Year-end financial planning isn’t just a checklist or a set of transactions. According to a survey of more than 1,000 Boldin users nearing or living in retirement, it’s a meaningful moment to step back, reflect, and make thoughtful decisions about the future. Respondents told us that the end of the year is a time to think strategically about their goals, their resources, and the choices ahead — and that this process leaves them feeling more grounded, more prepared, and more confident.

Across all ages and asset levels in the survey, one theme was unmistakable: When people engage in strategic year-end reflection, their confidence grows.

About the End-of-Year Planning Survey Respondents

The insights in this report come from more than 1,000 Boldin users who are actively planning for retirement or already living it. This group represents a financially experienced, highly engaged audience — the very people who understand how much strategy and reflection matter when navigating the next chapter of life.

Most respondents were in the heart of their retirement decision window:

- 63% were ages 55–64

- 22% were 65–74

- Just 14% were under 55

Many are already retired or preparing to retire soon:

- 51% are already retired

- 47% are actively planning retirement, with 31% planning to retire within the next two years and another 17% in the next 3-10 years.

- 2% plan to retire in more than 10 years from now

They tend to have meaningful savings, reflecting years of disciplined work and planning:

- More than 70% have between $1M and $5M saved

- 15% have more than $5M

- Only 14% have less than $1M

For survey respondents, planning is a regular habit:

- 27% revisit their finances once a week or more

- 21% plan 2-3 times a month

- 25% assess their situation monthly

- 20% review quarterly

- Only 6% review annually (1%), twice a year (3%), or when something comes up (2%)

6 Powerful Insights from the End-of-Year Planning Survey

1. Virtually All Survey Respondents Engage in Year-End Planning

Ninety-nine percent of respondents report that they engage in year-end financial planning.

2. Year-End Planning Is Largely a Strategic and Reflective, Not Tactical, Exercise

Most survey respondents treat the year-end as a meaningful moment to zoom out and look at the big picture. A full 87% of respondents said that they approach end-of-year financial planning as a long-term strategic exercise with 15% saying it is primarily strategic, 19% saying somewhat strategic, and 54% saying it is balanced, an even mix of tactical and strategic planning.

Only 12% said that their planning is somewhat or primarily tactical, focused on specific transactions.

Strategic activities

When asked which activities they complete before the end of the year, respondents overwhelmingly cited reflective and strategic actions.

Survey respondents review:

- Spending and income from the last year (62%)

- Their year’s financial performance (60%)

- Savings goals and progress (44%)

- Financial goals for the upcoming year (43%)

- Asset allocation (37%)

Tactical activities

Survey respondents are making fewer tactical adjustments to optimize their situation at year-end than in strategic planning. However, when it comes to tactics, they are primarily interested in health, tax, and investment optimizations.

- Planning their healthcare coverage for the upcoming year (50%)

- Adjusting investment allocations (45%)

- Optimizing tax liability or conducting tax loss harvesting (40%)

- Completing Roth conversions (39%)

- Adjust asset allocations (37%)

This is a powerful shift away from the old model of planning: chasing returns, collecting statements, or reacting to financial to-dos. People want a plan that helps them connect their resources to their goals — and make thoughtful adjustments as life evolves.

3. Taxes and Investments Are Top of Mind

When people think about the end of the year, two priorities clearly rise above everything else: taxes and investments. In our survey, both tied as the number-one concern, each selected by 68% of respondents. That means nearly seven out of ten people nearing or in retirement are focused on how to position their portfolios and how to make smart, tax-efficient moves before December 31.

This alignment tells a story about what matters most during the transition into a new year. People aren’t just looking backward at what happened in the markets; they’re asking how to set themselves up wisely for the year ahead.

In total, respondents highlighted a mix of cost-of-living realities and forward planning:

- Taxes and year-end planning: 68%

- Investment performance or portfolio mix: 68%

- Inflation or cost of living: 44%

- Planning for 2026 goals: 43%

- Managing expenses or cash flow: 42%

- The political environment: 31%

- Savings progress: 27%

- Economy or job market: 27%

- Interest rates: 16%

- Debt repayment: 5%

This blend of concerns reflects both the complexity of today’s financial environment and the desire for clarity in the face of uncertainty. People are thinking about their investments, their tax strategies, their day-to-day spending, and the economic forces shaping the next few years — all at the same time.

