Americans have changed a lot over the last 100 even last couple years – we live longer and have more active lives and our society and financial structures have evolved (and, in some cases perhaps, devolved). However, many of our ideas about retirement and retirement planning come from previous generations. These ideas are ill-suited to today’s realities. So, what are the NEW retirement rules?

Let’s explore what it takes for a NEW retirement is this crazy modern world:

1. Take Control

In the past, those with adequate wealth often outsourced financial decision making and the rest of us were left to make it work day to day. Today, it is more important than ever for individuals of all levels of wealth to understand personal finance and the levers available to build a secure and happy future. An important NEW retirement rule is to take control.

Sure, fee-only advice can be highly worthwhile, but it is made more powerful when you can understand and sanity check the guidance on your own.

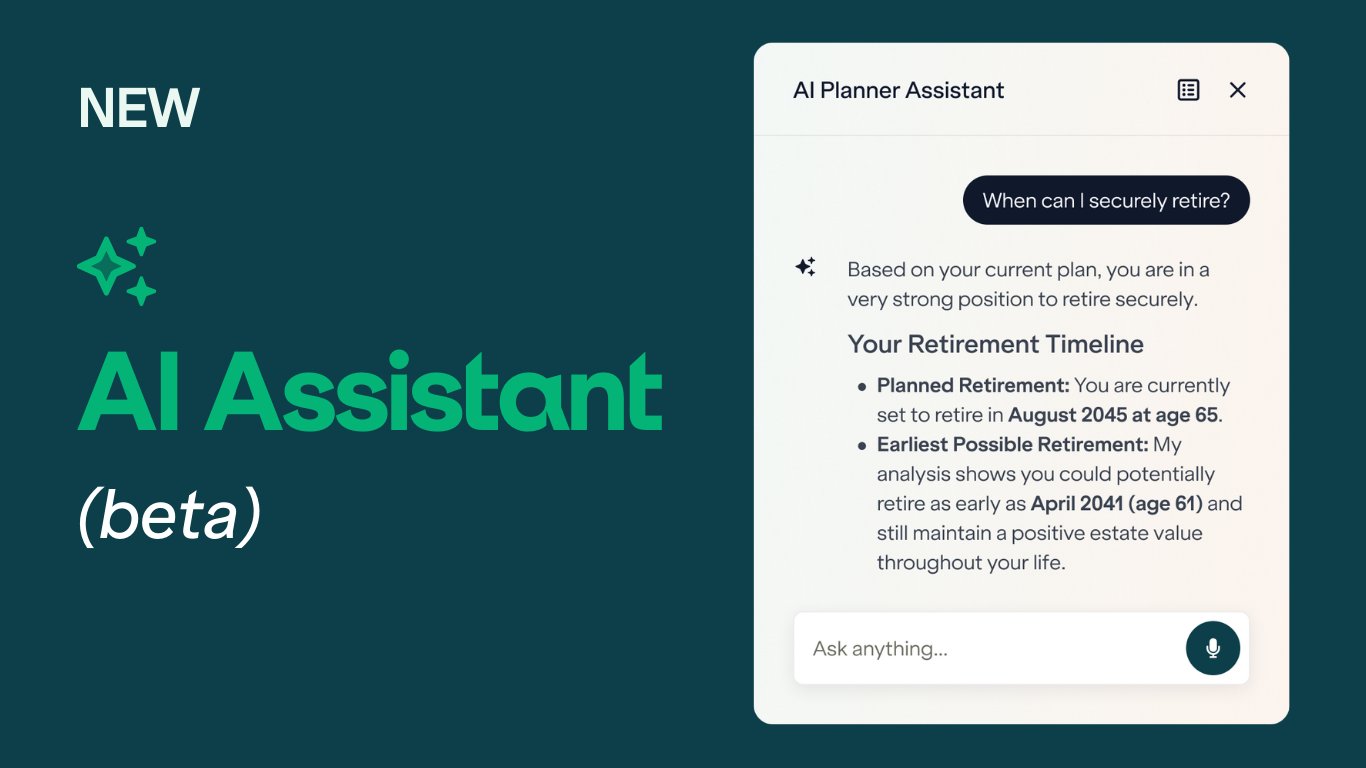

Tools like the NewRetirement Planner strive to give you control over your money and therefore your time and happiness.

2. There is Not a “Right” Way to Plan for and Live Your Future

The idea that you need $1 million to retire has been promoted relentlessly. However, this is neither reasonable nor accurate for everyone.

You might need $1 million. You might need $5 million. Perhaps you’ll need no savings at all. It is up to what matters to you, the resources you have, and how you want to live your life.

Furthermore, there is a lot more to a “retirement plan” than your savings balance. You have a wide variety of levers to achieve a secure future.

A NEW retirement means that you get to make trade-offs and decisions for the life you want.

3. Focus on What’s Possible

Focusing on what’s possible, rather than viewing personal finance as limiting, opens up a world of opportunities for retirement planning.

