On May 22, the House passed the One Big Beautiful Bill Act, which the Congressional Budget Office (CBO) estimated would reduce federal Medicaid spending by $793 billion over 10 years. Over 10% of those savings came from a provision that would place a moratorium on provider taxes, keeping current taxes in place but prohibiting states from establishing any new provider taxes or from increasing the rates of existing taxes. On June 16, the Senate Finance Committee released reconciliation language expanding on that provision by also reducing existing provider taxes in states that have adopted the Affordable Care Act (ACA) Medicaid expansion. Specifically, the Finance Committee language would reduce the safe harbor limit (currently 6.0% of revenues) for states that have adopted the ACA expansion by 0.5% annually until they are within a lower safe harbor limit of 3.5%. The moratorium applies to all provider taxes, while the reduction in existing taxes would exempt nursing facilities and intermediate care facilities.

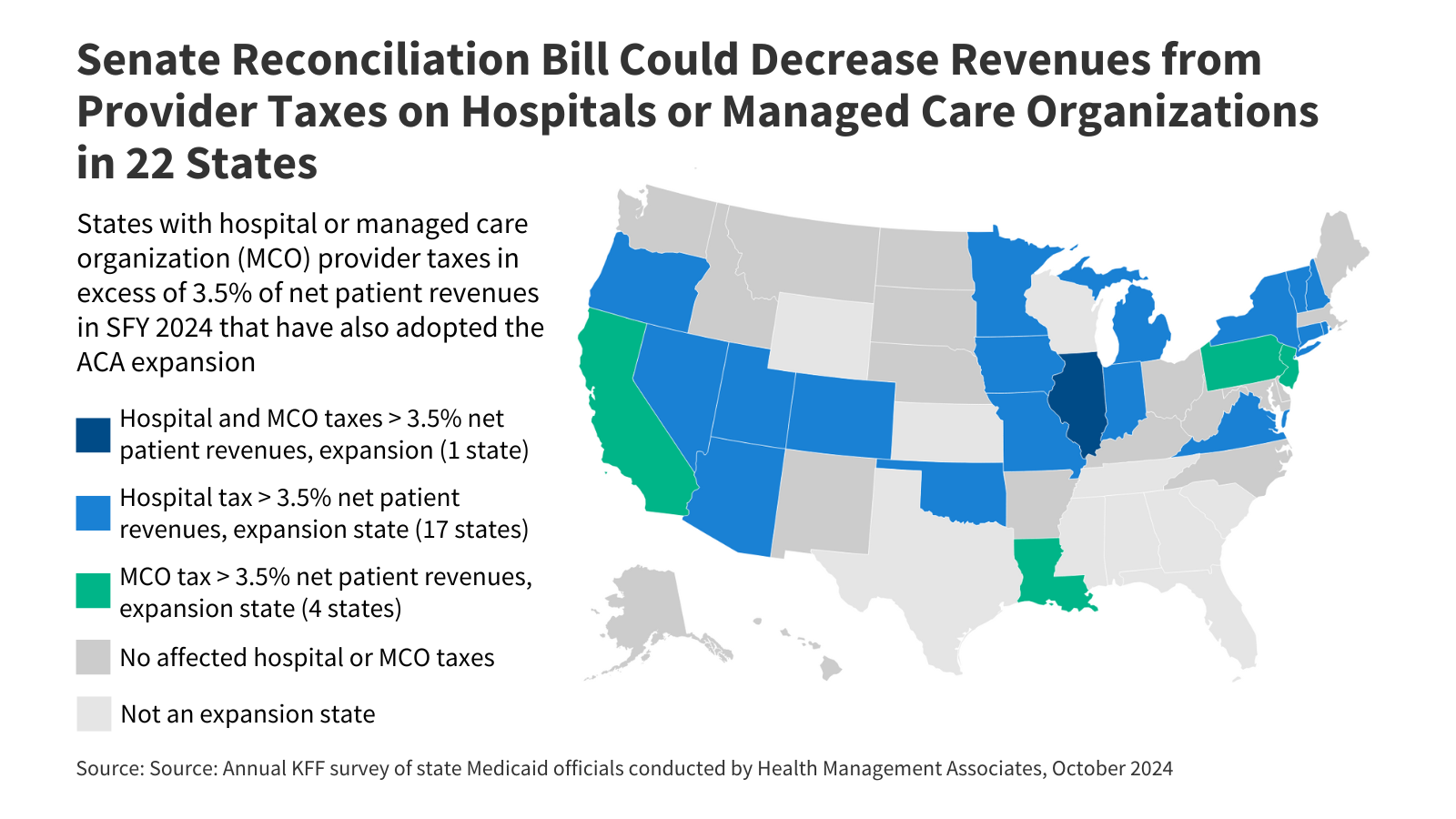

If Congress passes the reconciliation bill with the Finance Committee provision, 22 states could be required to reduce their provider taxes on either hospitals or managed care organizations, cutting a key source of state Medicaid funding in those states (Figure 1). Affected states include Arizona, California, Colorado, Connecticut, Illinois, Indiana, Iowa, Louisiana, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New York, Oklahoma, Oregon, Pennsylvania, Rhode Island, Utah, Vermont, and Virginia.

The new restriction on states’ funding sources would apply only to states that have adopted the ACA expansion, adding another financial penalty on expansion states—in the House bill, over half of the federal spending cuts stem from provisions that only apply to expansion states. This policy watch explains how the Finance Committee provision would reduce Medicaid spending, and the implications for expansion states.

All states except for Alaska use provider taxes to help finance the state share of Medicaid spending, and those provider taxes are set in accordance with federal laws. Among other requirements, provider taxes may not hold taxpayers (providers) “harmless,” meaning that states are prohibited from directly or indirectly guaranteeing that providers will receive the taxes they pay back in the form of higher Medicaid payments, unless the provider tax comprises 6% or less of net patient revenues. The 6% limit is referred to as a “safe harbor” limit, and many states set their provider taxes below that limit so they may use provider tax revenues as a source of increased funding for hospitals and other safety net providers.

CBO’s older estimates suggest that reducing the safe harbor limit to 3.5% in expansion states could generate federal savings that are tens of billions or even hundreds of billions of dollars. Specifically, CBO estimated that reducing the safe harbor limit to 5% would reduce federal Medicaid spending by $48 billion over ten years while reducing the threshold to 2.5% would reduce federal spending by $241 billion over ten years. Those estimates apply to all states and would be somewhat lower if restricted to states that have adopted the ACA expansion.

The new limits on provider taxes in states that have adopted the ACA expansion could lead to lower hospital payment rates or reductions in Medicaid eligibility and coverage. States often use hospital provider taxes to finance higher payment rates for hospitals that serve disproportionate numbers of Medicaid or uninsured patients; some states fund the state share of the ACA Medicaid expansion or other increases in Medicaid eligibility and coverage. The House-passed version of the One Big Beautiful Bill Act is estimated to increase the number of uninsured people by 10.9 million (including 400,000 more uninsured from the provider tax provisions). CBO assumes that with limited access to provider tax financing, states would make programmatic decisions that could affect coverage. Imposing more stringent limits to provider taxes in expansion states could result in additional federal spending reductions but also could amplify negative implications for provider reimbursement rates and for coverage loss.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

Publisher: Source link