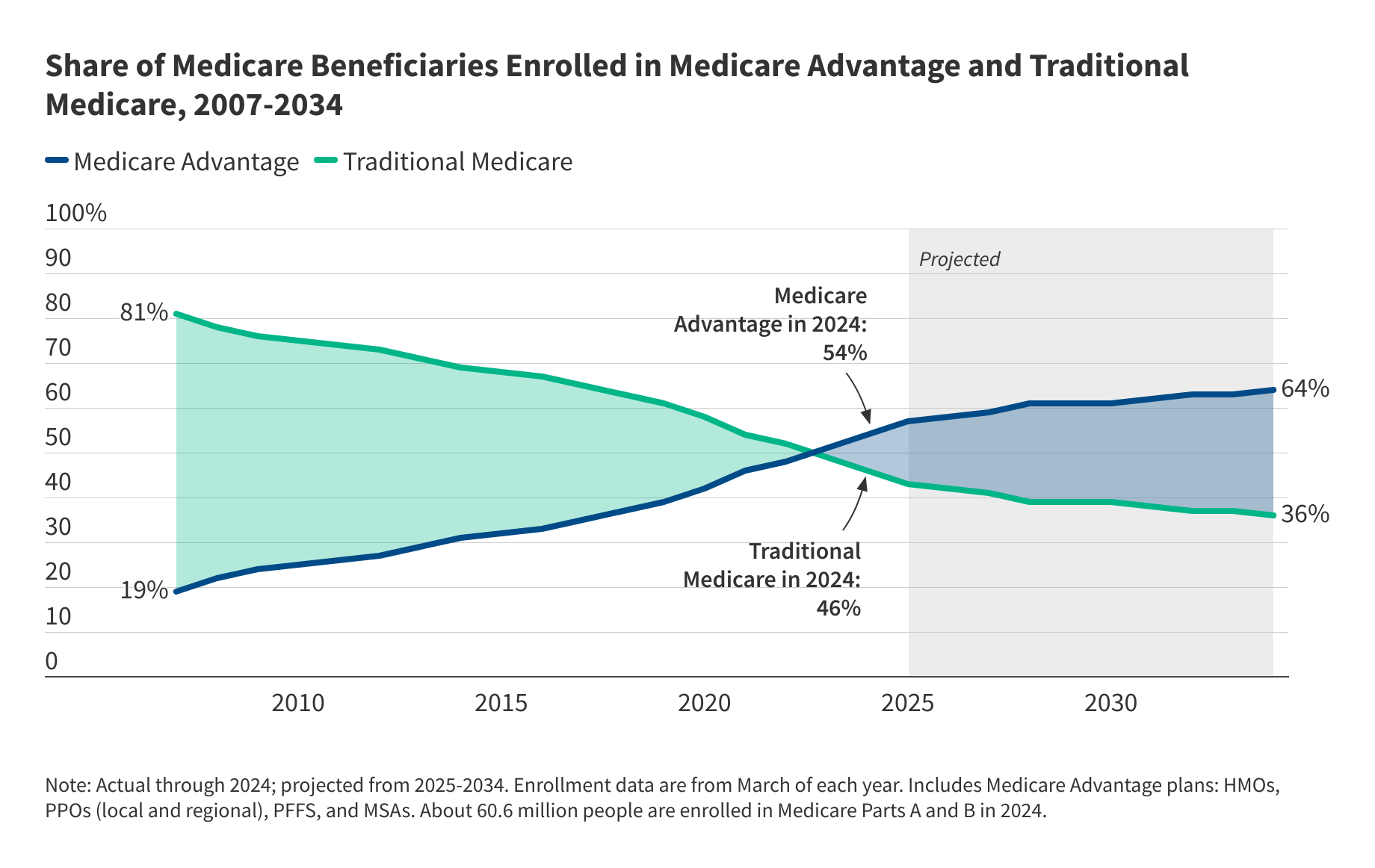

The privatization of Medicare has been taking place without much public debate – a trend that has implications for the 68 million people covered by Medicare, health care providers, Medicare spending, and taxpayers. Since 2010, the share of Medicare beneficiaries receiving their Medicare benefits from private Medicare Advantage insurers has more than doubled (Figure 1). The Congressional Budget Office (CBO) projects nearly two-thirds of all Medicare beneficiaries will be in private plans by 2033, though data released in the early part of 2025 show enrollment growth in 2025 has been somewhat lower than CBO projected. The Trump administration has the opportunity to weigh in on the pace of growth in private Medicare Advantage enrollment and the future of traditional Medicare, which remains the source of coverage for close to half of the Medicare population.

