Overview

Employer-sponsored health insurance (ESI) is the primary source of health coverage for working non-elderly adults, but adults working part time (fewer than 35 hours per week) have less access to these benefits than their full-time counterparts. Among non-elderly adults employed by public or private employers (excluding the self-employed), 18.5 million, or 14% of adult workers, work part time. This report examines the characteristics of part-time workers and their access to employer-sponsored health benefits.

Part-time workers—particularly those living in households without a full-time worker—are less likely to be offered health coverage and less likely to be enrolled in an employer plan, either through their own employer or as a dependent on someone else’s plan. Part-time workers who do not have employer coverage may be eligible for Medicaid or for subsidized coverage in the Affordable Care Act (ACA) Marketplaces. However, recent cuts in these coverage programs included in the Republican tax and spending law, as well as the potential expiration of enhanced Marketplace tax credits, will make it harder for individuals who may not have access to an affordable, job-based plan to find coverage.

Who are Part-Time Workers?

Workers cite a wide range of reasons for usually working part-time. Some of the most common include enrollment in school or a training program (30%); family or personal obligations, including childcare obligations (26%); and having a job where full-time work is less than 35 hours per week (19%). Smaller shares report working part time because they are unable to find full-time work (7%) or due to illness, health, or medical limitations (4%).

Generally, part-time workers can be broken into two categories: those working part time for economic reasons (such as inability to find work or seasonal declines in demand), and those working part time for non-economic reasons (such as medical limitations, childcare responsibilities, family or personal obligations, retirement, or jobs where full-time work is less than 35 hours per week). For this analysis, workers enrolled in school or training programs are treated as a separate category due to their large share of the part time workforce. The analysis focuses on non-elderly adult workers who usually work part time; it excludes full-time workers who happened to be working part time at the time of the survey.

On average, part-time workers are younger than full-time workers (35 years old vs. 41 years old) and are more likely to be women (66% vs. 46%). More than half (52%) of part-time workers earned a high school diploma (or equivalent) as their highest level of education. Compared to full-time workers, part-time workers are less likely to have earned a bachelor’s degree (27% vs 44%), or a postgraduate degree such as a master’s or doctorate degree (9% vs 16%).

Part-time workers are more likely than full-time workers to have household incomes below twice the federal poverty level (30% vs. 13%), which is about $30,120 for a single person and $62,400 for a family of four. At the same time, part-time workers are not a homogeneous group; many live in households with higher incomes. Specifically, 42% of part-time workers have household incomes above 400% of the federal poverty level (about $124,800 for a family of four), and 24% have incomes above 600% of the poverty level (about $187,200 for a family of four).

Where do Part-Time Workers Work?

About one in three part-time workers (33%) are employed in service occupations. More specifically, the most common occupations are food preparation and food service-related roles (15%), followed by office and administrative support (13%), sales (12%), transportation and material moving (9%), and education, training, and library occupations (9%). The most common jobs among part-time workers are cashier, waiter, retail salesperson, and personal care aide.

Among the major industry categories, 31% of part-time workers are employed in education, health care, or social assistance; 21% work in the arts, entertainment, recreation, or food services industry; and 17% are in wholesale and retail trade. The most common industries for part-time workers overall are restaurants and other food services; elementary and secondary schools; colleges, universities, and professional schools; hospitals (excluding facilities specifically for psychiatric and substance abuse); and supermarkets or other grocery stores.

What Share of Part-Time Workers Have a Full-Time Worker in the Household?

Sixty-five percent of part-time workers live in a household with a full-time adult worker. Those living with a full-time worker are much less likely to have a household income below 200% of the federal poverty level compared to those without at least one full-time worker in their household (18% vs. 52%).

What is the Health Insurance Coverage of Part-Time Workers ?

Compared to full-time workers, part-time workers are less likely to have employer-based health coverage, either through their own workplace or as a dependent on another plan. They are also less likely to work for an employer that offers health coverage to any of their employees. If a part-time worker is working for an employer that offers coverage, they are less likely to be eligible to enroll in that coverage.

