2026 marks the first year since 2020 that enrollees in the Affordable Care Act Marketplaces do not have access to enhanced premium tax credits. The effect of the expiration on how many people will use ACA Marketplace coverage remains unclear.

New data released by CMS on plan selections show that ACA sign-ups for 2026 are down by over 1 million people compared to the same time last year, marking the first year since 2020 that sign-ups appear to have declined. A more detailed Health Insurance Exchanges Open Enrollment Report is expected in March or April that will detail demographics, income, and metal levels for people who select or are automatically renewed into a plan. Plan selection data is unable to fully capture the effects of the enhanced tax credits expiring on the number of people with coverage. As people fail to make their premium payments, actual enrollment—known as “effectuated” enrollment—will inevitably decline. With the expiration of enhanced premium tax credits, premium payments are estimated to have increased 114%, on average, for subsidized enrollees who stay in the same plan. With such steep increases, it is not yet clear how many people who have selected a plan during Open Enrollment will make a payment.

This brief explains the limitations of early data in understanding the impact of the expiration of enhanced premiums tax credit on ACA enrollment. It also provides a timeline of when more complete data will become available. The bottom line is that it will be quite a while before we get a complete picture of how much enrollment has dropped following expiration of the enhanced premium tax credits.

What are the limitations of plan selection data?

Plan selection (or “sign-up”) data does not accurately reflect the number of people who ultimately have ACA Marketplace coverage because it does not account for premium payments. In other words, it shows how many people have selected a plan or been automatically renewed into ACA coverage, but it does not show how many people actually gain or maintain coverage.

New enrollees are generally required to submit their first premium payment (“binder” payment) within 30 days of the coverage effective date, thus “effectuating,” or beginning, their coverage. Returning subsidized customers, however, are generally given a 3-month grace period for nonpayment of premiums. This means that these returning consumers would then have until March 31, 2026, to catch up on premium payments before their coverage is retroactively terminated. The impact of enhanced subsidies expiring will therefore not be evident (even to insurers) until all applicable grace periods have been exhausted.

For 2026, nearly 20 million of the plan selections are returning customers. Plan selection data from 2025 shows that more than four in ten people in the ACA Marketplaces were automatically renewed into their coverage that year, meaning they did not actively sign up for their plan. As consumers automatically renewed for 2026 received their first premium bills for January, some may have disenrolled or stopped making a payment. Depending on what action they take and the timing, many people could be counted in preliminary plan selection data (in the “Final Snapshot” just released and the “Open Enrollment Report” in the spring) even though they may not truly have coverage.

When will we know more about ACA enrollment?

Below is a timeline of key ACA Marketplace deadlines and data releases. The data timing listed below is based on recent years’ release dates and there could be different dates in 2026. The section following the timeline explains each of these data sources in detail.

*Note: Timing is based on recent years and may change for plan year 2026.

Effectuated Enrollment

The effectuation rate is the share of people who have a plan selection during Open Enrollment who effectuate (or start) their coverage. While it is possible that some states or insurers may provide information about effectuation rates earlier, the first national data on ACA enrollments will likely come out in July 2026 with the Effectuated Enrollment Report, if the timing of past years is followed.

