The team at Omada Health took a victory lap Friday after the company’s successful Nasdaq debut, according to company president Wei-Li Shao. But the celebration doesn’t distract the team from the work ahead as Omada focuses on expanding its virtual chronic condition services to more people, Shao said.

The company closed its first day of trading at $23 per share, a 21% jump from the IPO price of $19 per share, securing a valuation just over $1 billion. Reuters reported Omada Health’s valuation hit $1.28 billion. That surpasses its last private valuation of $1 billion from its previous venture capital round.

The comany raised $150 million in its IPO.

With Hinge Health’s IPO two weeks ago and now Omada’s public debut, it signals an upswing in the public investor market after a prolonged slowdown. Shares of Hinge Health jumped 22% above the initial public offering price in the company’s New York Stock Exchange debut May 22, bringing its market capitalization to more than $3 billion.

“With recent IPOs like Hinge Health last month and Omada Health today there is a signal of the digital health market reopening after a long freeze,” said John Beadle, co-founder and manager partner of Aegis Ventures.

While many companies going public are seeing valuation markdowns, Omada Health was an exception, Beadle noted.

“I view Omada as priced for success. Notably, it is the only venture-backed IPO in the current market where the IPO price was set above the most recent private market valuation. They demonstrated superb discipline and rigor in how they structured this offering. Today’s substantial boost on day one is testament to the quality of their business model, track record, and growth opportunity,” he said.

Shao said Omada Health, a 13-year-old company, was feeling the pull from the capital markets to go public.

“We’ve been hard at work in our business. We like the scale of the business, the scale of the model. We think that pull [from the capital market] materialized right now, in this moment, not only because of the excitement about our mission and commitment to our mission to bend the curve but also our financial performance.”

In 2024, Omada generated $169.8 million in revenue (38.3% year-over-year growth) and $102.9 million in gross profit (60.6% margin) on the back of 7.8% growth in operating expenses.

The company is not yet profitable. In 2023, Omada reported a net loss of $67.5 million and that shrank to $47 million in 2024. The company reported a net loss of $9.4 million in Q1 2025, narrower than its loss of $19 million in the same quarter of 2024.

In the first quarter of this year, the company brought in $55 million in revenue, up 57% from $35 million the same period a year ago, and $32 million in gross profit.

“Folks have been tracking us. They’ve been keeping track of all the innovation that we’ve invested in, and they like the discipline that they see,” Shao said. “We’ve been meeting with investors for quite some time now. Every time we do, we ask them, ‘What’s your feedback?’ Most recently, over the last couple of months, the feedback has been pretty darn consistent of ‘We’d love to see you in the capital markets’.”

There was a dry spell in digital health IPOs post-COVID but investors’ appetite for the IPO market seems to be steadily returning. While the entire industry is watching Hinge Health and Omada’s IPOs carefully, Shao said the company didn’t feel the pressure.

“We’ve been basically operating internally, while not public, as a public company with that discipline. We put that pressure on ourselves for quite some time now. We like it. I think it makes us better, it makes us serve all our customers and our members to the utmost of our ability,” he said. “If it serves as a bit of a beacon of what it takes, alongside another great company like Hinge Health, then we’re happy to carry that torch, and we certainly hope others follow. We believe in the power of virtual health and digital health because people really need that support in between their doctor’s visits.”

Omada filed a draft registration statement with the U.S. Securities and Exchange Commission last June, according to SEC filings. It publicly filed to go public on May 9, marking the second digital health company to go public in 2025.

Omada launched its initial virtual program in diabetes prevention and weight health in 2012. The company now has 2,000 customers and over 679,000 total members enrolled in one or more programs, according to its S-1 filing. Omada says has it has supported over one million members since launch.

