If you are lucky enough to get a raise at work, you might consider directing the extra money directly into your retirement savings account. You have been living off your previous salary, so you won’t be any worse off now if those funds go into savings instead of getting spent.

You’ve probably heard a lot of advice about how to save more money, especially money for retirement. Everyone tells you that you really need to do it. And, if you’re like a lot of people, you probably think that it’s a great idea – you are just not exactly sure how.

If you want to know how to save more money but genuinely don’t know how to swing it, here are 23 tricks that make it happen. They won’t pinch. And if you start habits like these, soon enough, they could make a tremendous difference in your retirement.

You have a lot of demands on your money.

Money can be a sneaky thing. It hides, oftentimes in plain sight. Of course, you’d notice an extra $200 in your wallet. But what about 25 cents? Maybe not, but that quarter can make a big difference, to

1. How to save more money for retirement? Ignore your raise

Getting a raise might be one of the most satisfying experiences. You work hard, and a bump up in pay shows that the company really notices and appreciates your efforts. But what if you hadn’t gotten the raise? Would you suddenly be financially destitute? Probably not.

Each time you get a wage or salary increase, do yourself and your retirement a favor. Pretend that it didn’t happen. Instead, pluck that money out of your checking account and put it into retirement.

Merrill Lynch Edge says “Every time you receive a raise, increase your contribution percentage.”

It might help to reset how you think about raises. Can you transform your thinking to believe that the raise is really intended to help you in the future, not now?

If you genuinely need more money now, can you at least devote a percentage of the raise to retirement savings? According to Fidelity Investments, “Putting just 1% more of your salary into a tax-advantaged retirement account like a 401(k) or 403(b) could make a noticeable difference in your ability to afford the retirement you want.”

2. Make savings automated

There are many different approaches for how to save more money for retirement.

- Some people don’t think too much about saving — they just hope it happens. This type of saver might deposit their paychecks and hope that something is leftover as savings.

- Some people consciously deposit money into dedicated retirement savings accounts.

- Others automate the process and savings are deducted from their paycheck and automatically added to existing investments.

Automating your savings is proven to be the most effective way to ensure that you actually save. You don’t have to think about it, it just happens — no hassle, no excuses.

Your human resources department or your bank can help you set up an automated system.

