No matter how much you plan, you’ll likely experience a few retirement surprises. Most retirees experience a life different in many ways from what they originally planned.

Here are 18 things that surprised retirees. Use these findings to improve your overall retirement plan for a happier and more secure future.

1. You Will Make it Work and Be Quite Happy!

When it comes to retirement, planning is everything. Yet even the best-laid plans can be affected by unexpected events.

The real retirement surprise? You will generally get happier in retirement!

After the stress of building careers and raising kids, most people’s happiness seems to actually increase in retirement.

In fact, you’ll likely be shocked to learn which two ages in an adult’s life are likely to be at your happiest.

Experts from Princeton University and the London School of Economics and Political Sciences found that happiness peaks at the ages of 23 and 69. Learn more…

Use the NewRetirement Planner to find the confidence you need to retire and have a happy retirement.

2. Unexpected Emergencies Can Be a Real Financial Stress

A study from the Society of Actuaries found that “shock” events – retirement surprises – had a significant impact on the assets of many retirees and pre retirees. More than 50% of pre retirees and 40% of retirees experienced financial shocks that depleted at least 25% of their assets.

The majority of retirees are worried about their ability to handle these kinds of financial shocks:

Home repairs

Research from the Society of Actuaries found that unanticipated home repairs are retirees’ single most common financial surprise. Home ownership is expensive. Repairs and maintenance, insurance and taxes and many of the most unexpected repairs are not cheap. From repairing a roof to replacing a broken furnace or air conditioning unit, home repairs can cost thousands of dollars and make a serious dent in retirement savings, especially for retirees who are often still paying off a mortgage.

When retirement is on the horizon, take a look at your home and consider what major repairs you might need to make in the next ten to 20 years. Either make them before you retire or set aside some money to take care of them in retirement. Paying for a home inspection before retirement might be money well spent.

If you are among those worried about potential home repairs, do consider downsizing and other ways to reduce your housing burden. And, experts advise earmarking 1% of your home’s value for annual repairs and maintenance.

Car repairs

Meanwhile, 33% of retirees feel unprepared to manage car repairs or replacement. Research from the Bureau of Labor Statistics found that transportation costs are the second highest retirement cost after housing – costing more than even healthcare.

Family member in need of support

Retirees today run the risk of having to help their children AND their parents. And, only 54% of today’s retirees feel very prepared to help family members.

Setting aside funds for emergencies as well as for the specific types of costs outlined above can help reduce your worry.

Rising insurance costs

Climate disasters are more common. And, this can mean devastating losses at worst and rising insurance costs at best. Only 49% of retirees feel prepared to “weather a potential storm” (endure a climate disaster).