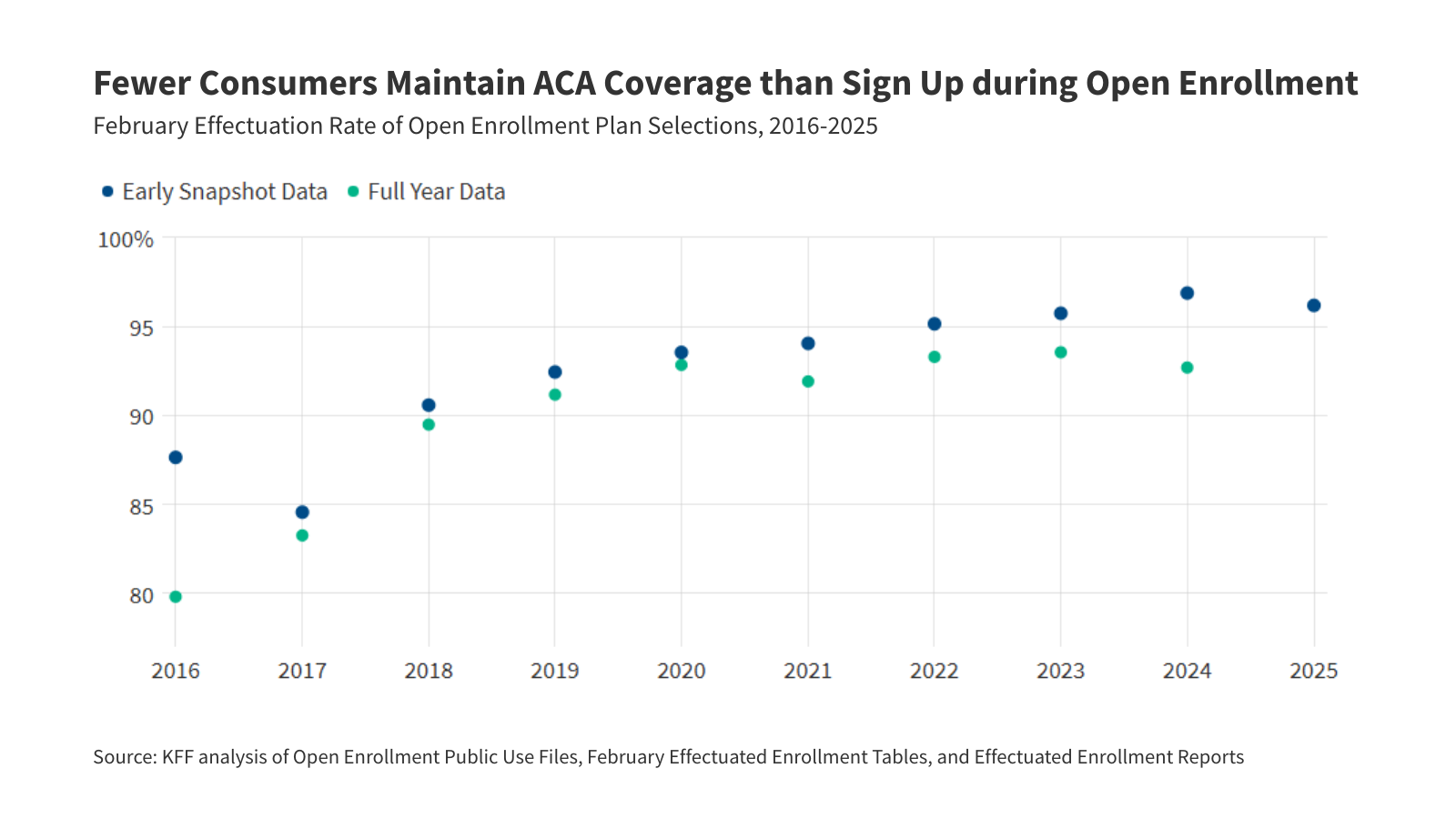

As shown in the chart below, the effectuation (or premium payment) rate has been quite high since 2022, meaning the vast majority of consumers who selected a plan ended up with coverage. For that reason, in recent years, plan selections and effectuated enrollment have often been discussed synonymously. However, the expiration of enhanced premium tax credits in 2026 will mark the first time that most ACA Marketplace enrollees experience a significant increase in their premium payments, making past years’ effectuation rates unreliable indicators of this year’s rate.

CMS typically releases an Effectuated Enrollment: Early Snapshot each summer. This data will provide a better picture of the impact of the expiration of enhanced tax credits on enrollment than plan selection data alone.

Based on past years, the Effectuated Enrollment: Early Snapshot report will likely be released in July 2026, and will report February 2026 effectuated enrollment, as measured on March 15, 2026. In other words, the July data release will likely show how many people had effectuated enrollment in February, based on what insurers know about premium payments by mid-March. However, as mentioned above, returning customers have until the end of March to make premium payments under the grace period. So even the data released in July of 2026 may still overstate the number of enrollees.

The effectuated enrollment data released in July of 2026 will likely not count new consumers who missed their binder payment for January or February, nor would it count consumers who were automatically renewed in December but then actively disenrolled in January. However, it wouldstill count people who were automatically renewed for January coverage and did not make a payment during the grace period—even if they eventually had their coverage retroactively terminated as of January 31.

The Effectuated Enrollment: Full Year 2026 data, likely to be released in the summer of 2027, would show the number of effectuated enrollees after all grace periods have elapsed. As a share of plan selections made during Open Enrollment, the chart below shows the final February effectuation rate from the Full Year (green) data has historically been a few percentage points lower than the Early Snapshot (blue).

