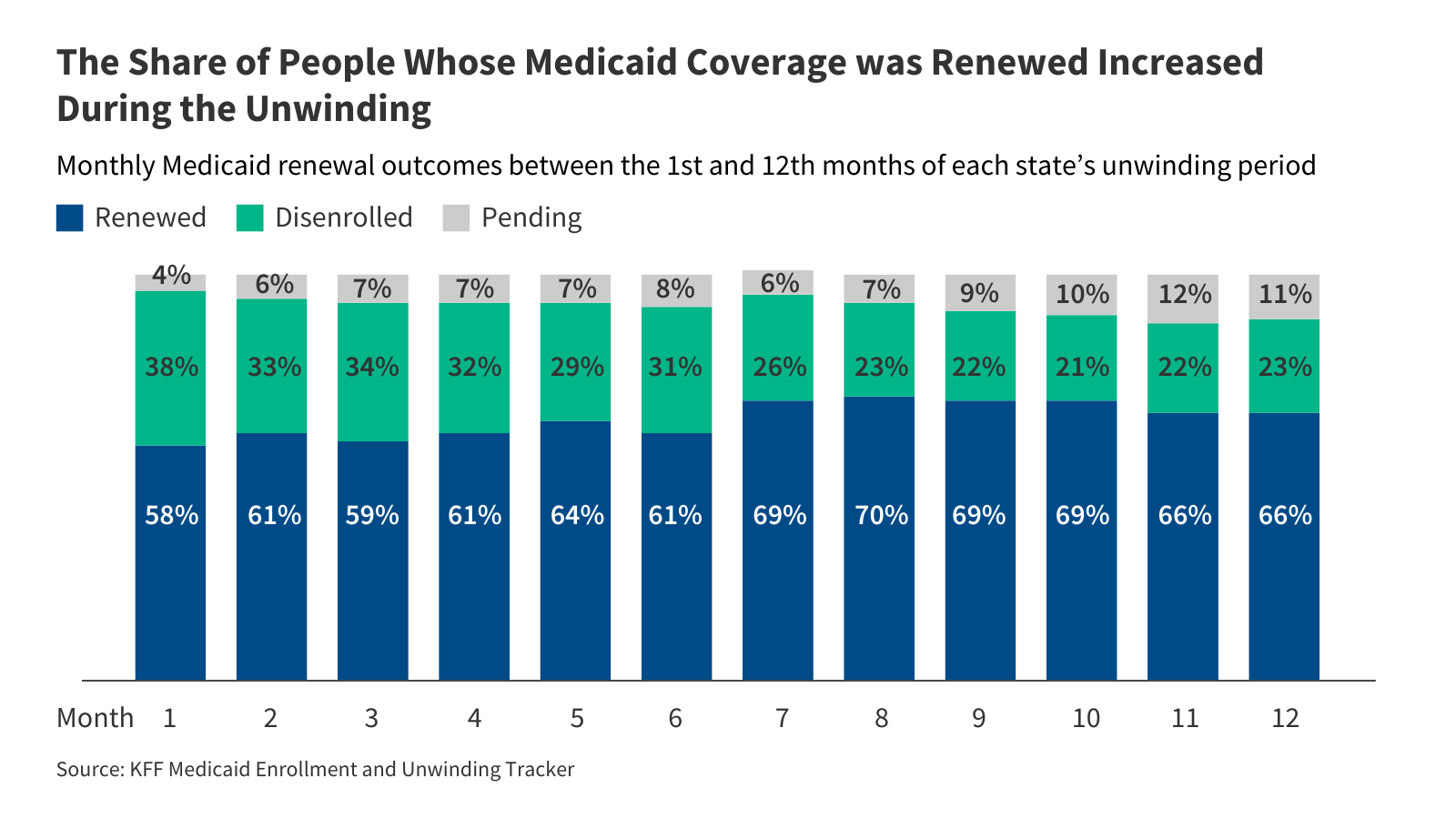

This policy watch uses unwinding data collected through KFF’s Medicaid Enrollment and Unwinding Tracker to examine how national-level renewal outcomes changed over the course of unwinding, including changes in the share of people who had their coverage renewed or were disenrolled from Medicaid each month. States’ unwinding periods have been aligned and are reported as months into the unwinding period (e.g., Month 1, Month 2, Month 3…). For example, Month 1 for Arizona is April 2023 but June 2023 for California. The data reflect updated renewal reports, where available, which follow-up on outcomes for cases initially reported as pending. Due to the lag in reporting updated data, some states’ updated renewal reports are not available for later months.

Over the course of the unwinding period, the share of people whose coverage was renewed increased while the share who were disenrolled dropped. From the start of each state’s unwinding period in Month 1 through Month 12, the share of people who retained Medicaid increased from 58% to 66% (Figure 1). Over the same period, the share of disenrollments declined from 38% to 23%. A sizable drop in the number of people disenrolled each month, from 2.8 million people in the first month to 1.6 million people in the twelfth month, appears to be driving the trends, although the number of people whose coverage was renewed each month increased slightly over the period from 4.1 million to 4.6 million. The decrease in the number of people disenrolled partially reflects states working through their “likely ineligible” populations in the early months of unwinding, as well as states’ policy and procedural changes in response to early unwinding data.

Among those who retained coverage, the share of people renewed on an ex parte basis increased from 51% in Month 1 to 70% in Month 12 (Figure 2). Ex parte renewals, also known as auto-renewals, require states to verify an enrollee’s eligibility based on data available to the state without requiring the enrollee to submit documentation. The Centers for Medicare and Medicaid Services (CMS) encouraged states to increase ex parte renewal rates – and provided new flexibilities during the unwinding period for them to do so – as a strategy to help eligible people avoid losing Medicaid coverage during the renewal process. Notably, there was a large increase in ex parte renewals in Month 7, jumping from 57% to 68%. The timing of this jump in ex parte renewals reflects many factors, including policy and procedural changes, as well as CMS taking enforcement action in 29 states to address noncompliance with federal ex parte requirements.

Although the total number of disenrollments declined during the unwinding period, among people disenrolled from Medicaid, the share of people disenrolled for procedural reasons remained high. Procedural disenrollments occur when someone’s eligibility (or ineligibility) could not be verified, typically because the renewal process was not completed. During the unwinding, procedural disenrollments as a share of total disenrollments decreased from 74% in Month 1 to 66% in Month 12 (Figure 3). However, while states took steps to reduce procedural disenrollments through increased outreach to enrollees and other policy and procedural changes, roughly two-thirds of people who were disenrolled from Medicaid in Month 12 of unwinding lost coverage for procedural or paperwork reasons, reflecting ongoing issues with the renewal process.

The national data present a high-level picture of renewal outcomes during the unwinding but mask differences across states. For example, while most states experienced gains in ex parte renewal rates during the unwinding, the magnitude of the changes varied. Similarly, in most states, the procedural disenrollment rate declined, but in some states the rate increased, possibly reflecting pauses in procedural disenrollments in the early months of unwinding or other procedural issues. Differences in state policies, procedures, enrollee populations, and system capabilities are likely the biggest factors driving the variation in renewal outcomes across states. However, more analysis is needed to understand which factors had the largest impact on renewal outcomes.

Publisher: Source link