Fifty-four percent of part-time workers have employer-based health coverage, compared to 78% of full-time workers. Notably, part-time workers living in a household without a full-time worker are much less likely to have employer-based coverage (36%) than those in households with at least one full-time worker (63%). Only 19% of part-time workers have employer-based coverage from their own jobs, compared to 62% of full-time workers.

Overall, part-time workers are more likely to be uninsured than their full-time counterparts (13% vs 9%). Among part-time workers, those living in a household without a full-time worker are more likely to be uninsured (17%) than those living with a full-time worker (11%). Part-time workers are also more likely to be covered by Medicaid (21%) or Direct-Purchase (12%) than full-time workers (7% and 6% respectively). Direct purchase coverage would primarily be through the ACA marketplaces and typically comes with a tax credit to subsidize the premium, scaled with income.

Offers and take-up of employer-based coverage

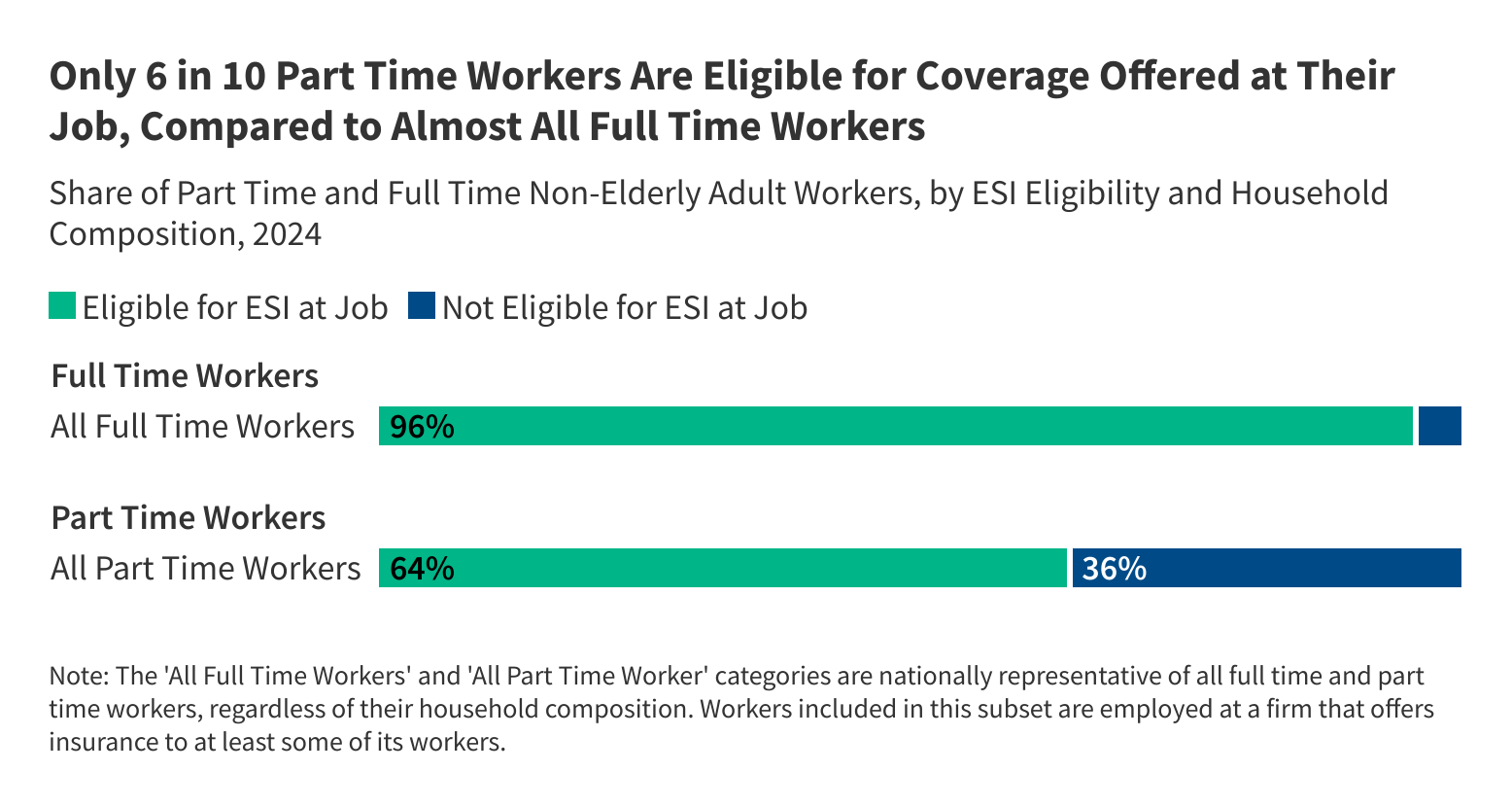

One of the reasons part-time workers are less likely to have health coverage through their job is that they are less likely to work for employers who offer health benefits. Specifically, only 60% of part-time workers work for an employer that offers health insurance, compared to 84% for full-time workers.

Among part-time workers who do work for an employer offering health benefits, just 64% are eligible to take up the coverage. For those who work for an employer offering coverage but are not eligible to enroll:

- 84% do not work enough hours per week or weeks per year to qualify,

- 8% are contract or temporary employees,

- and 5% have not worked for their employer long enough to become eligible.

Under the ACA’s shared responsibility mandate, if employers with at least 50 full-time equivalent employees do not offer minimum essential coverage to 95% of their full-time employees and their dependent children, they are taxed. However, employers are not required to offer coverage to part- time workers.

Of the 60% of part-time workers that work for an employer that offers health insurance, only 64% are actually eligible for coverage at their job. Overall, 19% of part-time workers are covered by their own employer. Among those part-time employees who are eligible but do not take up coverage offered at work, 68% cite having other coverage as the reason for not enrolling, while 28% find the coverage too expensive.