Taken together, these results reinforce that year-end planning is about more than optimizing returns or reducing taxes in isolation. It’s about connecting year-end decisions to broader goals, preparing for what’s ahead, and creating a sense of control during a time when many external variables feel unpredictable.

4. End-of-Year Planning is Important for Achieving Financial Goals

The vast majority of survey respondents don’t see year-end planning as optional. They see it as essential to staying on track with their long-term financial goals. In our survey, 72% of respondents said year-end planning is extremely or very important to their ability to achieve their goals — and an incredible 95% said it’s important to them in some way.

This near-universal agreement shows that people recognize year-end as a natural checkpoint: a moment to review their progress, make adjustments, and ensure the choices they’re making today support the outcomes they want in the future. Only 1% said year-end planning is “not at all important,” which underscores how widely this behavior is embraced.

5. Confidence Is the Core Reason People Engage in Year End Planning

When we asked why people do year-end planning, one theme rose above everything else: confidence.

This is a group that takes financial decisions seriously. They think about taxes, healthcare, longevity, and legacy. They use tools, ask good questions, and want to understand how different parts of their financial life connect. And above all, they told us that confidence — not just optimization — is what they’re really seeking at year-end.

These respondents provide a valuable window into how thoughtful planners use reflection, alignment, and strategic review to feel more prepared for the future.

Here are the most popular answers for why people complete end-of-year financial activities:

- 66% said to feel more confident in my financial decisions

- 64% to feel more financially secure

- 61% to increase confidence in my plan

- 50% to reduce my tax burden

- 48% to gain more clarity on where I stand

- 45% to feel like I’m doing the right things financially

- 44% to stay on track toward my goals

- 43% to reduce financial anxiety

- 43% to build wealth over time

- 42% to reduce financial risk

This is a meaningful insight: People aren’t planning simply to optimize performance. They’re planning to feel grounded, informed, and capable of moving forward.

Planning doesn’t eliminate uncertainty — but it makes uncertainty manageable.

It gives people the confidence to say, “I know where I stand, I know what matters, and I know what I’m doing next.”

#1 Retirement Planning Software

6. Planning and Confidence Rise Together

The strongest signal in the data is the link between planning and confidence. Across three separate questions:

Knowing your numbers drives better financial decisions

Here is how Boldin users responded to this question: “Knowing where I stand financially at the end of the year gives me the confidence to make the right decisions for the future.”

- 90% agreed, with 65% saying they strongly agree and 34% saying they somewhat agree