3. Figure out how much you NEED and set goals! (You’ll likely double your savings rate)

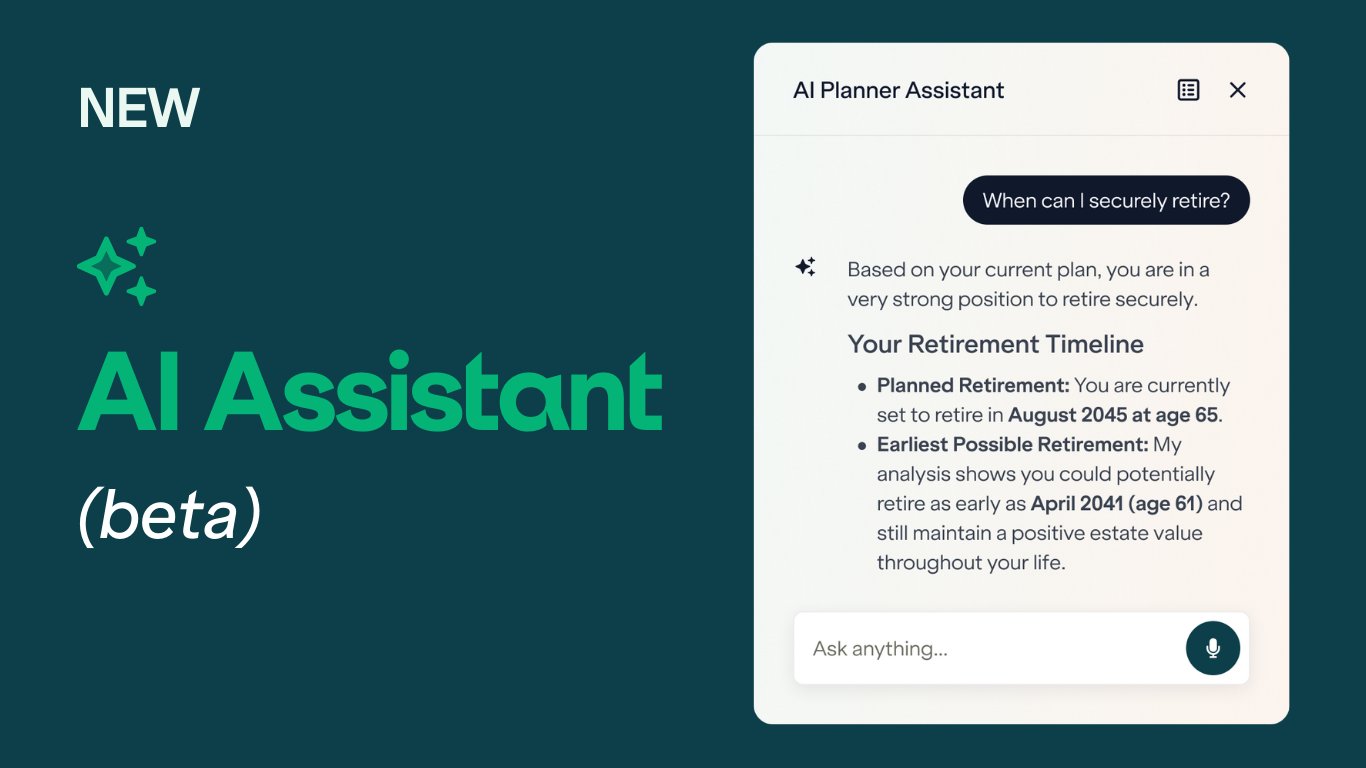

Perhaps the biggest roadblock to being able to save for retirement is not knowing exactly how much you need for a secure retirement. The majority of Americans do not have a retirement plan and they do not know how much is required to retire comfortably.

Research has found that those who have written goals and a written plan for achieving those goals are significantly more likely to succeed. Other studies have shown that having a plan can double your savings rate.

Seems like it may be worth your while to take a minute to find out for yourself exactly how much you need for retirement and create a detailed retirement plan. The Boldin Retirement Planner makes it easy.

Start by entering basic information and get some initial feedback on where you stand. Then, add more detail and more accurately estimate how much you need. Best of all, you can try an infinite number of scenarios.

4. How to save more money for retirement? Overcome “present bias”

It is easy to over index on your immediate needs: mortgage, auto loans, credit cards, maybe you’re paying for your children’s college education. If you are feeling overwhelmed, you’re not alone. What’s more, your brain isn’t always helping.

A study by the National Bureau of Economic Research (NBER) discovered that our brains often work against us. Turns out, most of us have what they call “present bias,” the tendency to place greater emphasis on those events that occur closer to the present. If you’re 55, for example, and assume retirement is still 10 years away, you’re more likely to focus your financial efforts on saving up for a summer vacation or putting money into a 529 plan for your child’s college.

Retirement seems so far away.

Simply being aware of this bias can help you overcome it.

5. Take a real look at compounding interest

We’re not only limited by our present bias. The same NBER study that talked about present bias also discovered that many of us also have what they term an “exponential-growth bias.” This means that we fail to appreciate how our retirement account balances can grow exponentially over time — our money benefits from compounding. In fact, the study discovered that less than 25% of us fully grasp the value of compounding.

For many of us, we view putting away a dollar for retirement today as about the same as putting away a dollar for retirement a year from now, or five years from now. Avoid this trap!

Start putting money into your retirement account today. Each dollar adds up — and can grow exponentially over time. Not convinced? Try this compound interest calculator from the US Securities and Exchange Commission.

Just look how even a modest $100,000 grows a lot in a short five or ten-year time period! Start saving NOW!

The NBER study discovered that a whopping 70% of surveyed respondents underestimated the increase in value from compounding based on the individual’s own circumstances, costing potentially tens of thousands of dollars in their retirement fund.

Learn more about compound interest.

6. Imagine Yourself in 10, 20, 30 Years

Research suggests that our brains process our future selves as strangers. And, let’s face it — you are unlikely to save for the retirement expenses of a stranger.

To increase the likelihood that you save for your retirement, they suggest that you imagine yourself in the body of one of your own grandparents or great-grandparents. Think about what this old version of yourself wants to do and where you are living. Consider this person paying the bills in retirement. By visualizing yourself in retirement — and writing down these thoughts to make them more real — you may be far more likely to adequately prepare for being this older person.

In fact, the study suggested that retirement savings increased when the saver could understand that they were saving for an actual person (themselves) with real needs in the future.

Here are 7 ways to imagine your future in order to achieve your personal and financial goals.

7. Add coupon savings to the pot

If you’re a coupon clipper, you already know the excitement of getting a great deal. But has the lack of a coupon ever prevented you from buying something that you wanted? For some big-ticket items, that might be the case. But what about groceries and household supplies?

Add coupon savings to your big retirement savings pot, and it might add up more quickly than you realize. Check your receipts, as most stores proudly show how much you saved that day. Then write yourself a check and put it into savings. You’ve earned it.

8. Buy used

Buying a new car is a poor investment. New cars lose about 20% of their value as soon as you take ownership and their value drops anywhere from 6% to 13% annually.