This perspective helps to reduce the stress and anxiety often associated with retirement planning. Instead of feeling restricted by budgets and limitations, you feel empowered to make choices that align with your aspirations. This can lead to increased satisfaction and a sense of control over your financial future. Embracing possibility fosters resilience and adaptability, crucial traits for navigating the uncertainties of retirement.

Ultimately, focusing on what’s possible turns retirement planning into a motivating and fulfilling journey rather than a daunting task.

4. Keep Investments Simple and Affordable: Be Aware of Investment Fees and Consider Index Funds

Are you aware that you are likely paying fees that are significantly eating away at your investment returns? Research suggests that less than 30% of people know how much they pay in fees. And, observational data suggests that people would rather keep their heads in the sand on the topic than investigate how much their faith in an investment advisor or managed funds cost.

Here are a few tactics to consider if you want to reduce your investment fees:

- Figure out what you are paying in fees. Ask your advisor. Talk to your human resources department if you have a 401(k). Consult your bank. This is especially true if you are paying an advisor on an AUM basis. AUM stands for Assets Under Management and you are paying the advisor a fee based on a percentage of the value of your money.

- Work with a fee-only advisor to set an investment strategy that you can manage on your own.

- Focus on low cost index funds for mid to long term investments.

- Understand simple bucket strategies and devise your own simple investment plan.

- Consider free advice from your bank or a company like Vanguard who has long heralded low cost investing.

5. Plan for Longer and Healthier Lives

In general, perhaps the best news of a NEW retirement is that you are likely to live significantly longer and healthier than your own parents.

In the 1950s, people retiring at age 65 lived until 78. Today’s retirees can expect an average lifespan of 83 or 84 years – which means that half of you will live much longer than that.

While it is great that you are living longer, your expanded lifespan means that you need more money for retirement:

- Retirement savings will need to last longer

- Your overall health-related costs will be higher now than ever before

- You will need to plan for different phases of retirement – each with its own financial requirements

The NewRetirement Retirement Planner lets you see what happens to your finances no matter how long you live. You can easily compare your finances with different goal ages. Find out how much you can spend if you live to your expected longevity. Will you run out of money if you live 10 or 20 years longer than average?

Get answers for these scenarios and everything in between.

6. Think Creatively About What You Have and Optimize Your Resources

While many of today’s retirees have not saved adequately, that does not mean that you can’t retire and that you don’t need a retirement plan.

Everyone has resources and an important NEW retirement rule is that you need to think about using those resources creatively. You likely have savings. However, you will also probably have Social Security, the capability to work in some capacity, family and friends, a house, the ability to reduce expenses, or other possibilities.

You can make small trade-offs to achieve a secure retirement at any level. Examples of small trade-offs that make a big difference include:

- Delaying the start of their Social Security which could mean an additional 30 percent in monthly income.

- Working longer — even just part time — could be the difference between making ends meet and not.

- Explore passive income opportunities.

- Planning to have a multi-generational household could financially help everyone involved.

- Downsizing or otherwise reducing expenses could mean that you’ll never run out of money.

You won’t know which strategy or set of strategies will work for you unless you try them out. Model these scenarios and others in the NewRetirement Planner.

7. Guarantee Your Own Lifetime Income – Reduce Risks

A big part of NEW retirement planning rules today is finding ways to guarantee adequate monthly income to cover your monthly expenses – no matter how long you live. Guaranteed lifetime income is an income stream that can never run out – no matter your life span – ideally adjusted for inflation.

In the past, shorter lives meant (among other things) less risk to your retirement financial plan. Without careful planning, today’s longer retirement period and the increased complexity of our financial markets leave your retirement security subject to much more risk. Issues related to Social Security and Medicare financial woes are another area of concern.

A NEW rule for retirement is having a plan that maintains your quality of life in the face of: inflation, stock market fluctuations, an unforeseen medical crisis or other big event outside of your control.

Some retirees use annuities and passive income to guarantee adequate lifetime income. Others rely on careful investment schemes like bond ladders, dividend producing stocks or a bucket strategy. Still others reduce their spending to live within very limited means.

Understand your options. Model them in the NewRetirement Planner. Or, consult with a fee only planner to gain more confidence in your plans.

8. There is No Such Thing as an Average Retirement Age

Some people are retiring earlier and earlier. A few even “retire” in their 20s and 30s. Others are delaying retirement past the traditional age of 65 – either because they like work or due to needing income.

Long retirements (even if you retire at 65, retirement will likely last 20 years or more) are a relatively new phenomenon. For most of our history, people either worked until they died or until they physically could not labor any longer. In fact, according to the Bureau of Labor Statistics, there has been an incredibly steep decline of men 65 and over participating in the labor force:

- In 1880 78 percent of men over the age of 65 were working.

- By 2000 only 17.5 percent of men over the age of 65 were working.

A NEW Retirement means that you are retiring when YOU are financially, physically, intellectually, and emotionally ready.

9. Utilize Your Home Equity

Housing prices have risen dramatically, even if they have stabilized recently. If you’ve owned your home for a while, your home equity can make retirement viable.

Home equity represents the biggest source of wealth for most households in or nearing retirement. This equity can – in some cases – make up for a lack of savings in your financial profile. To use home equity for retirement expenses, retirees often consider downsizing or cash out refinancing – either at retirement or at some point in the future .