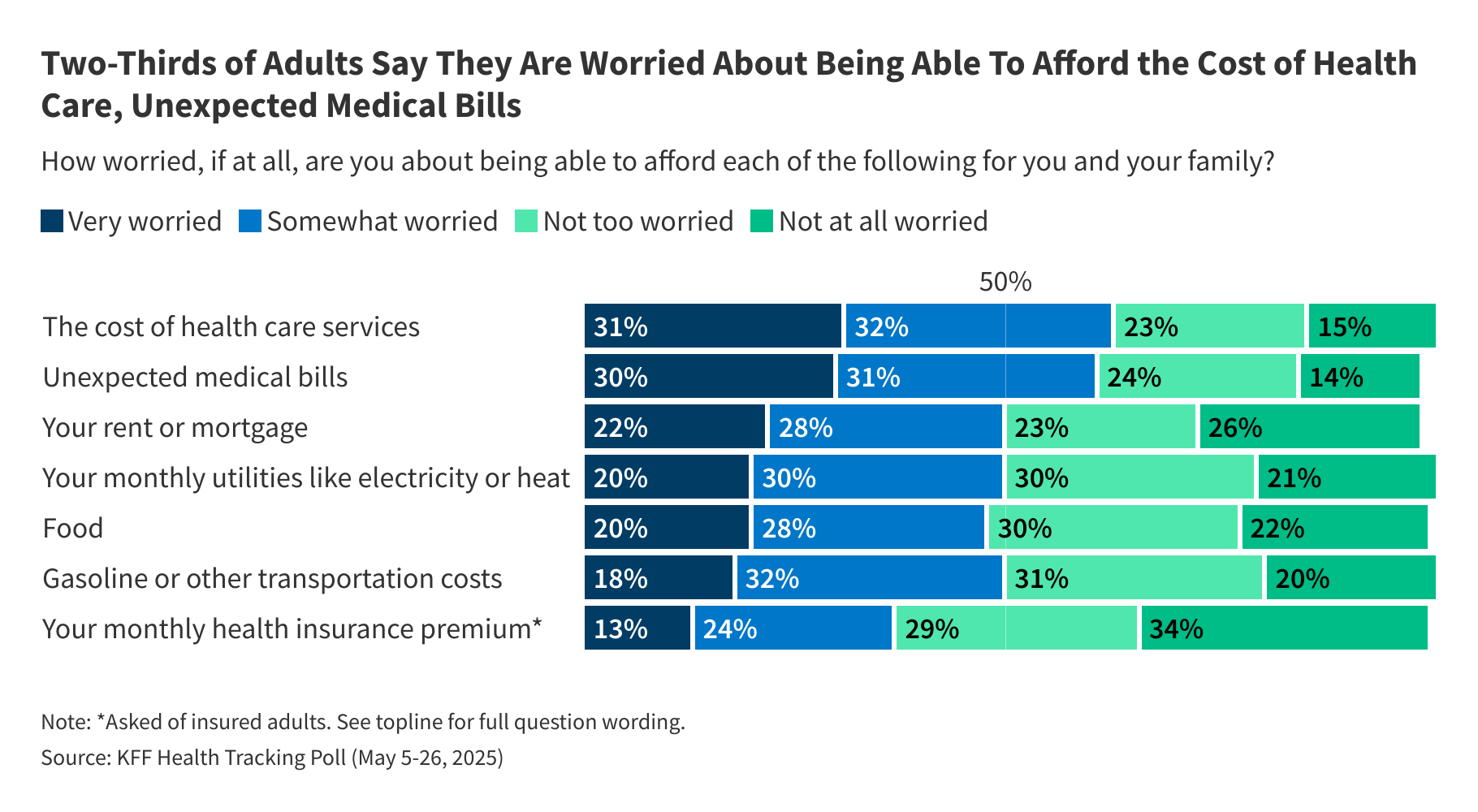

3. Many Health Care Expenses Will Be Paid Out of Pocket

Fidelity Benefits issues an annual report on health care costs. According to their latest estimates, a single person age 65 in 2023 may need approximately $157,500 saved (after tax) to cover health care expenses in retirement. An average retired couple age 65 in 2023 may need approximately $315,000 saved.

These costs include Medicare premiums, co-payments, deductibles, prescription drugs, and other out-of-pocket expenses. However, the estimate does not include long term care expenses.

If you’re able, a great way to save for out-of-pocket medical costs before retirement is a Health Savings Account. Employees covered by high-deductible health plans can put money into an HSA pre-tax during their earning years, then withdraw the money tax-free to use for health care costs later on.

4. Long-Term Care Isn’t Covered by Medicare

If you become disabled, the cost of assistance with daily living tasks generally isn’t covered by Medicare. Most people dream of a retirement spent being active, golfing, traveling, gardening, or just spending lots of time with loved ones.

Unfortunately, that dream doesn’t last long for a startlingly high percentage of retirees.

According to LongTermCare.gov, someone turning 65 today has a 70 percent chance of needing some form of long-term care, whether that is in-home or in a facility.

The AARP recommends buying long-term care insurance when you are between 60- and 65-years-old for individuals and between 55- and 60-years-old for married couples. There is also a tax break for buying this coverage, which can help lower your overall costs.

However, there are numerous other ways to cover this potential financial outlay.

One of the most unique aspects of the NewRetirement Planner is that it lets you “try on” different ways of planning for a long term care event. You can roughly model what happens if you buy long term care insurance, purchase a deferred income annuity, or opt to have a relative care for you.

5. Divorce Is Common for Retirees

A study by Bowling Green State University sociologists noted that the divorce rate for people over age 50 has doubled in the last decades. It was fewer than 1 in 10 in the 1990s and has grown to more than 1 in 4 marriages being dissolved.