Worse yet, according to Edmunds, the average length of a car loan has slowly crept up past five years, and Americans keep their cars, on average, just over six years. The result is that a high percentage of people trade in cars that are worth less than what they owe on the loans. Nearly one-third of all vehicles offered for trade-in at U.S. dealerships are “underwater,” and their owners are adding the difference between their loan balance and the vehicle’s value to the price of the new car…and the vicious cycle of debt continues.

Is that new car smell really worth it? If you want to save big, drive your current vehicle into the ground. Today, a decently maintained vehicle should still be running long after the 100,000-mile mark. Continue to drive it long after paying off the loan, until a massive repair bill makes trading it in cheaper than paying to fix it.

When it’s time to trade in the clunker, buy a two- or three-year-old vehicle that has just come off a lease. You’ll pay far less than you would pay for the same one brand new, so your monthly payments, insurance, and registration fees will be lower.

How Much Will You Be Able to Save?: For the average-priced car, you could probably add at least $7,000 to retirement savings by buying used. Never mind the additional savings from holding onto the car longer and having less debt.

9. How to save more? Round up your checking account

Are you one of those people who keeps a precision checking account balance down to the last percentage of a penny? Stop it. No, we don’t mean to imply that you should take on poor money management habits. Quite the opposite. Round up, and pretend that the extra isn’t there.

When you make a purchase totaling $5.99, you probably write the exact amount in your register. But would you really miss that penny if you ignored it? Now think bigger. Instead of rounding the expense to $6, enter it as $10. If you’re rounding up, go big or go home.

Rounding up every transaction to the next whole dollar (or, the next $10 or $100) gives you an even tidier sum to forget about. Then at the end of the month, go ahead. Satisfy your desire to keep a tidy account by balancing it. Remove what you didn’t realize that you had and tuck it away. This is one of the money-saving hacks that locates truly “found money.” You’ll never miss it because you don’t see it.

10. Save big on vacations and stash the extra

Do you take a vacation every year? Those trips can really add up fast. But what if you could visit all of the cities that you love and spend half of the amount you’d budgeted for? Some bed and breakfasts are most expensive than a hotel. But not AirBnB.

This service matches home or vacation homeowners with people who want a getaway. And the prices are significantly less expensive, so you can carve your budget down. When you carve your budget down, you know what to do from there.

Many families budget for vacation months or longer in advance. So, if you travel the thrifty way (it doesn’t have to be AirBnB), take the remainder of your budget and put it into your retirement.

And if you like AirBnB enough and have an extra room or two in your home, you could become an AirBnB host and let your home pay for your next vacation.

11. What about a staycation?

Do you know that the average U.S. vacation for two costs $4,000. Conversely, the average staycation costs just $500. While traveling can be life-changing, you might consider saving some money by trading in a vacation or two for a staycation closer to home. Besides the financial benefits, staycations can also be less stressful because you won’t be wasting time in an airport or dealing with airline security and missing luggage.

Depending on where you live, you may be able to find excellent off-season rates at nearby hotels. For instance, resorts in Phoenix and Scottsdale focus on attracting locals in the hot summer months by offering room, restaurant, and spa deals for a fraction of what the same services would cost during peak tourism months.

So, consider being a tourist in your own town. Staying home doesn’t have to mean sacrificing fun. Treat it like a real vacation: don’t answer work email, do housework, or run errands. Do some research online to find out what tourists like to see while visiting your area. There may be a beach, restaurant, museum, or trail just minutes away that you’ve never visited. You could be surprised at what’s unexplored in your own backyard.

How Much Will You Be Able to Save?: You can probably add $4,500 to your retirement accounts.

Both good and crazy ideas abound on social media, even in the realm of personal finance. Underconsumption core, loud budgeting, no spend challenges, and more can be really effective ways to save more money for retirement.

Check out 10 Personal Finance Fads That Are Totally Buzzing

13. Never ever spend coins

Have you known someone who always had a coin jar someplace in the house? Saving coins is a great habit and one that can add up surprisingly fast. This might be a difficult habit for someone who prefers to use exact change, but it’s worth at least trying.

If you buy a coffee on your way to work, toss the coin change into a bin, cup, or coin purse. Pay for lunch with cash? Save the coins. Wherever you spend cash, keep those little metal discs aside.

At the end of the day, plunk all of the change that you haven’t spent into a piggy bank. If you really want to be ambitious, try to get your hands on an empty water cooler jug. According to Bill Carey for the Journal News, a lot of people save money this way. Depending on which coins make it into the jug, you might have several hundred dollars once it’s full. Or, you might even have a few thousand.

14. Shift payments to savings once a bill is gone

Is there anything more exciting than paying off a bill? Maybe it’s a car, or maybe it’s a credit card. It is a great accomplishment when you’ve buckled down and paid something off. And, it is a great opportunity to shift that payment amount into savings before you grow accustomed to having it available to spend.