However, retirees need to consider carefully how and when they tap their equity. In a NEW Retirement, retirees use their home equity to help make retirement work, but they do so carefully. When thinking about how to tap into home equity for retirement, strive for the following:

- Be holistic and comprehensive – Look at all of your resources and goals and include home equity as part of a larger financial view.

- Promote flexibility – Your plan needs to meet both your long and short-term retirement goals.

- Be prepared for future changes – Financial, health and family needs and risks change as people grow older – your home and home equity should be part of the equation.

When using the NewRetirement Planner you can model different ways you might want to tap into home equity.

10. Plan for Your Own Retirement and Also the Needs of Your Parents and Children

Another advantage of longer lives is that multiple generations are living and interacting with each other. Today’s retirees often find themselves caring for themselves, their children and their own parents.

This can be a source of great financial complexity. You may need to think of multiple generations. Your retirement plan should include what both older and younger family members might expect or need from you.

You can also consider ways to leverage their resources as well.

11. Think About Different Phases of Retirement – Budget Carefully

A NEW retirement rule is to think about retirement not as one thing, but a time of life with many different phases.

Because retirement today lasts so long, you will want to think about budgeting for different phases of retirement. Many retirement planners recommend that people plan on spending 70% of what they spent while working. While this may be accurate overall — it might not be and it certainly will not give you visibility into when you will actually need money.

You will likely have a more accurate and reliable plan if you budget for different phases. At a minimum, you will want to think about 3 phases of retirement:

- When you first retire, you’ll likely spend more than you ever have before.

- Then your expenses will likely wind down as you age. (Though they may not.)

- Finally, spending will spike as your healthcare needs grow in old age.

You can also create a detailed retirement budget in the retirement planner. A detailed budget has at least 3 distinct benefits:

- More distinct visibility into your financial needs,

- Better ability to invest your money for both growth and security, and

- The ability to more accurately predict your tax liability.

Create an account or log in now to create a detailed budget. Or, here are 9 tips for predicting your retirement expenses.

12. You’ll Need to Take Some Calculated Risks

It used to be that retirees were advised to avoid most investments that involved risk – especially stocks.

However, retirees today need to figure out how to ensure that their money grows at the pace of inflation — if not faster.

The traditional retirement rule of thumb has been to subtract your age from 100. The difference represents the percentage of stocks you should keep in your portfolio. So, at age 40, 60% of your portfolio should be in stocks and by age 70, only 30% of your portfolio would be in stocks.

But today, that rule may be out of date. Some financial planners now recommend that the rule should be 110 or 120 minus your age.

However, rather than a retirement rule, you might be better off creating a personalized investment policy statement.

13. Plan for Your Emotional, Physical and Social (Not Just Financial) Health

Your finances are important, but your emotional, physical and social well being are probably even more important.

Many of today’s retirees are seeing retirement as a time of growth, adventure and new experiences. However, figuring out your goals for this phase of life can be overwhelming. Here are a few resources to help:

14. Make Financial Planning a Habit

An often overlooked retirement rule is that you actually need to maintain and update your plan every month (or at least quarterly).

It is not enough to create a retirement plan just once before you retire. Things change and little differences in income, rates of return, spending, inflation and more can have a huge impact on your finances.

In the 1970s hardly anyone exercised regularly, but now everyone does or thinks that they ought to. Today, more and more people are coming to understand that personal finance, like exercise, needs to be a regular habit.

And, simply reviewing your goals and where you stand is scientifically proven to help you achieve better outcomes.

The NewRetirement Planner enables you to document and save a very detailed retirement plan. And, it is easy to log in every month or quarter to make updates and discover ways to strengthen your retirement security.

15. Trust Math

Human beings are not built for rational financial management. Research into behavioral finance has proven that time and time again.

Our instincts often go against what is proven to build wealth. As much as you want to, trusting your gut isn’t a good plan. A better option is to at least look at the math on your financial decisions. A new retirement rule is to use math to evaluate your financial choices.

NewRetirement gives you the tools to make informed financial decisions. Our reliable model is best in class and holds up to the best financial advice money can buy.

16. Keep Up With Change

For financial planning, you don’t need a once-a-year dossier about the state of your money, you need a living breathing plan that evolves with you – your goals, dreams, and whatever life throws at you.

The NewRetirement Planner is always at your fingertips to give you financial confidence in an ever changing world.

17. Have a Plan B

You want to be prepared if things go wrong. But, also consider how to take advantage when things go right!

Have you ever wondered what if you: Retired early? Worked abroad? Moved somewhere new?

In addition to evaluating back up plans for all the things that might go wrong, the NewRetirement Planner enables you to build any what if scenario you can imagine.

Know how to get by when things go wrong and also see the possibility of your dreams coming true. (Need some inspiration? Here are 20 scenarios to try.)

18. Value Your Time

Perhaps the biggest part of the retirement equation is your time. A NEW retirement rule is to value your time when making financial decisions, not just money.

Don’t forget what is really important.

Publisher: Source link