In most cases, divorcing couples split assets in half during the divorce settlement. All of a sudden, what may have been plenty of money to live on during your retirement years doesn’t look like much.

If you divorce during your working years, you have some time to work hard, and put money away to try to recover from the loss. But divorce during retirement means you’re out of time for making up those lost assets.

If you are worried about divorce, try:

6. Dividend Income May Not Be Safe or Stable

In the past, retirees could finance a good percentage of their living expenses through stock dividends and interest payments on bonds. But these sources of income have not been as popular, though there has been more interest over the past couple of years.

There are many reasons dividends are a smaller part of the retirement income mix, including the historical trend of companies to pay out less of their profit in dividends since the 1990s and investors’ preference for growth stocks over value stocks. In reality, the majority of retirees depend on Social Security as their main source of income, and employer-sponsored retirement savings plans (your 401k) come in behind traditional IRAs for retirement income.

Dividend investing can still be considered a good source of retirement income, but dividend-paying stocks should be balanced with other types of investments in a diversified portfolio.

7. Retirement Income is Challenging to Figure Out

You’ve spent your whole life working, spending the money you earn and hopefully saving a little too. When you retire, everything you have ever experienced about managing your own finances gets turned upside down. You no longer earn as much or any money from work.

The retirement surprise is that you have to figure out how to make do with and maximize what you already have. Instead of saving as much as possible, the new objectives include developing retirement income strategies — creating predictable retirement income out of what we have.

Explore 18 ideas for retirement income.

8. Time Is More Valuable than Money

When you are free from the rat race – when you have the freedom to retire and get off the treadmill, you may come to realize that time is more valuable than money.

One study found that people who were extremely worried about retirement finances surprisingly found themselves to be much happier once they retired — largely because they had greater control over their time. In fact, the ability to control your own time is how many people are now defining retirement.

Explore how to value time.

9. Inflation Has a Bigger Impact in Retirement Than it Does When You are Working

In the SOA survey, 65% of pre-retirees and 48% of retirees said they think inflation will affect the amount of money they need each year in retirement at least somewhat. Retirement planning that doesn’t take inflation into account may meet the needs of retirees early in retirement but fail to address their spending ten to 15 years later.

Recently, inflation numbers have skyrocketed. Only time will tell if recent price increases are temporary. But any inflation can impact your retirement well being. Consider that from 1913 to 2013 the average US inflation rate was 3.22%. While that sounds reasonable on a year-by-year basis, that rate of inflation means prices doubled every 20 years.

Retirees are also more affected by cost increases in certain categories of spending that general cost-of-living indexes may not emphasize, such as Medicare premiums, health care costs and long-term care expenses. Cost-of-living increases in Social Security benefits have not kept pace with increases in these categories.

Inflation can be one of the more damaging of the common retirement surprises.

The NewRetirement Planner allows you to set and change your own pessimistic and optimistic inflation rates — giving you a better picture of your future.

10. Other Unforeseen Events in the Financial Markets Can Sink Well-Laid Plans

Potential stock market declines or losses in the housing market are reasons for retirement worry.

In fact, the research indicates that very few retirees feel ready for these financial shocks:

- Only 14% of retirees feel ready to deal with a drop in their home’s value

- 8% are prepared for the possibility of running out of assets

- 10% are ready for investment losses

In fact, managing your assets – your home and your savings – is important and complicated.

Many people do it themselves, but others seek help from a fiduciary financial advisor. NewRetirement offers a low-cost advisory service that harnesses the power of technology to deliver extremely valuable advice and guidance for a more secure future. Talk to us about your concerns today!

11. Working Till Your Target Retirement Date May Not Be Possible

The SOA survey found that today’s pre-retirees plan to retire at a considerably older age than current retirees actually retire. The median actual retirement age is 60, yet two in 10 pre-retirees said they plan to work at least until age 68 and 14% said they do not plan to retire at all.

While that’s an admirable goal, the fact is that many seniors are unable to continue working past normal retirement age. Surveys from the Employee Benefits Research Institute show that, since the economic downturn of 2008, about half of retirees left the workforce before they were ready. Some seniors are laid off from jobs they’d held for years; others have health problems that make working impossible. Even many “voluntary” retirements are actually pushed by companies offering early retirement packages or workplace cultures that are inhospitable to older workers.

