The country’s largest for-profit hospital chain isn’t sitting on its hands when it comes to artificial intelligence.

Speaking Wednesday morning at the 2025 UBS Global Healthcare Conference, HCA Healthcare Executive Vice President and Chief Financial Officer Michael Marks offered an update on key clinical, operational and administrative deployments of AI tools across the 191-hospital system.

“Broadly, I’m pleased with where we are,” Marks said. “We’re in early innings with this effort. We’re trying to be judicious in our allocation of resources and making sure that we’re getting either a clinical or a financial return on these investments as we scale them.”

Clinical use cases are the steepest hill for AI due to the “inherent risks” around patient safety, the executive said, and as such are taking longer to roll out. Still, HCA has multiple projects aimed at improving patient safety and quality outcomes, among which is a partnership with Google to tighten the roughly 400,000 weekly shift handoffs between the system’s nurses.

“When a nurse is leaving shift and a nurse is coming on shift, the amount of time that they’re in overlap because they’re doing this patient handoff is longer than you think it is,” Marks explained. “We’re finding an opportunity to use AI to really synthesize the medical record and the operational records and give our nursing teams a much more synthesized and effective way to do shift handoff as they hand off their patients. Given the amount of times we do this in the company, that has a real opportunity clinically to help our nurses through what is one of the riskier areas of work.”

That project is so far live in eight of HCA’s hospitals, with plans in place to roll out more broadly in the coming year, he said.

Another clinical deployment Marks highlighted uses AI to read portions of fetal heart monitoring strips for HCA’s labor and delivery service line. That algorithm, developed in partnership with GE Healthcare, has been submitted to the Food and Drug Administration for review and approval, he said.

On the operations side, nearly 100 HCA hospitals have rolled out an AI-driven scheduling and staffing tool that’s live for nurses. Marks described that as an ongoing project that “has a lot of potential” but has come with its share of challenges.

“What we’ve learned through that rollout, though, is how hard it is to roll out AI tools and change behavior on the ground,” he said. “So we’re learning that we have to be just as good at implementation and change management as we do about building AI tools. And so that investment continues in the company as we continue to learn and iterate.”

The final domain for AI deployment, administrative use cases spanning IT, supply chain, human resources, revenue cycle and HCA’s physician practice management platform, have shown “the shortest pathway to value,” the executive said.

“Millions of transactions, more centralized operations, more standardized data—and we’re finding a long list of use cases to get organized around, to digitize our workflow and bring artificial intelligence into efficiencies and effectiveness in the administrative work.

“Overall, I’m really encouraged. I think digital transformation will be one of the key strategic initiatives of the company for the foreseeable future,” he said.

HCA remains hopeful for last-minute ACA subsidy deal

HCA recently raised its guidance for 2025 amid a third-quarter performance that topped analysts’ expectations. Year-over-year, the company raised its revenues by 9.6% and its net income attributable to shareholders by 29% as same-facility admissions rose 2.1%.

Marks’ Wednesday talk at the conference reiterated and elaborated on HCA executives’ comments during the quarter’s investor call.

