LAS VEGAS — At AHIP’s annual conference, the trade group told reporters they oppose the reconciliation bill moving through Congress because of the impacts it would have on Medicaid and the individual market.

AHIP executives said they will continue to work with other prominent healthcare organizations to convince lawmakers to protect federal health programs and help Americans remain insured—both by avoiding the harshest cuts and changes to Medicaid and the Affordable Care Act and extending the ACA enhanced premium tax credits.

“We are working arm in arm with hospitals, with physicians, with nurses, with patient advocates to try to mitigate these provisions,” said CEO Mike Tuffin. The group is continuing to meet with lawmakers and Congressional staff members to warn of dangers, should the bill pass.

Most recently, the Senate Finance Committee released its draft of the bill, which includes harsher changes than approved in the House’s final version. Policy experts already expected the legislation could raise healthcare costs, increase premiums, constrain state budgets and raise the uninsured rate.

Don Antonucci, president and CEO of Providence Health Plan, a provider-sponsored health plan, told Fierce Healthcare cuts to Medicaid could be devastating to local hospitals and the healthcare system at-large.

“In simplistic terms, if people come off of Medicaid … and they need to go to the emergency room, it doesn’t matter if they have Medicaid or don’t have any insurance, they’re going to the ER,” he explained. “That impacts everybody.”

One consequential provision is appropriating funds toward cost-sharing reductions (CSRs). Reduced cost-sharing for low-income individuals is required under the ACA.

“That is a significant disruption to how plans are priced today, and many plans have already filed their premiums and rates for 2026,” said Jeanette Thornton, executive vice president of policy and strategy for AHIP. She questioned how insurers should plan pricing for the next benefit year in the current environment. She added enrollees are likely to experience “sticker shock” when premiums rise as a result of CSR changes and not extending the ACA tax credits.