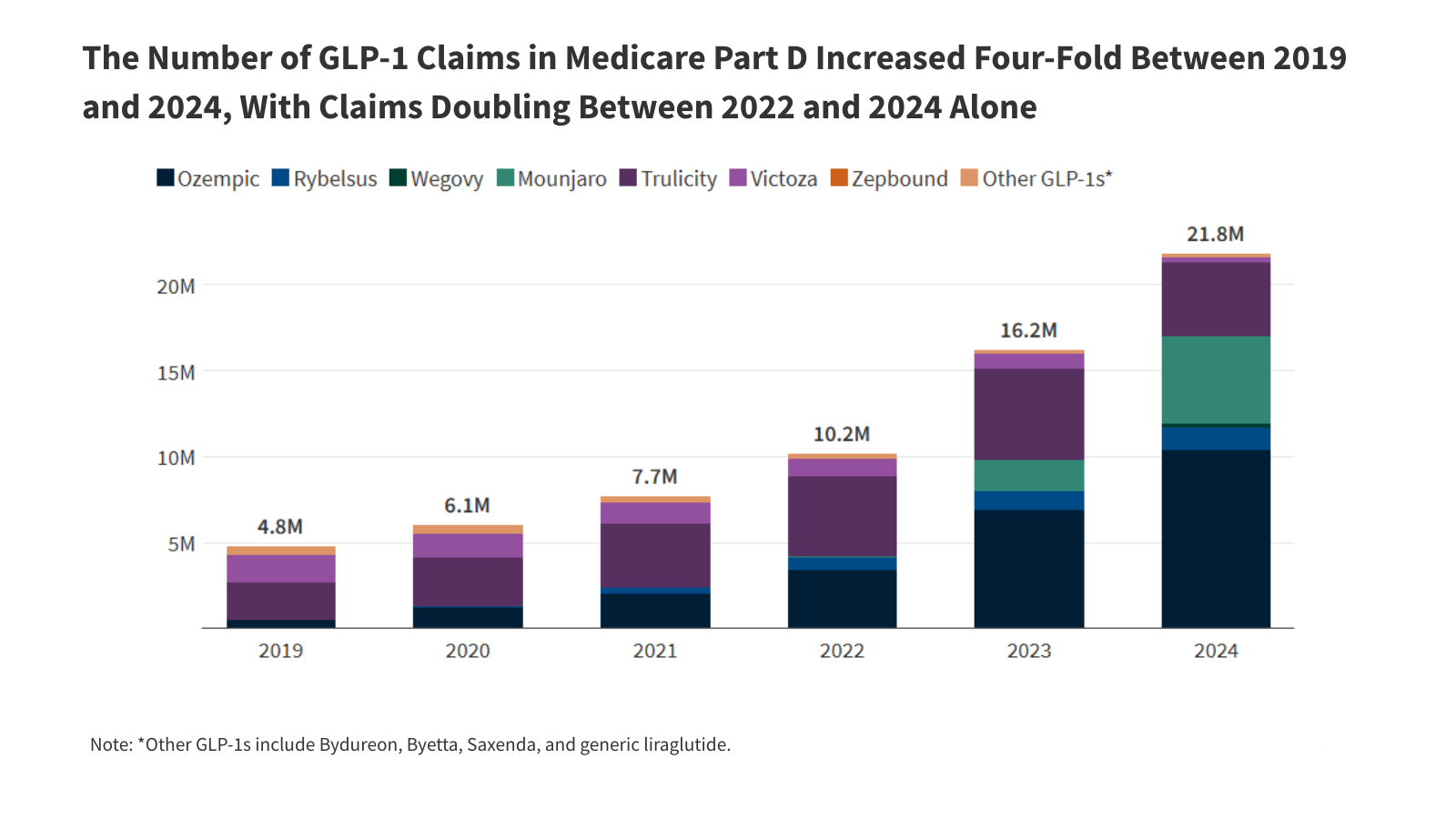

The company expanded its virtual care programs to target prediabetes, hypertension and musculoskeletal conditions. It also offers an enhanced care track program for GLP-1 drugs that seeks to make it easier for employers to cover and provide these medications. The offering pairs GLP-1 medications with clinical oversight and lifestyle change to drive weight loss and better manage obesity and its related conditions.

The company is going after a massive market. As of 2022, more than 156 million Americans suffer from one or more chronic conditions, such as obesity, prediabetes, diabetes, hypertension, and musculoskeletal conditions, and approximately 40% of U.S. adults have two or more chronic conditions, based on data published in the Annals of Bioethics & Clinical Applications.

The company sells primarily to employers, who either contract with Omada directly or obtain access to its programs through a channel partner, such as a health plan or PBM. The remainder of is revenue is derived from inclusion as a benefit in fully insured health plans, primarily in the commercial market, from PBMs through specific therapeutic programs, or via health systems that assume the cost of care for their patients.

Omada said it launched a new model of care, called “between-visit care” to bring together different healthcare professionals, connected devices and personalized software experiences to fill gaps in medical care when patients aren’t seeing their doctors.

Both Hinge Health and Omada Health have been in business for more than a decade, representing the earlier wave of digital health companies.

“I think being a private company for that long has allowed us to really build the engine and build a scalable model. We have been methodically just building out this multi-condition care platform, knowing that most Americans unfortunately suffer from a number of diseases, and not just one. We know that they also suffer from a fragmented healthcare system. We’ve always endeavored to build that unified experience, and we think we’ve arrived at that point. Out of our 2,000 customers, almost a third of them have multiple products of ours,” Shao said.