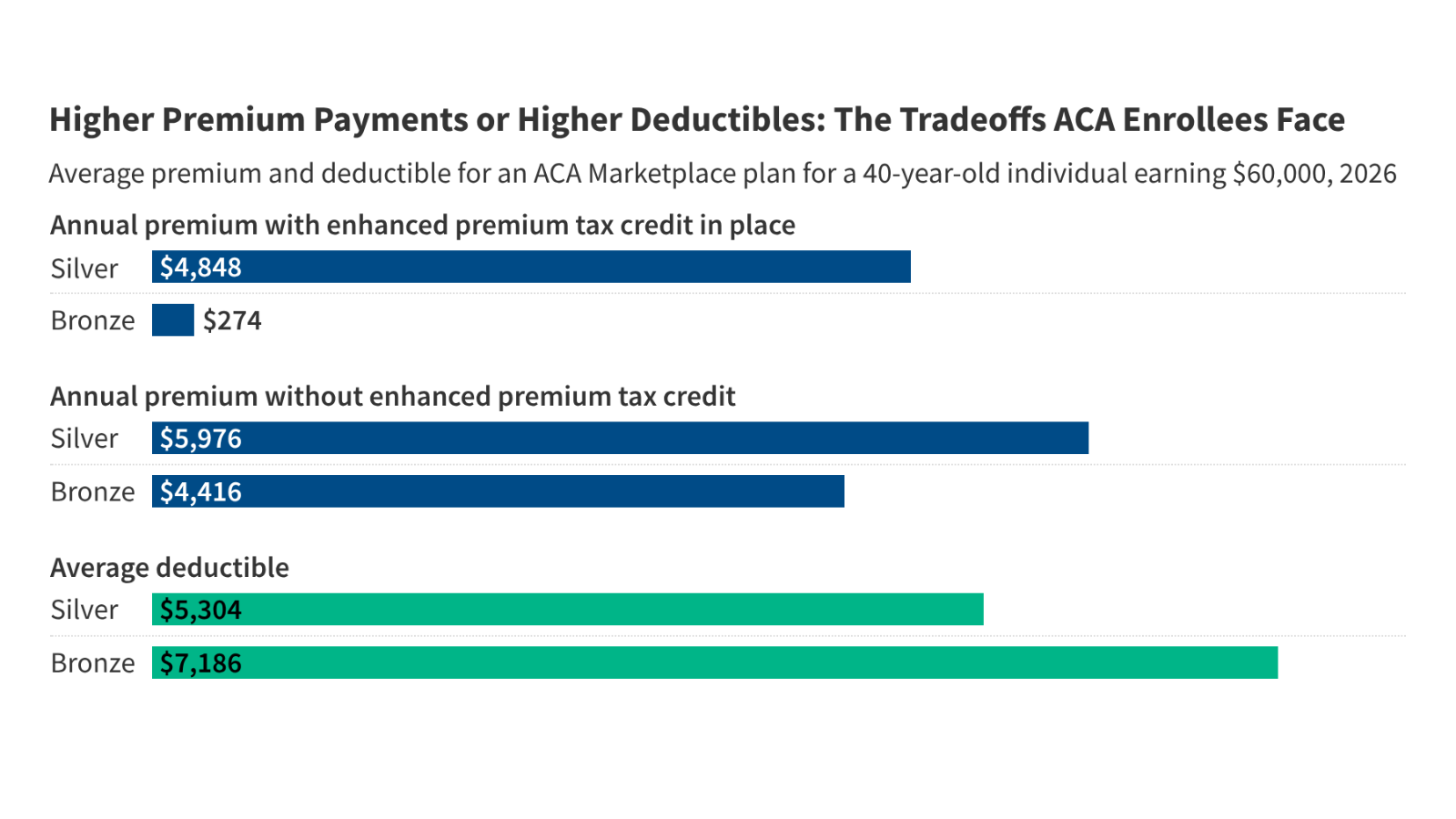

A rough estimate of 2026 volume growth between 2% and 3% will largely hinge on the eventual outcome of the Affordable Care Act enhanced premiums, with an extension landing on the higher end of the range and an expiration on the lower, he said.

Marks kept the hope for a deal alive, saying that the issue has gained widespread recognition among both parties.

“We’re on the clock,” he said. “While the company continues to be heavily active in trying to advocate for this, … we are also preparing. We have spent a lot of time as a company over the last 12 to 18 months working on our resiliency plans, working on our digital transformation agenda to really prepare the company for the future, whichever course, frankly the exchanges go.”

Marks also acknowledged other potential policy-based headwinds for his company, such as the chance for HCA’s 15% of hospitals with rural classifications to earn a share of the $50 billion Rural Hospital Transformation Program—which he characterized as a potential “moderate-type of benefit for us.”