Another reason the Effectuated Enrollment: Early Snapshot (expected to be released in July 2026) may not give a complete picture of the effect of expiring enhanced tax credits is that there could still be additional coverage loss later in the year. If an enrollee makes an initial premium payment but then decides their premium is unaffordable and drops their coverage mid-year, they may still be counted in the Effectuated Enrollment: Early Snapshot data even though they will not have coverage after their termination.

CMS may release additional effectuated enrollment counts before the Effectuated Enrollment: Full Year report; since this additional reporting may be after the run-out of grace periods, they would reflect finalized enrollment. In 2025, effectuated enrollment counts for the first five and seven months were released. Additionally, these releases may include information on the contribution of premium tax credits to the gross premium.

While effectuated enrollment data will tell us the number of people who are covered by ACA plans, it will not provide information about who paid their premium. The Open Enrollment Report and concurrent public use files, based on plan selections, will be the earliest source of information about income and other demographics of ACA enrollees. It is likely that the demographics and income distribution of ACA enrollees could shift from between the measurement of plan selections and effectuated enrollment. Additionally, the effectuated enrollment data from the Full Year report does not typically include metal level selection. There could be differences in payment rates for people who stay in their previous plan and face large premium increases and those who switch to lower-cost plans.

What other sources can be used to understand 2026 enrollment trends?

Quarterly Earnings Reports: April and May 2026

Prior to the publication of the effectuated enrollment data, some data on enrollment trends may be available from the insurers that enroll large shares of the individual market, during investor earnings calls. Insurers will host their fourth-quarter and year-end 2025 earnings calls in late January or February of 2026: Centene and Oscar will host their Q4 earnings calls on February 6 and February 10, respectively.

Insurers may start releasing membership counts for 2026 during their first-quarter 2026 earnings calls, expected to happen in April or May. Centene has announced their first-quarter earnings call for April 28. Elevance and UnitedHealthcare typically have first-quarter calls in April, while Oscar and Cigna typically report earnings in May. First-quarter calls that include enrollment information may not be fully adjusted for retroactive terminations due to nonpayment grace periods.

Insurer Rate Filings: Summer 2026

Every spring and summer, individual market insurers, including those offering ACA Marketplace plans, publicly file proposed premium rate changes to state regulators. These filings offer insight into what insurers believe is driving health cost growth and changes in enrollment. These rate filings will show insight into what insurers are planning in 2027 and may provide early counts of 2026 enrollment.

National Health Interview Survey Quarterly Releases: Likely January 2027

The National Health Interview Survey (NHIS) early release data will provide early indications of changes in the uninsured rate without the enhanced tax credits. From 2021-2024, first-quarter data came out in the summer of the same year, and data for the second quarter of the year came out closer to the end of the year. The Centers for Disease Control and Prevention has transitioned to biannual releases of data and released data for the first half of 2025 at the end of January 2026. If this release schedule remains consistent, data for the first half of 2026 may become available in early 2027.

Risk Adjustment Data: July 2027

Based on past years, the CMS Risk Adjustment Program State-Specific Data for 2026 is expected to come out in July 2027. The risk adjustment data will provide a state-by-state look at how many billable member months were reported for the ACA-compliant individual market. Because it will include on- and off-Marketplace enrollment, it will capture all people in ACA compliant coverage, even if they chose to purchase it off-exchange.

Issuer Level Enrollment Data: July 2027

The issuer-level enrollment data is split between HealthCare.gov and state-based exchanges. Data for HealthCare.gov states includes more information, including average monthly effectuated enrollment and average months of enrollment for those who have disenrolled. Additionally, issuer-level enrollment across all states will be made available through the Medical Loss Ratio Data and System Resources Public Use File, released late in the following year.

Enrollee-Level External Data Gathering Environment (EDGE): 2028

Enrollment by metal tier can be determined using the Enrollee-Level External Data Gathering Environment (EDGE) dataset, but this is subject to its own limitations: sparse enrollee demographic information, incomplete longitudinal data, and no information on terminated/non-effectuated coverage prevent fine-grained analysis on how the expiration of enhanced premium tax credits affected enrollee decisions. EDGE data for 2026 will likely not be available until 2028.

Publisher: Source link