He added, “We also have the school of thought that healthcare is hard and pioneering a new form of care that is in-between doctor visits, as opposed to just recreating a doctor’s visit on FaceTime, is not easy. Healthcare is not an easy industry or sector to penetrate, and we recognize that. So, we didn’t want to go too early.”

Hinge and Omada were both “first movers” in their respective industries, noted Beadle. They both have “strong management teams that charted a path of sustainable and responsible growth,” he noted.

“They both generated outcome data, demonstrating effectiveness and value. In summary, both companies offered an attractive combination of a strong growth profile, clear outcomes, and room to grow profitably in large markets,” Beadle said.

The successful Hinge and Omada IPOs are welcome news for the IPO market generally, and for the health tech market specifically, noted Edward Best, co-chair of the Capital Markets Practice at Willkie Farr & Gallagher.

“While the markets in April were extremely volatile, May has seen them calm down quite a bit which paved the way for a number of successful IPOs. While we can’t predict the future, if this stability continues, we should see a robust second half of 2025,” Best said.

He added, “Companies with a mature business and a record of solid financial performance always do better, and these two IPOs [Hinge Health and Omada Health] are a good example of why staying private a bit longer makes sense.”

These IPOs are an indication that the market is receptive to solid technology-related healthcare IPOs, Best said.

“Whether this is a sign the market will be receptive to companies in the broader healthcare market remains to be seen. Of course, investors will evaluate each company individually and companies with strong fundamentals and shown profits or a clear path to profitability will do great,” he said.

What’s next for Omada Health?

Omada is looking to grow its business by acquiring more covered lives across multiple buyer categories: selling to new customers and channel partners as well as expanding within its existing channel partners to new lines of business, the company said in its S-1 filing.

Last year, among its new customers, more than half signed up for multiple Omada Health products, Shao noted. And the company is focused on increasing that “multi-product penetration,” he noted.

Omada is seeing strong interest in its enhanced care track program for GLP-1 drugs, given the growth of the buzzy weight loss medications. The company has managed 50,000 individuals though its GLP-1 care track and has inked relationships with more than 200 clients, executives told Fierce Healthcare in March.

Omada inked a partnership with CVS Health’s Caremark as part of the pharmacy benefit manager’s weight management program, its second partnership with a major PBM. It also teamed up with Cigna’s Express Scripts within its EncircleRx initiative.

“The GLP-1 business is performing well and it’s a an area of opportunity, But, there’s also problems to be solved because we know that people on GLP-1s need lifestyle intervention support that not only amplifies their weight loss, but also helps them maintain the weight they’ve lost should they stop taking GLPs,” Shao said.

Omada is expanding its capabilities in artificial intelligence as well.

“We quip that we’re in the era of the two ‘Gs’: GLP-1 and GPT,” Shao said. The company seems to be positioning itself to take advantage of opportunities in both big trends.

Omada is exploring ways to use generative AI to enhance the member experience and members’ relationship with the company’s care teams, Shao said.

The company recently launched Nutritional Intelligence that includes an AI agent called OmadaSpark that provides members with real-time motivational interviewing and nutrition education.

The company estimates about 20 million people have benefits coverage for one or more Omada programs. This represents about 14% of the self-insured insurance market, 9% of the fully insured market, 1% of the Medicare Advantage market and 1% of the PBM market, according to the company’s S-1 filing.

So there is plenty of runway for Omada to grow.

The prevalence of chronic conditions in the U.S. is increasing, and individuals with these conditions need continuous health support.

Six in 10 Americans have at least one chronic disease, and 4 in 10 have two or more chronic diseases, according to data from the Centers for Disease Control and Prevention. Chronic conditions are also leading drivers of the nation’s $4.5 trillion in annual healthcare costs.

“We love the fact that we enrolled over a million people all time and have close to 700,000 under active care management. But that number, frankly, needs to be 2 million, it needs to be 5 million or 10 million. Our focus, clear and simple and straightforward, is to triple down on creating the best member care experiences we can within the condition areas that we’re focused on,” Shao said.

Omada boasts a 90% three-year average customer retention rate. The digital health company also touts its clinical and economic outcomes, supported by 29 peer-reviewed publications.

Studies have shown reductions in hemoglobin A1c, total cholesterol, and blood pressure, alongside improved medication adherence and satisfaction rates.

It also touts cost savings for employers by lowering medical costs. Omada’s diabetes program, as one example, can lead to $3,900 in gross healthcare cost savings per member at three years of using the program, according to its S-1 filing.

Publisher: Source link