You got along just fine while paying off the debt. You’ll get along just fine without adding the amount back into your usable income once it’s paid off.

Some payments can make a huge difference. If you’re paying a few hundred dollars monthly for a vehicle, your retirement savings will jump nicely every month once you’ve redirected that amount into your future.

15. Don’t overpay for education

Parents want the best for their children, but what if “the best” includes an expensive private education? Are the benefits worth the price tag? And it is a good trade-off to spend on schooling at the expense of your own future?

The average private school tuition in the U.S. is around $13,000. And while many parents cite academics as their primary reason for paying up for private school, if you live in an area with an excellent public school system, there may not be that much difference.

If paying private school tuition makes it difficult to save for retirement, keep in mind that many public schools offer a quality education. If you aren’t fortunate enough to live in a neighborhood with a thriving public school district, you may be better off relocating to a new area that does. If that’s not an option, choose a private school with lower tuition and look into financial aid.

The cost/benefit comparison you do for elementary and secondary education will be much the same when it’s time to consider college.

How Much More Will You Be Able to Save?: Depending on your costs, you could probably sock away an extra $13,000 a year per child, per year.

16. Save more when the kids fly the coop!

If you have kids, I don’t need to remind you that they are big expenses!

No matter if you are happy or sad about the empty nest when they move out, you should definitely use this as an opportunity to save more for retirement.

With fewer mouths to feed, a newly empty nest is a great time to increase the amount of money you contribute to your retirement savings. (After college costs are taken care of.)

17. Getting a tax refund? Put it into your retirement savings

If you are lucky enough to get a tax refund, this is an excellent opportunity to boost your retirement savings. Sure, there is lots you could spend the money on, but why not invest in your future security and happiness?

18. Downsize

In 2016, the average size of a newly constructed single-family home was 2,422 square feet. The amount of living space per person has nearly doubled since 1973! While many people are under the impression that bigger is better when it comes to housing, larger houses typically mean bigger mortgage payments and property taxes, costlier utilities, and more time and money spent on upkeep.

Downsizing might seem scary, but it can actually make your life considerably more stress-free. You’ll be forced to get rid of “stuff” you’ve probably had for years and never use. That “stuff” can weigh you down, physically, financially, and psychologically.

19. Eat In

Dining out in restaurants can be fun and relaxing, but it’s also expensive. The average person dines out three times a month and orders delivery 4.5 times a month. And, the average meal outside the home costs $11-$20 per person, compared to about $4-5 per person per meal for food prepared at home.

How Much Will You Be Able to Save?: Most people find that it’s not reasonable — or enjoyable — to completely eliminate dining out. But consider cutting back. For a family of four, one less meal each week might equate to a savings of $4,000 per year.

20. Try to Reduce Insurance Costs

Insurance protects your finances from all kinds of risks. But, the protection can be very expensive. Usually worth it, but it is costly.

Shopping for the best rates at regular intervals could save you money. Do a review of your coverage at least once a year and look for opportunities to reduce your costs.

Here are 10 ways to lower property insurance.

21. Take Advantage of Catch Up Savings

Catch-up contributions are congress’s way of making it easier for savers age 50 and up to tuck away enough retirement savings.

You probably already know that there’s a limit to how much you’re allowed to save in tax-advantaged retirement account such as IRAs and 401(k)s. Well, once you reach age 50, you’re allowed to make additional “catch up” contributions over and above those annual contribution limits.

However, according to a Transamerica Center study, only 52% of workers know about catch-up contributions.

Time to learn about catch-up savings and start stashing away more money.

22. Invoice Yourself for Retirement Savings

You have probably heard the phrase, “pay yourself first.” But are you doing it?

Gone are the days of a reliable pension. Your future financial security is in your own hands.

Saving for retirement should really be thought of as just another bill to pay. The trick is to convince yourself that saving for retirement is as important as paying your electricity or mortgage. Put as much of your paycheck as you can (or at least something) into your company’s 401(k) plan or your own IRA.

If you have to, send yourself an invoice! If you are already saving for retirement, give yourself a raise!

23. Be Mindful and Purposeful with Your Savings

This article has already suggested numerous ways to potentially save over $100,000 or more for retirement.

However, this tip is the most important one of the article: It is not enough to not spend money. You need to also mindfully save and invest it for retirement.

So many of us try very hard to be frugal, but we end up frittering away these savings on other things instead of having the discipline to lock that money up into a retirement account for our future.

This is why it is so important to take assess your spending and saving each month and actually save money into retirement accounts. As an added incentive, you can update your retirement plan whenever you add money into your savings and feel the satisfaction of getting closer and closer to your retirement goals.

Publisher: Source link