Part-time workers—especially those living in households without a full-time worker—tend to have lower incomes and are less likely to be covered by a job-based health plan. Even when coverage is offered, many part-time workers cite cost as a reason for not enrolling. These workers may struggle to afford the premiums required to enroll in the plan, or the cost-sharing required by the plan when they go to use services. While, overall, those with employer-sponsored plans spend an average of 3.9% of their income on premiums and cost-sharing, the financial burden is much higher for lower-income households. Fifteen percent of workers have household incomes below 200% of the federal poverty level.

Employer-sponsored insurance remains the linchpin of coverage for non-elderly working adults, but workers with lower incomes or part-time schedules are significantly less likely to have access to this type of insurance. For part-time workers who are either ineligible for or cannot afford job-based coverage, upcoming federal policy changes may further limit their options. Changes to Medicaid and the Affordable Care Act in the Republican tax and spending package — formerly known as the “One Big Beautiful Bill”— are projected to result in 10 million more people becoming uninsured by 2034. Furthermore, if the enhanced premium tax credits that reduce the cost of ACA Marketplace coverage for many enrollees are not extended beyond 2025, an additional 4.2 million people are expected to lose coverage.

Some employers have taken steps to make coverage more accessible for low-wage workers. In 2024, 14% of firms with 200 or more employees offered a plan with reduced benefits and low premium contributions specifically designed to be affordable for low-wage workers. Additionally, some firms provide voluntary benefits to part-time workers outside of their standard health plans. These benefits may include financial assistance for hospitalization or specialized services such as telehealth. In 2024, 3% of small firms and 14% of large firms that did not offer standard coverage to part-time workers offered a voluntary benefit. Despite these efforts, access to employer-sponsored health benefits remains a significant challenge for many part-time workers.

Publisher: Source link