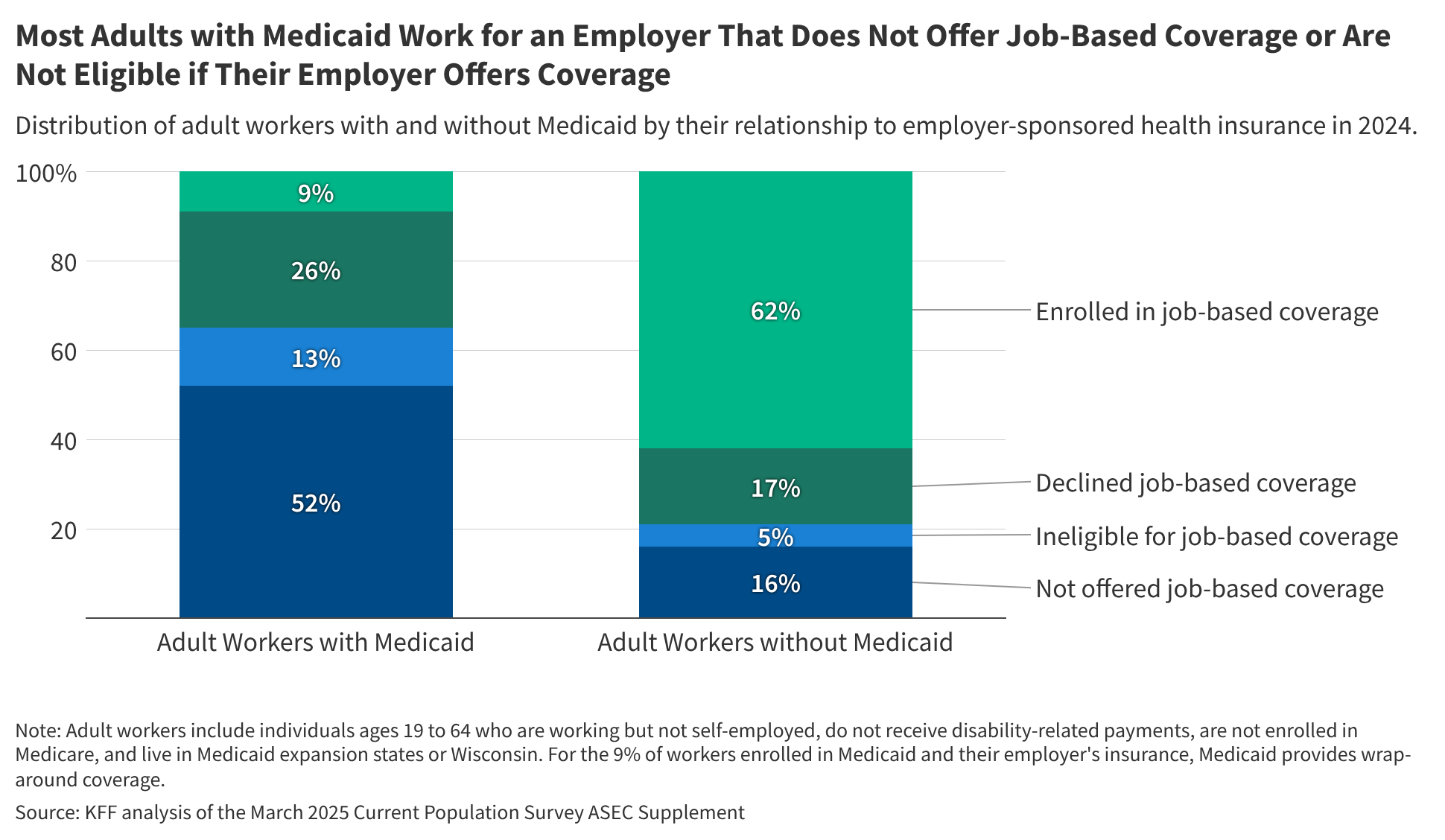

Trump’s bill does not specify how work requirements will be enforced, only that the process must work by the end of 2026, Thornton explained.

The Senate’s bill also cracks down on states’ usage of provider taxes in Medicaid, capping them at 3.5% for expansion states, down from the current 6% rate. The House bill would have instead frozen the taxes at current rates.

In addition to health systems, advocacy groups and condition-focused organizations, the Alliance for Community Health Plans has consistently voiced opposition to the budget bill. Other groups like the Modern Medicaid Alliance and the Keep Americans Covered Coalition oppose the bill.

“There is just a huge administrative apparatus that has to be worked out, both on initial enrollment and then on the reverification process,” said Thornton. “I think the most challenging situation is, how do you prove that you qualify for an exemption?”

Uncertainty extends to tech vendors tasked with advising plans, according to Mike Jones, president and general managers for the payer unit of data and platform company Inovalon.

“Right now, not knowing if they’re going to make Medicaid cuts, Medicare changes, how the RADV audits are going to hatch out, how the stars ratings may be affected in the coming years,” he said. “There’s so much uncertainty that there’s not a clear direction from the administration.”

In Medicare Advantage, plans have already submitted bids to the Centers for Medicare and Medicaid Services and are speaking with state regulators now. Plans need to set pricing rates based on the population that will be enrolled for coverage.

“If some of these changes are going to be made, they, at the bare minimum, need to be made on timetables that are workable,” said Tuffin. “I think you’d see that’s a shared sentiment across the healthcare system.”

President Donald Trump, and influential health policy allies around him, routinely claim there is not interest around cutting Medicaid or Medicare, other than by rooting out waste, fraud and abuse. AHIP’s stance is the Medicaid changes clearly go far beyond mere waste, fraud and abuse.

To healthcare consultant and former National Association of Medicaid Directors Executive Director Matt Salo, the administration’s stated support for the bill doesn’t pass the smell test.

“I think there is a difference between how folks on the Hill are thinking about this as they’re debating it and they’re writing it,” he said during a panel. “And to me, that perspective is, ‘yeah, we want people to lose coverage. That’s how we’re saving money.’”

He added: “Because quite frankly, a lot of it is a backdoor repeal of the ACA. That perspective is very, very different than the perspective I am hearing in every state in the country that I’ve talked to, and that includes very, very red states.”

Despite vocal pushback from House members in districts with constituents relying on Medicaid, so far lawmakers have agreed to advance the legislation at the behest of Trump. Republicans hope to finalize the bill sooner rather than later.

New polling from KFF finds 64% of adults view the One Big Beautiful Bill unfavorably, and Medicaid is viewed favorably by nearly three-quarters of Republicans. However, 68% of adults support Medicaid work requirements, depending on how the question is asked.

Publisher: Source link