- 8% neither agree nor disagree

- 2% somewhat disagree

- 0% strongly disagree

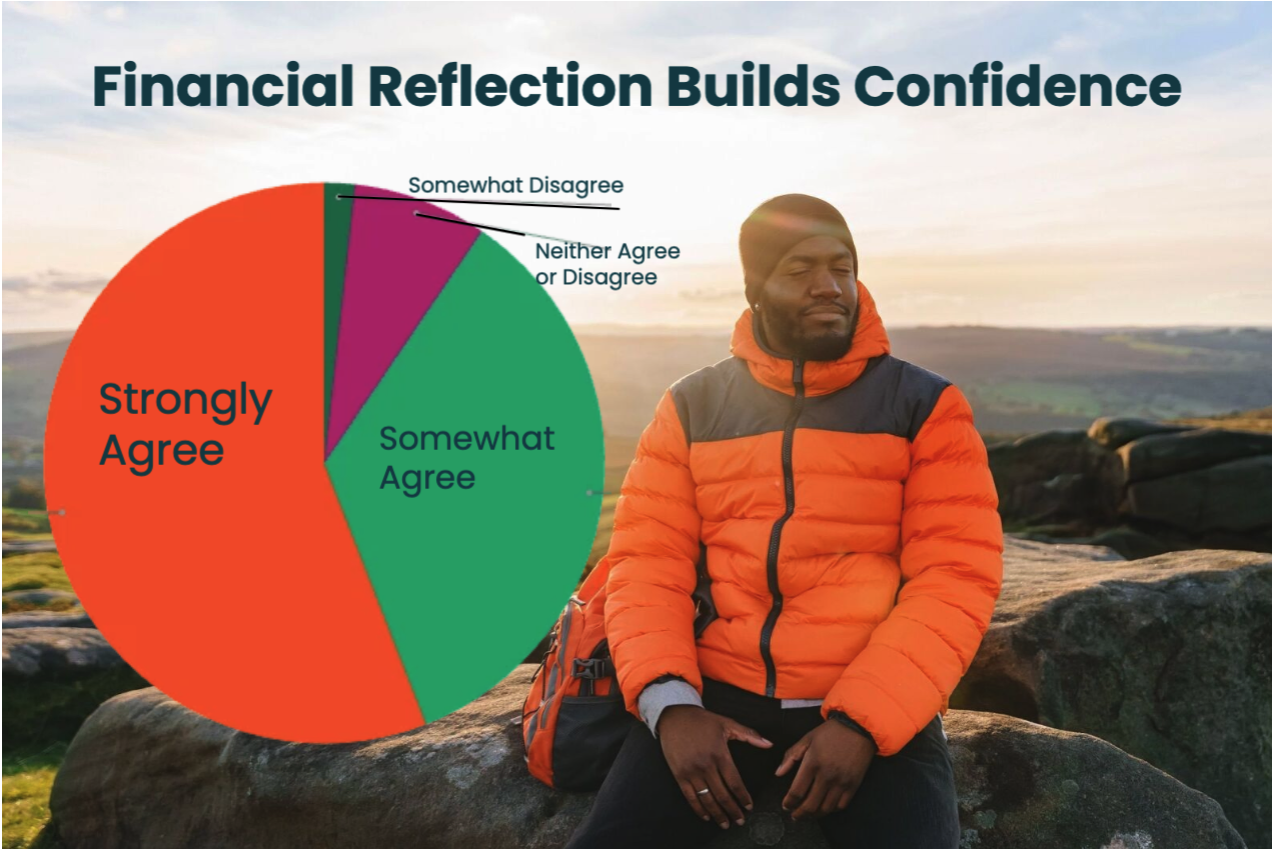

Reflecting on big picture goals builds confidence

We asked users whether “annual (or more frequent) reflection on my big-picture financial goals and progress significantly increases my confidence,” and Boldin users overwhelmingly agreed:

- 92% agreed, with 57% saying they strongly agree and 34% saying they somewhat agree

- 7% neither agree nor disagree

- 1% somewhat disagree

- 1% strongly disagree

The financial right tools make people feel more capable

Finally, we asked the question: “The financial planning and management tools I use give me confidence in my ability to achieve my financial goals.” Here is how Boldin users responded:

- 92% agreed, with 51% saying they strongly agree and 41% saying they somewhat agree

- 7% neither agreed nor disagreed

- 1% somewhat disagreed

- 0% strongly disagreed

Planning is an important feedback loop

Across all three questions, the pattern is clear: clarity leads to confidence. When people take a moment to look back, reflect, and reconnect with their goals, they move into the next year feeling steadier, stronger, and more in control—exactly what good financial planning is meant to do.

These results tell us something important:

- Reflection builds confidence.

- Confidence builds better decisions.

- Better decisions build better outcomes.

- Confidence builds better decisions.

And that feedback loop is what keeps people engaged in planning year after year.

What to Do If You Want a Wealthier and More Confident Future, According to Successful Retirees and Pre-Retirees

Year-end planning isn’t about checking off tasks. It’s about stepping into the driver’s seat of your financial life.

It’s a moment to:

- Reflect on what mattered this year

- Assess what’s changed

- Connect your goals to your resources

- Make adjustments with clarity and intention

- Set yourself up for a new year with more confidence and less uncertainty

And that’s exactly why planning matters — it’s not the frequency, but the quality of the reflection that makes the difference.

Boldin Is Built for Planning

Boldin is designed to help you think strategically — to understand the “why” behind your decisions, see how everything fits together, and build confidence through clarity.

Whether you’re planning for taxes, healthcare, retirement income, or legacy goals, Boldin gives you a clear view of your financial future and the tools to take thoughtful action.

A more confident financial future starts with a more intentional plan. And we’re here to help you build exactly that.

Publisher: Source link