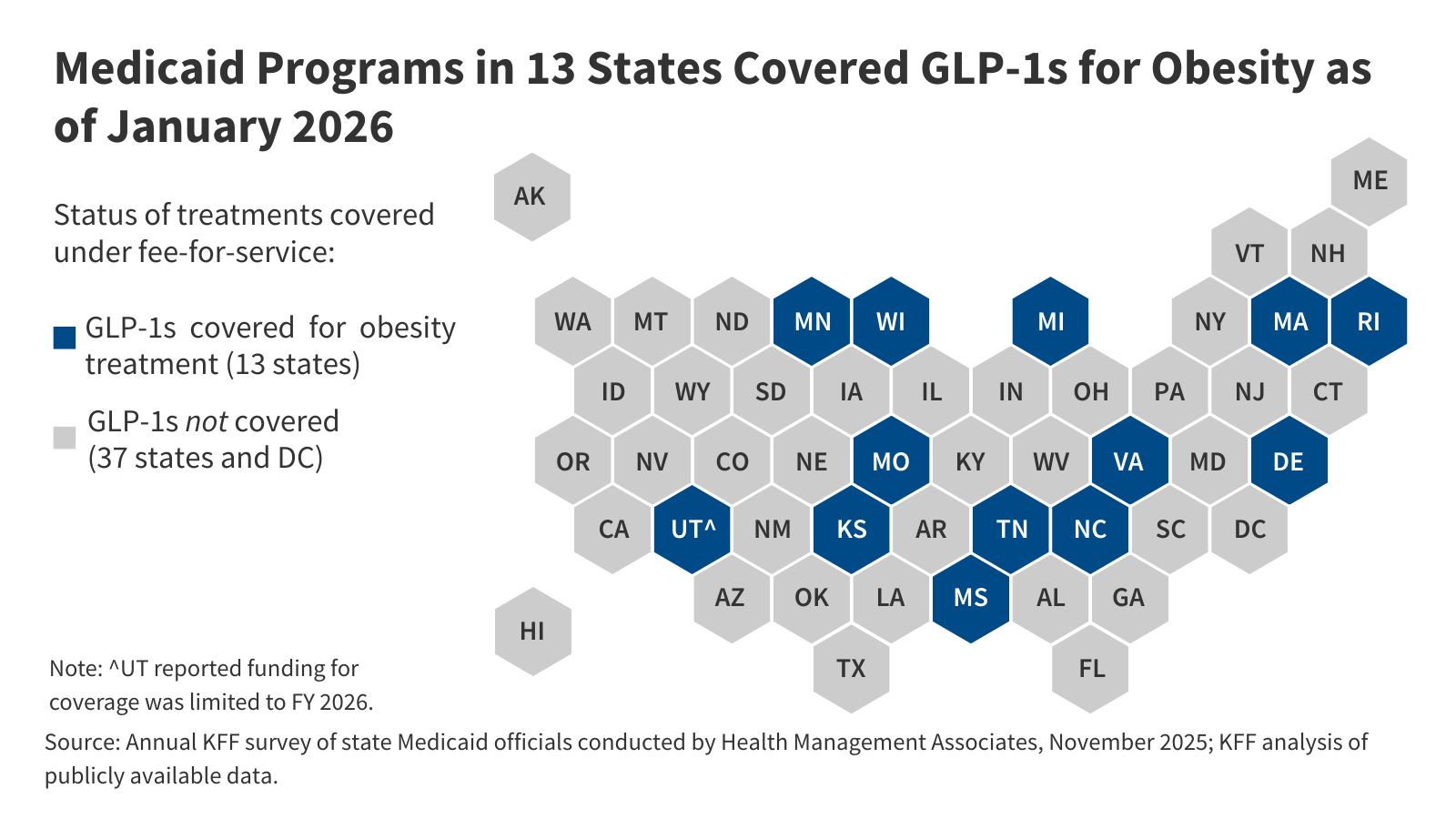

There’s also supplemental Medicaid payments for which states are still awaiting application approvals from the federal government. The outcomes of these for five states—Kansas and Texas, which have already been approved, and Florida, Georgia and Virginia, which are pending—are “material to HCA,” Marks said, and offer a silver lining in the runup to state directed payment reforms outlined under sweeping legislation from the summer.

“There are positives and negatives in everything, right?” he said. “The One Big Beautiful Bill reforms over the next decade the payment amounts and the tax rates related to [state directed payments]. It also gave us this opportunity for states that filed pursuant to the grandfathered provisions to enhance their programs in the meantime.

“Suffice it to say, these are good things. These are helpful things that I think will, if we can get them approved by CMS, help us navigate both the [ACA marketplace subsidy] environment should those expire, and then over the longer-term view, help us navigate the reform to Medicaid. We’re hopeful that they get reviewed, and we view them as a positive potential for the company,” he said.

Marks declined to quantify the potential benefit those approved applications could bring, though session host and UBS Managing Director A. J. Rice said his group has estimated “in aggregate about $700 million of potential EBITDA tailwind.”

Publisher: Source link