Questions about Medicare Advantage are likely to come up at the forthcoming confirmation hearing of Dr. Mehmet Oz, President Trump’s nominee to head up the Centers for Medicare & Medicaid Services (CMS). In the past, Dr. Oz has promoted Medicare Advantage in co-authored papers, interviews and on his television show. His support for Medicare Advantage aligns with general preferences among Republicans to maximize the role of the private sector, including Medicare Advantage, over government-run public programs, such as traditional Medicare.

The growth in Medicare Advantage is due to a number of factors, but none may be greater than the appeal of potentially lower costs and extra benefits like dental coverage and debit cards, offered by Medicare Advantage plans and aggressively marketed by brokers and insurers. Insurers are required to offer extra benefits when they estimate that their costs for Medicare-covered (Part A and Part B) benefits will be lower than the maximum amount the government is willing to pay in an area. They are able to offer additional extra benefits, in part, due to a payment system that, on average, sets maximum payments well above the costs of similar people in traditional Medicare and adjusts payments for health status in a way that overestimates costs for Medicare Advantage enrollees.

According to MedPAC, an independent, non-partisan agency that advises Congress about Medicare payment, the federal government pays insurers 22% more for Medicare Advantage enrollees than it pays for similar people in traditional Medicare, at a cost of $83 billion in 2024. To put the $83 billion in context, that’s more than Medicare paid physicians under the physician fee schedule to treat traditional Medicare patients in 2024. The higher Medicare spending for Medicare Advantage enrollees results in $13 billion in higher Medicare Part B premiums paid by Medicare beneficiaries, including those who are not in Medicare Advantage.

To promote efficiencies and trim federal spending, the administration could, for example, make technical adjustments to the payment system through the annual rate notice that could have the effect of lowering payments to plans. To achieve further savings, the administration could work with Congress to adopt savings proposals, including those that have recently been advanced by the Paragon Health Institute. These include ending the quality bonus program that increases Medicare spending by nearly $12 billion a year or capping Medicare Advantage benchmarks at 100 percent of local traditional Medicare costs except in areas with low Medicare Advantage penetration. Such changes would achieve Medicare savings but could also make it less profitable for insurers and potentially slow growth or even reduce private plan enrollment.

Alternatively, the Trump administration could adopt policies to accelerate the pace of privatization, such as boosting payments to plans through the annual rate notice and adopting other policies to encourage more private plan enrollment. The administration could, for example, make it easier for insurers and brokers to market Medicare Advantage plans to attract new enrollees, by unwinding the requirement that all television ads be approved before they can be aired or easing the requirement that brokers provide certain information to beneficiaries before they can enroll them in a plan.

The administration could also advance policies to make Medicare Advantage the default enrollment option for new beneficiaries – an approach that would likely accelerate the pace of privatization, and potentially increase spending, all other things equal.

The transformation of Medicare into a marketplace of private plans raises a number of questions that are not being debated. Should the payment system for Medicare Advantage plans be modified, and if so, how and to what end? What should be the role of traditional Medicare nationwide and in rural areas, where fewer beneficiaries are enrolled in Medicare Advantage? Should traditional Medicare be strengthened, with additional benefits and an out-of-pocket cap, so beneficiaries have a meaningful choice when comparing Medicare coverage options? What more should be done to help beneficiaries understand the tradeoffs between traditional Medicare and Medicare Advantage including the potential for extra benefits and lower costs in Medicare Advantage versus challenges that may arise due to limited provider networks and prior authorization requirements?

It’s not yet clear whether the administration will promote policies that fast track the privatization of Medicare in a way that may increase federal spending, or focus more on achieving efficiencies and savings within Medicare Advantage. How this plays out will have implications for beneficiaries, health care providers and insurers, and is worthy of serious debate.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

Publisher: Source link