Many retirees who find themselves in this position turn to “bridge employment,” a job that may be part time and pay less, but helps bridge the gap between their last job and full-time retirement.

The NewRetirement Planner lets you set different work income levels for the transition to retirement — giving you a more accurate and realistic plan.

12. Depression Is Common

While it IS very likely that you will be happy in retirement, retirement depression is surprisingly common.

A study published in the Journal of Population Ageing found that those who were retired were about twice as likely to report feeling symptoms of depression than those who were still working. And, research from the London-based Institute of Economic Affairs found that the likelihood that someone will suffer from clinical depression actually goes up by about 40% after retiring.

Learn more about how to combat retirement depression.

13. You May Have Saved Too Much

While the vast majority of Americans have not saved enough, there are a significant number of people who have definitely saved too much.

Learn why people save too much and get advice for how to know if you are over saving. Or, hear from people who over saved.

14. Watch Out for Overspending in Retirement

Traditional retirement planning recommends aiming for 80% of your pre-retirement income each year to maintain your quality of living in retirement. The thinking is that once you retire, certain expenses — including housing costs, commuting, dining out, payroll taxes and retirement savings — will decrease.

However, households end up spending more than what they’ve budgeted for, especially early in retirement.

That overspending is not typically on necessities — such as food and health care — but on discretionary spending, such as travel and maintaining a more expensive home than they need. It’s understandable that after a lifetime of working, new retirees may want to treat themselves a bit. However, overspending in the early years of retirement can significantly increase your chances of not having enough to last a lifetime.

Even the best-laid retirement plans can come unraveled if you aren’t proactive about setting a reasonable budget for retirement spending and sticking to it. And the more detailed the better.

The Budgeter in the NewRetirement Planner enables you to predict expenses by category and vary your expenditure over time. This tool makes it easy to get started planning your future finances, and it addresses many details not covered in other tools. This can mean a more reliable plan for your future.

15. Some Retirees Drink Too Much

Some people leaving the working world feel like they’ve lost their status, identity, social support, or their purpose. In some cases, these feelings of loss lead to an increase in alcohol consumption and even alcohol abuse. Some studies have even shown that drinking alcohol is increasing among the elderly.

In general, the CDC recommends limiting drinking to no more than one drink per day for women and two drinks per day for men. But even that amount can be too much for some. As people age, they often become more sensitive to the effects of alcohol, and heavy drinking can make some health problems (such as osteoporosis and high blood sugar) even worse. Drinking and taking certain medications, even over-the-counter medications or herbal remedies, can be dangerous or even deadly.

16. Retirement Boredom is Real

By far, the most common complaint about retirement is boredom and not having anything to do. Worse yet, not having anything to do and feeling irrelevant.

Here are 14 ways to avoid retirement boredom.

17. Living a Long Time is a Blessing (and Expensive)

You are probably going to live a long time and you need to plan for living longer than you anticipate and this can be expensive. The good news? You won’t need quite as much money in old age. On average, people spend quite a bit less as they get older.

Use the NewRetirement Planner to run scenarios on your longevity and make sure you have a plan for being comfortable into old age.

18. Establishing a Daily Routine Can Be Challenging

Depending on your personality, you may find the freedom of retirement somewhat difficult. Many people who had regimented schedules while working do well by planning their days and weeks and being sure to prioritize get togethers with friends and other activities.

It is important to create opportunities for regular social and intellectual endeavors.

Identifying potential gotchas and surprises as part of your retirement plans

While most retirees seem to just “roll with the punches” and adapt as financial troubles happen, it might be better to learn from people who are already retired and adopt “forewarned is forearmed” as your retirement motto…

Or, better yet, maybe the best strategy for your retirement is: “Hope for the best, plan for the worst.”

When building your retirement plans, you’ll want to:

Make sure you can achieve a secure retirement using optimistic assumptions. Once that is achieved, consider what happens with average or pessimistic assumptions or if something on this list of retirement surprises were to pop up in your future.

Running various worst case “what if” scenarios can help you gain confidence about your money and enable you to live the life you want.

Create an account or log in right now to find out which phase you are in. The NewRetirement Planner makes it easy to create and maintain a plan.

Publisher: Source link